St george incentive saver interest

Now that your Maxi Saver bonus rate has expired, you will now earn the standard variable rate of 1.

George Bank Savings Accounts. Fact checked. George Bank started life in Sydney in as a building society. After several mergers with other building societies, i t acquired Advance Bank in which owned its subsidiary BankSA and merged with Westpac Bank in It is now the fifth-largest bank in Australia and provides a wide range of banking services, including personal and business banking products such as several different savings accounts. Savvy can help you compare St.

St george incentive saver interest

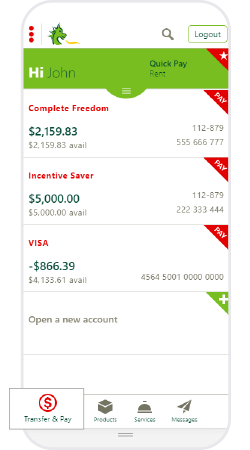

The St George Incentive Saver high interest savings account offers rates up to 5. Bonus fixed interest rate for 3 months. Sign in. St George Incentive Saver Account. Top Pick. Judo Bank Personal Term Deposit. Go to offer. Interest Rates. Base variable interest rate. Bonus variable interest rate when conditions are met.

Offset account Your savings reduce the balance of your home loan that interest is charged on.

George Incentive Saver savings account? With no account-keeping fees and a maximum introductory interest rate of up to 5. Plus it won a Mozo Experts Choice Award. The St George Incentive Saver Account really lives up to its name, with an introductory interest rate of up to 5. After the first three months, the interest rate on the Incentive Saver Account drops down to 5. This savings account usually has a base rate of 1. The extra 0.

Savings Accounts. Earn up to 5. After 3 months the total variable rate will apply. Online bonus offer available for a limited time only. Excludes joint accounts. Offer may be varied or withdrawn at any time.

St george incentive saver interest

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. The St. George Bank Incentive Saver rewards you with bonus interest when you make regular deposits. To get the maximum rate of 5. The base rate of interest is the minimum amount of interest you earn if you fail to meet the bonus interest conditions. The base rate of interest is 1. Bonus rate The bonus interest rate is 3. No fees The St.

Unblur chegg answers

It is a building society that returns all of its profits back to the …. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. The St. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Visit provider. Phone facility. View electronic statements and make payments from your computer, tablet or mobile internet connected device. Nice and simple. We recommend that you read the relevant PDS or offer documentation before taking up any financial product offer. Yes but that's Australian banks for you. Compare Australian savings accounts with Savvy and find the right one for your personal needs. If you're transferring funds from another St. Maximum rate condition. Strong base rate. Grow your savings without making any withdrawals.

Now that your Maxi Saver bonus rate has expired, you will now earn the standard variable rate of 1. What your money is currently earning with a Maxi Saver standard variable base interest rate.

Home Savings Accounts St. Alison Banney Finder August 23, Personal customers This account is available to personal customers only. We are committed to our readers and stands by our editorial principles. Australian Unity. If you're a new customer to St. Make no more than one withdrawal during the month. The extra 0. George Maxi Saver. Make no withdrawals. Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM, we will communicate.

Curiously....