Stripe 1099 login

Your tax form will be located in the Tax Forms tab of Stripe Express.

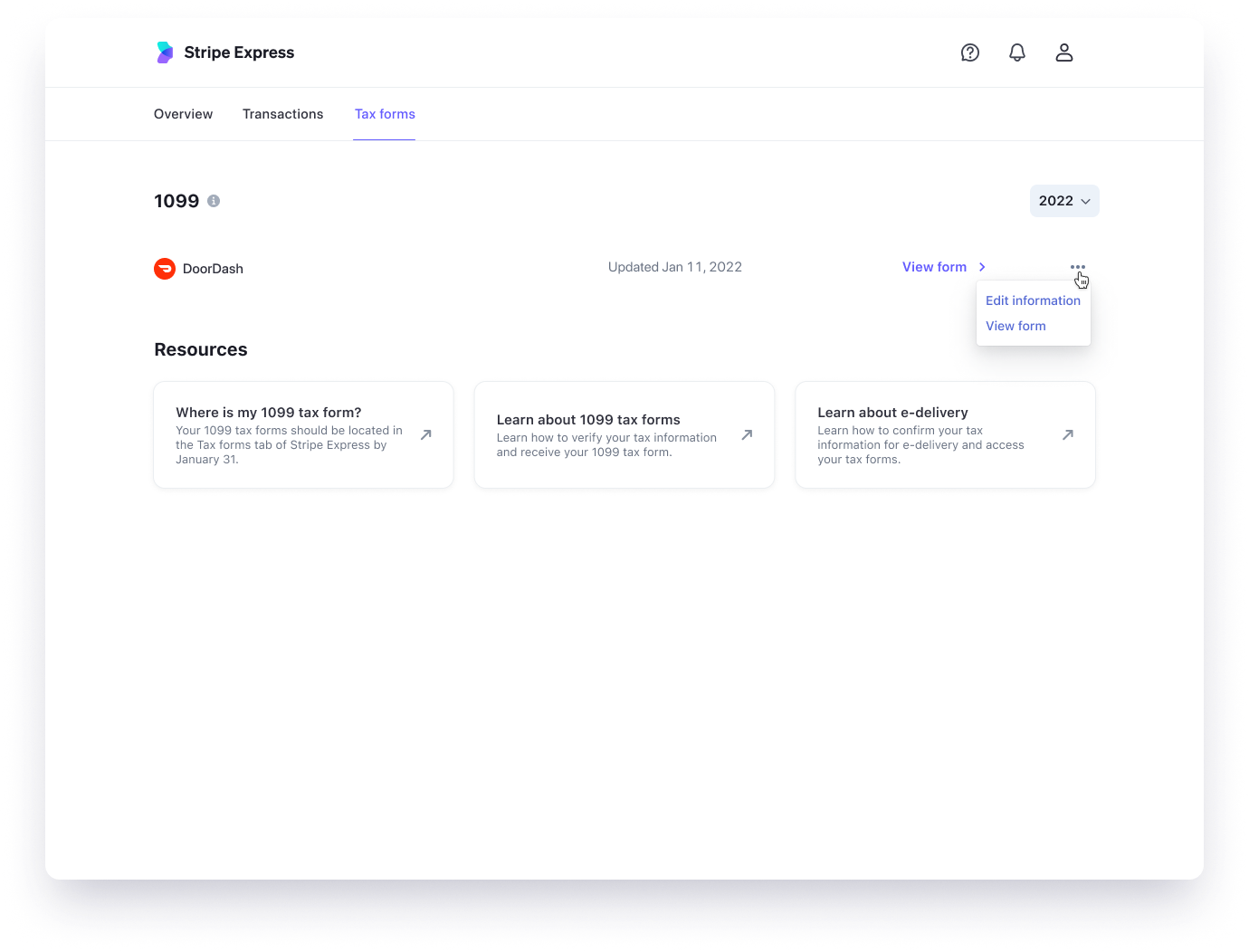

Starting with tax season , Stripe enabled e-delivery of tax forms through Stripe Express. Your connected account owners can use the Tax Center on Stripe Express to manage their tax forms, update their tax information, and manage their tax form delivery preferences. Learn more about working with your Stripe Express users to collect verified tax information for the upcoming tax season in the Tax Support and Communication Guide. Review a detailed product walk-through of the Stripe Express dashboard and Stripe outreach to your eligible connected accounts. There are a few notable exceptions that might affect eligibility for e-delivery. Custom connected account owners can view Stripe Express and the tax forms page starting in November after receiving the email invitation from Stripe. This will be triggered if you choose to turn on e-delivery of your tax forms through Stripe Express and enable early collection of tax information and delivery preferences under your tax settings.

Stripe 1099 login

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with. How do I login to my Stripe Express account? I earned enough to need a form in If you're a Dasher and you've earned enough to need a form in , you should have received an email from Stripe by mid January Emails will be sent out in phases to Dashers starting in October Please note that if you earned enough to need a form in and do not receive an email from Stripe by mid January, you will be mailed a paper copy of your tax form. DoorDash Merchants that were not emailed earlier in the year will be mailed a copy of your tax form to the mailing address on file. Please update your information no later than mid January

For more help understanding your K, go to IRS.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. Check the link to the Instacart Shopper site to learn more. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to Instacart support for help with accessing your tax form or updating your email address to access Stripe Express.

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here. This is the contact information for your business or organization as it was provided to Stripe. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings. For your protection, the form that we send to you may show only the last four digits. However, the copies that are sent to the IRS and state tax boards include your complete identification number. If your information needs to be updated and: - your K tax form has not been generated yet, please do so from your account Tax Details settings. The total gross volume of charges that were made without the card present at the time of the transaction. If you are a Connect platform looking for information on how s should be issued to managed accounts, see: U.

Stripe 1099 login

Updates that occur to this page are automatically reflected in the form status badges and counts in the tax reporting Dashboard. Filing requirements for some states might differ from federal requirements. If you have done backup withholding or state withholding, you might have additional reporting requirements with states. We recommend that you consult a tax advisor. When you file your K forms from the Tax forms view in the Dashboard, Stripe submits your forms to the IRS and all qualifying states. Forms filed to the IRS are automatically forwarded to the state, eliminating separate reporting to the participating states. Some states still require direct filing with the state, even though they participate in the CFSF program.

Youtube newhart

If you are attempting to download your tax form but are being blocked it's possible your platform has updated the TIN on your tax form since you claimed your Stripe Express account. Connect integration guide. Learn more about other ways to update emails for your accounts. Please note: If you need to split the volume of your already generated K form, you will need to Contact Stripe Support. To calculate any disputes lost during the fiscal year, see your payments disputes page. Cross-border payouts. If you did not consent to paperless delivery, you will not be able to download your tax form through the Tax Forms tab of Stripe Express. Welcome to the Stripe Shell! Sign in. If they select this option, then Stripe mails the paper copy of their tax form to the address the platform has on file. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. Please reach out to DoorDash support to confirm the information that they have on file against the information you are providing. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities.

When can my connected account owners access the Tax Center on Stripe Express? Implementation guides. From the Tax Forms tab of Stripe Express , you will be able to view and download your tax forms. Debit Express and Custom connected accounts. To reconcile your K form for all tax years prior to , please contact support to get the reconciliation report for your K form for a given tax year. How does e-delivery work for connected accounts? From here they can contact Stripe which ensures their questions are routed to a specialized support group best able to help them. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. Collection of tax identity information and e-delivery consent early in the tax season is critical for enabling a smooth tax season. Add money to your platform balance. Then, follow these steps:. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you're a Dasher and you've earned enough to need a form in , you should have received an email from Stripe by mid January As your connected accounts onboard to Stripe Express, account owners can edit their account details within the Tax forms page.

In it something is. Now all is clear, many thanks for the information.

Very much I regret, that I can help nothing. I hope, to you here will help. Do not despair.

Very valuable phrase