Spy financials

These stocks are selected by a committee based on market size, liquidity, spy financials, and industry. As of Sept. Because ETF shares trade in a similar manner to stocks, investors can buy and sell SPY shares via their spy financials throughout the day, including selling them short. SPY turned 30 on Jan.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics.

Spy financials

.

Investing ETFs.

.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Spy financials

Now, it is the largest, most traded, and most liquid ETF in the world. It is widely considered to be the benchmark for the US stock market, representing the performance of the largest and most widely held public companies in the country. SPY is owned by its investors — the shareholders of the fund. The fund is required to disclose its holdings and other financial information to the public on a regular basis, and it must follow certain rules related to diversification, valuation, risk management. As an investor in SPY, you can expect a high level of transparency and accountability from the fund and its management team. SPY was created on January 22, The creation of SPY and other ETFs revolutionized the investment industry by providing investors with a new way to access diverse asset classes and investment strategies.

Genshin mbti

Please see the prospectus for more details. It is not known whether the sectors or securities shown will be profitable in the future. Keep in mind that these fees do not include any broker fees or commissions. Use profiles to select personalised advertising. Measure content performance. Investors can also employ traditional stock trading techniques; including stop orders, limit orders, margin purchases, and short sales using ETFs. It is gross of any fee waivers or expense reimbursements. The Fund's investments are subject to changes in general economic conditions, general market fluctuations and the risks inherent in investment in securities markets. Understand audiences through statistics or combinations of data from different sources. Index Dividend Yield The weighted average of the underlyings' indicated annual dividend divided by price, expressed as a percentage. Investopedia requires writers to use primary sources to support their work. SPY was the first index exchange-traded fund listed on U. This compensation may impact how and where listings appear. The Bottom Line. Investors should be aware of both world and U.

Each client deserves an inspiring strategy for your Real Financial Life.

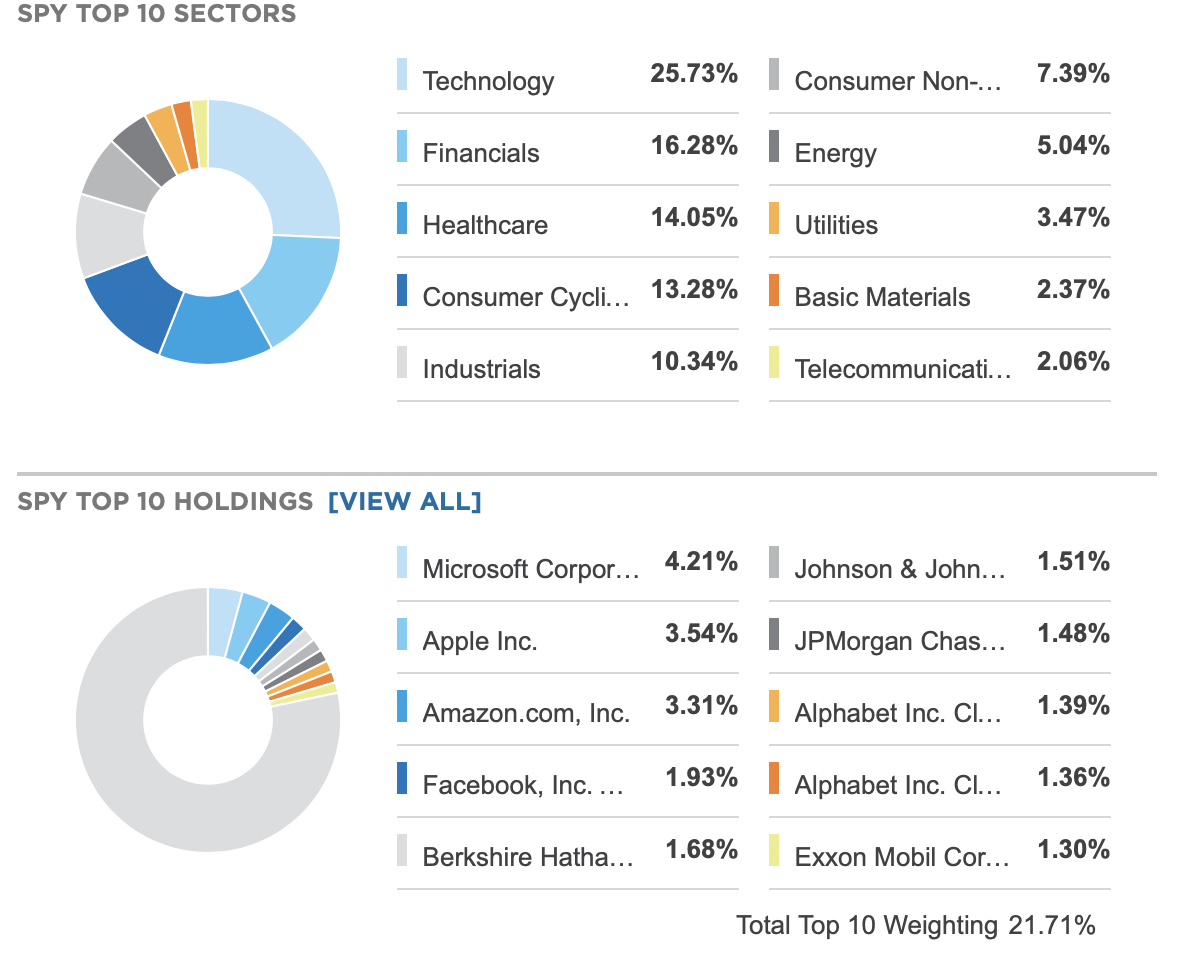

The weighted harmonic average of closing market price divided by the most recent reported book value for each security in the fund's portfolio as calculated for the last twelve months. The SPY is a well-diversified basket of assets, which allocates its holdings across multiple sectors. After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The market price used to calculate the Market Value return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund's NAV is calculated. The Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. Vanguard, Personal Investors. Download All Holdings: Daily. Investopedia requires writers to use primary sources to support their work. Create profiles for personalised advertising. Apple AAPL. Investopedia does not include all offers available in the marketplace. To obtain a prospectus or summary prospectus which contains this and other information, call download a prospectus or summary prospectus now, or talk to your financial advisor.

It agree, a remarkable phrase