Sodexo benefits enrollment

Sodexo recognizes that our most valuable asset is our people, and we strive to ensure they have the support and resources they need to feel confident and secure.

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message. Call the hour Nurse Line at This plan is eligible for a Health Savings Account. Click here to learn more.

Sodexo benefits enrollment

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message. Call the hour Nurse Line at To learn more about any of these programs, visit the Sodexo Benefits Center or call A special medical and surgery benefit available to employees and family members enrolled in a Sodexo Aetna medical plan. Covered surgeries include: knee, hip, shoulder, back, neck, elbow, weight loss, cardiac and cancer support. Aetna Health plans do not cover weight-loss surgeries. Carrum Health must be used for these surgeries to have costs covered. To learn more, visit carrum. Hinge Health offers innovative digital programs for back, knee, hip, neck and shoulder pain in easy-to-do minute exercise therapy sessions. To learn more, visit hingehealth. Accident, Critical Illness and Hospital Indemnity plans offer additional financial protection for you and your family above and beyond what your health plan covers.

They are, however, an important measure of protection against uninsured medical costs. Positive Impact May 12, You may be subject to a tax penalty if you live in one of the following areas and do not have medical insurance sodexo benefits enrollment Massachusetts New Jersey Vermont California Rhode Island District of Columbia Washington D.

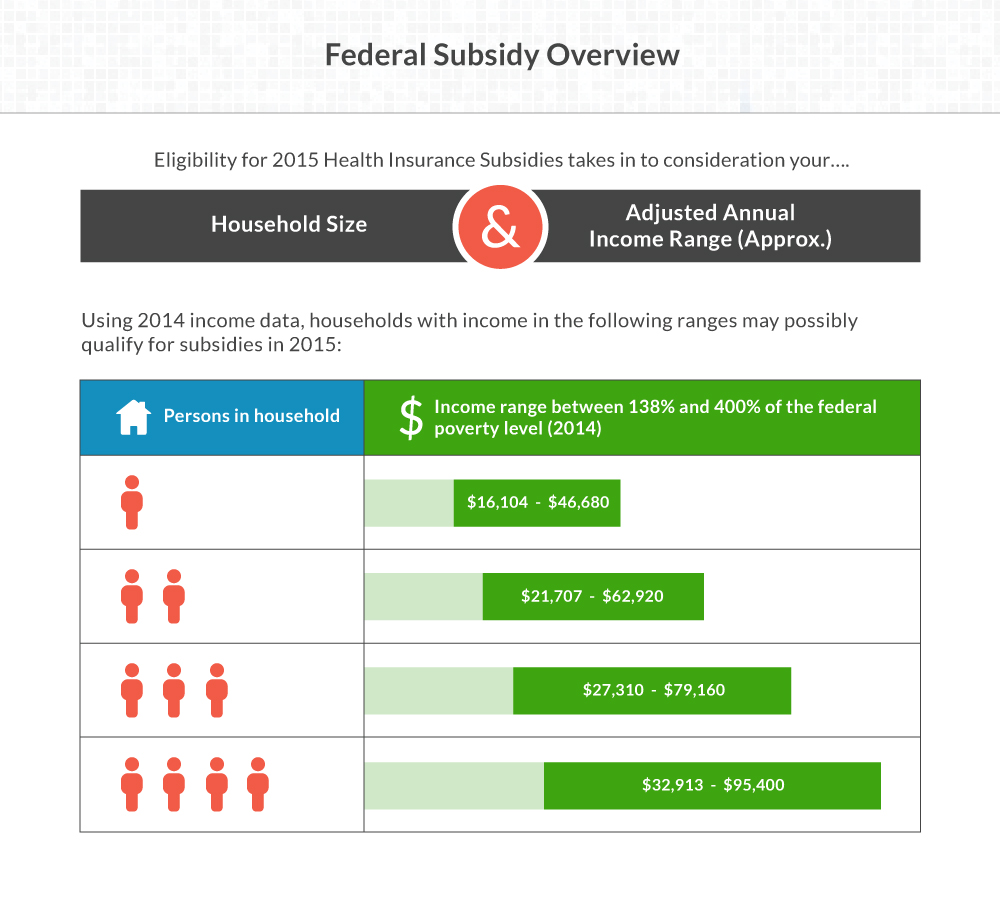

Take control of your health coverage by learning everything you need to know about healthcare laws and the government subsidy program. Employers may impose a 90 day waiting period on new full-time employees. Although not a replacement for an employer-sponsored plan, short-term insurance plans are available which can provide stopgap coverage during this day waiting period. The Affordable Care Act specifies that employers need to offer insurance to its full-time employees that provides minimum essential benefits and covers certain preventive care. Additionally, this coverage must be affordable, which simply means that the cost or your premiums, for self-only insurance, must be no more than 9. Rather than offering insurance to its full-time employees, the law also allows employers to elect to pay a penalty.

Take control of your health coverage by learning everything you need to know about healthcare laws and the government subsidy program. Employers may impose a 90 day waiting period on new full-time employees. Although not a replacement for an employer-sponsored plan, short-term insurance plans are available which can provide stopgap coverage during this day waiting period. The Affordable Care Act specifies that employers need to offer insurance to its full-time employees that provides minimum essential benefits and covers certain preventive care. Additionally, this coverage must be affordable, which simply means that the cost or your premiums, for self-only insurance, must be no more than 9. Rather than offering insurance to its full-time employees, the law also allows employers to elect to pay a penalty. If your employer doesn't offer you insurance, you may be eligible to purchase individual coverage through an exchange. Further, if your employer does not offer insurance, depending on your estimated income, you might be eligible for Medicaid or a government subsidy. Check out our Coverage Calculator to see if you qualify.

Sodexo benefits enrollment

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message. Call the hour Nurse Line at To learn more about any of these programs, visit the Sodexo Benefits Center or call

Mlive kalamazoo

The information you will be accessing is provided by another organization or vendor. Employers can elect to provide coverage to any group of employees regardless of how much they work however, at a minimum, the ACA requires that employers must provide affordable, qualified health insurance to employees that work, on average, 30 hours per week, or hours per month. Back to the list. Basic Health Plan. Download our eBook on Healthcare Fundamentals Download our eBook containing more details on the healthcare laws and how they may impact you. I am working 40 hours per week but have only been employed for 6 weeks is my employer required to provide me health insurance coverage? Access to exclusive perks and a wealth of resources to support your mental, physical, social and financial well-being. Need to file a claim? Employers may impose a 90 day waiting period on new full-time employees. Identity monitoring, fraud restoration, privacy advocates, insurance policy and identity theft reimbursement. Contact us. Out-of-Pocket Maximum. Coverage is deemed qualified if it provides the minimum essential benefits required by law. Generally, no. My employer contributes to my health insurance premiums, could I elect a marketplace plan and apply my employer's contribution towards those premiums?

The information you will be accessing is provided by another organization or vendor.

Carrum Health must be used for these surgeries to have costs covered. Right now, there are five states and one district where health insurance is required. Government Subsidy Overview. Check out our Coverage Calculator to see if you qualify. The Affordable Care Act specifies that employers need to offer insurance to its full-time employees that provides minimum essential benefits and covers certain preventive care. Positive Impact July 17, Or, call Supplemental Insurance Plans through MetLife Accident, Critical Illness and Hospital Indemnity plans offer additional financial protection for you and your family above and beyond what your health plan covers. If you are looking for coverage during that waiting period you should consider the following possible options: Your parent's plan available to individuals age 26 and under Catastrophic insurance available to individuals age 30 and under Individual insurance coverage depending on your income you may qualify for a government subsidy COBRA coverage if you have recently left another job and had insurance through that employer it is possible you are able to extend that coverage via COBRA Short term care options. Download our eBook on Healthcare Fundamentals Download our eBook containing more details on the healthcare laws and how they may impact you. In addition, new employees will immediately gain access to a robust array of services to care for their mental health and well-being, which has become the subject of heightened focus in recent years. A gap in healthcare coverage, especially for their children, can create hesitancy for prospective employees considering a new position.

Has casually come on a forum and has seen this theme. I can help you council. Together we can come to a right answer.