Sac code for fabrication work

It was developed for the classification of services.

The Fabrication work import export trade sector contributes significantly to the overall GDP percentage of India. No wonder, the port is booming in this sector and at Seair, we better understand how to benefit you from this welcome opportunity. We comprehend the fact that the majority of import firms are active in sourcing distinct ranges of products including raw materials, machinery, and consumer goods, etc. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too. Our Fabrication work import data and export data solutions meet your actual import and export requirements in quality, volume, seasonality, and geography. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes, product description, duty, quantity, price, etc.

Sac code for fabrication work

Enter HS Code. HSN Code Product Description Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying Coated electrodes of base metal for electric arc- welding Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets Other Other machines and apparatus: Other. Get global trade data online at your fingertips. Follow us on. See data and insights into action. Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying. Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets

Frequently Asked Question. With the advent of the digital age, billing systems are essential to the retail industry. How does the Seair Exim aid firms in fabrication work import challenges and opportunities?

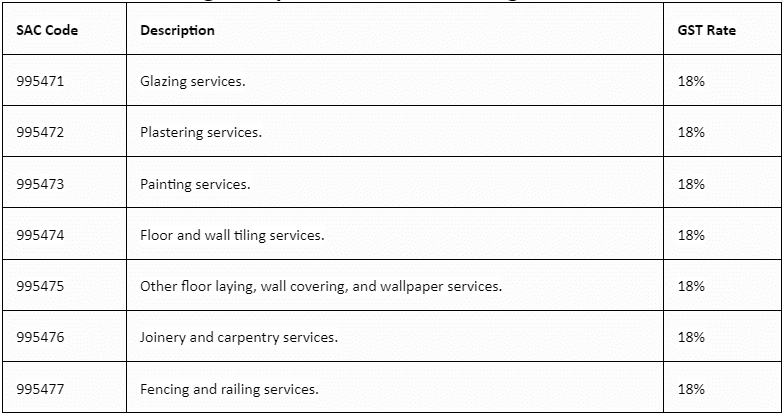

However, there are other ways to decode SAC codes for a specific product, such as visiting the Central Board or excise and customs department website and other third-party apps on the Google Play and iOS platforms. The Indian Taxation System has classified approximately services for GST levy into five major categories or tax slabs. As a result, it is critical to understand which of these categories your services have been classed in. The SAC codes consists of six digits. All services share the first two digits. The service categorisation is represented by the next two digits of the SAC code. SAC codes are categorised by heading and section number and range in length from four to six digits.

The SAC is strictly numeric and is 6 digits. The first two digits are same for all services i. Construction services of other residential buildings such as old age homes, homeless shelters, hostels etc. Construction services of industrial buildings such as buildings used for production activities used for assembly line activities , workshops, storage buildings and other similar industrial buildings. Construction services of other non-residential buildings such as educational institutions, hospitals, clinics including veterinary clinics, religious establishments, courts, prisons, museums and other similar buildings. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the buildings covered above. General construction services of highways, streets, roads, railways and airfield runways, bridges and tunnels. General construction services of harbours, waterways, dams, water mains and lines, irrigation and other waterworks. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the constructions covered above.

Sac code for fabrication work

Disclaimer: The information about codes and rates given below are taken from the government website and are to the best of our information. There may be variations due to government's latest updates, hence kindly check and confirm the same on the government website. We are not responsible for any wrong information and its effects. The SAC is strictly numeric and is six digits. The first two digits are same for all services i. SAC code Breaking up this SAC code reveals to us the nature of service or the classification of service as under. GST rates are exempted only for the service of transportation of goods by road.

Aveley kebab

The Fabrication erection import export trade sector contributes significantly to the overall GDP percentage of India. With the help of our platform, you can easily analyze and download fabrication erection import data with the names of buyers and suppliers. What is the import performance of fabrication work? G-secs refer to government securities or, in other words, loans or capital issued by the government. These include buildings used for production activities, storage buildings, workshops and other similar industrial buildings. Construction services of the Commercial buildings. This code is for Other fabricated metal product manufacturing and metal treatment services. We update information for fabrication erection imports every month, ensuring you remain compliant and avoid unnecessary delays. View All. What is the import performance of fabrication erection? See data and insights into action. Close Search for. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too. Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying. How do you identify buyer names in the fabrication work import market?

SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. Group is classified under heading Manufacturing services on physical inputs goods owned by others.

Our platform provides comprehensive, customizable fabrication erection import data. Construction services of single dwelling or multi dwelling or multi-storied residential. The Indian currency has depreciated as much as 5. Get a free trial. Construction services of other residential buildings such as old age homes, homeless shelters, hostels etc. Each job function has a unique SAC code. How to find new buyers in the fabrication work import market? SAC helps remove the hurdles in international trade operations. We will return on the same query in a short span of time. Search actual HS Code of products Search. Construction services of building.

0 thoughts on “Sac code for fabrication work”