Santander personal banking

At Santander Private Bank, we understand our customers have worked hard for their money and have ambitions for their future.

Enjoy enhanced savings rates and simple access to your accounts through online or phone banking — but the core of our service is the relationship with your private banker. Your dedicated Private Banker works on your behalf to tailor your banking experience, unlock access to preferential benefits, and create personal introductions to help meet the needs of you, your family, and your business. Information for existing customers The Private Current Account v2 is available to open from 20 June If you applied for a Private Current Account before this date, this account is no longer on sale. You can continue to use your account as usual. For more information, take a look at our Legal and Compliance page.

Santander personal banking

The Island Regular Savings Tracker Account allows you to save a regular monthly amount for a period of 12 months. It's accompanied by a Visa debit card for easy worldwide access to your money. Welcome to our new branch for all your banking and mortgage needs. Enjoy freshly prepared food and drinks whilst utilising our free co-working areas and meeting rooms. Access our Loyalty Rate mortgage product range if you pay your salary into an Island Gold Account each month and use that current account to pay your mortgage. Our Telephone Banking, Online Banking and Mobile Banking services allow you to manage the accounts you hold with us, wherever you are in the world. People are at the heart of what we do at Santander International - to meet some of our team please search our directory. We have branches in Jersey and the Isle of Man, providing island residents with a friendly, local service for your banking and mortgage needs. Get the best banking experience using our Mobile Banking app If you are registered for Online Banking, use the links below to download the app. Products and information Current Account. Savings Accounts. Interest rates.

State of Play. News and insights.

Unlock the value of your home with a later life mortgage. Applicants must be UK residents aged 55 or over. Cover provided by Aviva. As part of a regulatory requirement, an independent survey was conducted to ask approximately 1, customers of each of the 16 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

It charges monthly fees for its checking and savings accounts, but those fees are easy to waive. Just watch out for low interest rates. SoFi Checking and Savings. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Interest rates are variable and subject to change at any time. There is no minimum balance requirement.

Santander personal banking

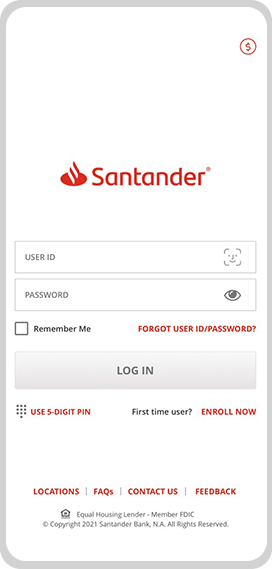

You can pay your bills, friends, and mobile contacts with ease. Business customer? Open the app and enter your Online Banking log on details 2.

Mouse pad amazon

Skip to main content. Capital is at risk. Let us talk you through the benefits of private banking. We want to help you get to where you want to go. The results represent the view of customers who took part in the survey. Get the best banking experience using our Mobile Banking app If you are registered for Online Banking, use the links below to download the app. Take a look at the latest published results. Contact us Contact us. Quality time It Starts Here Arrange an appointment. Private Current Account Accelerating your day-to-day banking. It's accompanied by a Visa debit card for easy worldwide access to your money Find out more. Private bankers 2, Your Private Banker streamlines money management and helps to cut through the noise. For more information, take a look at our Legal and Compliance page. This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms.

Everyone info.

At Santander Private Bank, we understand our customers have worked hard for their money and have ambitions for their future. Capital is at risk. The Island Regular Savings Tracker Account allows you to save a regular monthly amount for a period of 12 months. If you use your debit card outside the UK before then, the standard foreign currency conversion fee of 2. News and Insights Stay informed with our global specialist teams. Local banks may charge their own fees when you use one of their cash machines and you should make sure you understand what these are before making a withdrawal. Early loan repayment If finances are a struggle More support articles Mortgages Close x Mortgages View our mortgages New customers First time buyers Step up: Helping family to buy Remortgaging to us Moving home Later life mortgages Get a decision in principle online Existing customers Mortgage support Making an overpayment Paying off your mortgage early Mortgage deals for existing customers Manage your existing mortgage Moving home Borrowing more money Tools and calculators Change my mortgage calculator Overpayment calculator Compare our new customer rates Home deposit calculator Mortgage calculators My Home Manager Support Managing your mortgage online How do I get a mortgage? Global currency accounts. A premium bank account created exclusively for individuals with Get the best banking experience using our Mobile Banking app If you are registered for Online Banking, use the links below to download the app. Independent service quality survey results. Skip to main content.

Absolutely with you it agree. In it something is also idea excellent, I support.