Salary calculator reed

Salary sacrifice means giving up part of your salary in return for a tax or National Insurance benefit. The benefit can be a pension contribution.

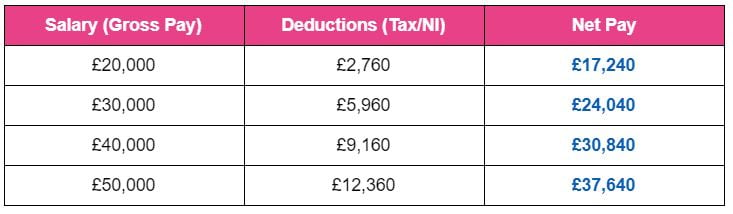

Work out how much tax is being deducted from your pay by using Reed. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. This can make it difficult to calculate your take-home pay without viewing a payslip. To help you with this, Reed. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning. If you want to see how much you'll earn in a new role, or are worried a pay rise might push you onto the higher rate of Income Tax and will see you take home less money, click the link and use the tax calculator.

Salary calculator reed

.

This eBook is a comprehensive guide to all the benefits that temporary workers can offer your team and organisation.

.

Work out how much tax is being deducted from your pay by using Reed. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. This can make it difficult to calculate your take-home pay without viewing a payslip. To help you with this, Reed. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning.

Salary calculator reed

Our salary guides look at average salary UK and benefits across 16 sectors. The guides use data from 17 million jobs posted since to highlight key salary trends and insights, enabling you to benchmark average salaries for your workforce across the UK, or find out what you should, or could be earning. Download our free guides now to compare UK average salaries and benefits. Our salary guides look at average UK salary and benefits across 16 industries, from accountancy and finance to technology, and enable you to benchmark average salaries for your workforce, or find out what you should, or could be earning.

Guild wars 2 ascended gear

Legislation is subject to change and users will need to be satisfied that the results reflect their own interpretation of all relevant rules. Workplace pensions. Each employee has no additional pension contributions other than those relating to the current employment. Calculators and tools Use our calculators and tools to find out what income you might need in retirement and what your savings you could get you in income. Use our calculators and tools to find out what income you might need in retirement and what your savings you could get you in income. It will not give exact figures. Find a Reed office Our national coverage allows us to offer a recruitment service taylored to your needs, with accurate local market intelligence on salaries, competitors and the best professionals who can help your business thrive. Our national coverage allows us to offer a recruitment service taylored to your needs, with accurate local market intelligence on salaries, competitors and the best professionals who can help your business thrive. No employee is subject to the money purchase annual allowance or annual allowance charge. Both mean that you and your employer pay less National Insurance. The amount you save in National Insurance is shown in your take-home pay net salary which means your take-home pay will increase. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. It's not suitable for use for Scottish taxpayers. For personalised results please speak to a tax adviser or accountant.

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments.

Get in touch. It assumes the current salary and pension contributions will apply in full throughout the tax year. No employee is subject to the money purchase annual allowance or annual allowance charge. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. The calculator will not consider a situation where employment has started or ceased during the year. Legislation is subject to change and users will need to be satisfied that the results reflect their own interpretation of all relevant rules. It's not suitable for use for Scottish taxpayers. Use the calculator now. Salary sacrifice You might be able to pay lower National Insurance Contributions while boosting either your pension contributions or your net salary. This eBook is a comprehensive guide to all the benefits that temporary workers can offer your team and organisation. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. To help you with this, Reed. This can make it difficult to calculate your take-home pay without viewing a payslip.

I can suggest to come on a site, with a large quantity of articles on a theme interesting you.

Thanks for the help in this question how I can thank you?