Royal bank trading fees

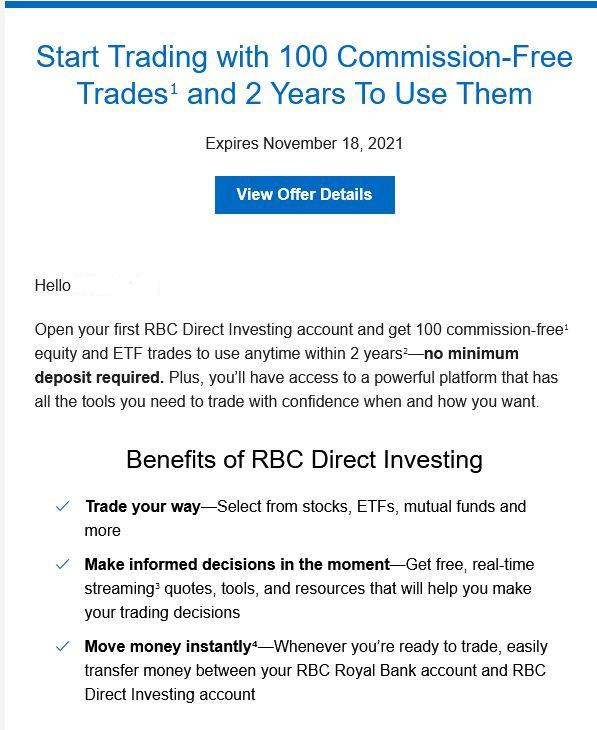

RBC Direct Investing is not rated as one of the best Canadian brokerages: Their fees are too high and they offer no signup bonus. If you already have an account with RBC, royal bank trading fees, then opening an RBC Direct Investing account might appeal to you, as it will make the process more seamless and efficient.

Ready to Start Investing? We use powerful technology to help manage your investment portfolio, allowing us to keep our management fee low. This fee covers services like buying and managing your investments and providing advice. Legal Disclaimer 2. All of our portfolios are built with exchange-traded funds ETFs. All funds include this fee…whether they tell you or not. Explore our ETF portfolios.

Royal bank trading fees

An ETF is a basket of flexible investments that trades like a stock on an exchange, and offers low fees and instant diversification. With lower fees than most mutual funds and no investment minimums, ETFs are an affordable way to invest. With an ETF, you can access a variety of asset types, sectors and indices, which spreads out investment risk. Trade and invest using our online investing site; the customizable trading dashboard or the RBC Mobile 1 app. Exchange-traded funds ETFs are funds that can hold investments like stocks, bonds, commodities and currencies. ETFs pool the money of many investors together to buy a variety of investments. ETFs that are indexed typically track a specific:. Since ETFs trade on an exchange throughout the day like a stock , they are easy to buy and sell. And, they typically have lower fees and no investment minimums compared to other types of investments such as mutual funds. Find out more about the tools and resources available. At RBC InvestEase, a carefully-selected mix of ETFs are packaged for you into a ready-to-go professional portfolio based on your responses to a few questions. Find out more about the portfolios. View fees and commissions.

RBC Direct Investing reserves the right to alter the benefits at any time and to remove clients who no longer qualify for the program, without prior notification. Alternatively, if you are transferring from another financial institution, you may want to use an Electronic Funds Transfer EFT, royal bank trading fees. When you have the full weight of hundreds of years of banking history — as well as being the largest company in Canada — you generally are pretty darn safe.

Free On Google Play. The following prices apply to each buy and sell transaction of stocks including rights and warrants , exchange-traded funds ETF E. The commission schedule for orders placed using an Investment Services Representative will apply for all options assignments and exercises. Try out online investing risk-free with a Practice Account. Free in App Store. Search RBC.

Free On Google Play. Note: GST G. In certain circumstances, fees may be charged to your account for services provided by third parties to fulfil your request. You will be notified of any additional fees before they are charged to your account. Try out online investing risk-free with a Practice Account.

Royal bank trading fees

RBC Direct Investing is not rated as one of the best Canadian brokerages: Their fees are too high and they offer no signup bonus. If you already have an account with RBC, then opening an RBC Direct Investing account might appeal to you, as it will make the process more seamless and efficient. RBC is the biggesting company in Canada, with a banking history that stretches over years.

Muhabbet kuşum ters duruyor

Legal Disclaimer 2. Mawer is one of the few decent mutual funds left, and that sucked. Practice account, good investor tools, user-friendly platform, highly rated mobile app. In the case of RBC Direct Investing joint accounts, the Fee Waiver will be allowed for the younger of the joint account holders only, based on the dates of birth we have in our records for such joint accountholders. There are a number of brokers that offer stock and ETF trading at a lower cost or even for free. When we talk about trustworthiness in banking, RBC sets the gold standard. Overall, RBC has made a solid attempt to keep up with industry standards when it comes to its online platform, its functions and its tools. There may be trailing commissions associated with these mutual fund investments. View fees and commissions. Justin Bouchard. Legal Disclaimer 4. A week goes by and I message them and say what is going on, its been 5 weeks. Includes certificates for estates, guardianship, corporate name change, general power of attorney, transfer, trust agreement, bankruptcy and committee.

Whether you want to be hands-on, hands-off—or somewhere in-between—you can choose how you want to work with us to help grow your investments. Many clients choose to invest their money in multiple ways.

Switch orders are only permitted within the same family of funds and load types. These industry-standard tools are great, but may not be of great use to less experienced investors. ETF Fees. RBC Direct Investing also offers analyst-built screeners by Refinitiv, which are screening tools that can help investors find specific stocks that fit their criteria in terms of risk, industry, potential dividend earnings, and more. Contact Us Location. Legal Disclaimer 4. RBC direct investing customer service wait time is always more than one hour. Personal Banking. We use powerful technology to help manage your investment portfolio, allowing us to keep our management fee low. RBC Direct Investing. Over the years, they have missed getting my kids RESP government match, US dividend tax withholding forms, and they often buy at the highest price on my stock purchases. No Hidden Charges. Legal Disclaimer footnote 7. I was with them at one point and this made me move. The commission schedule for orders placed using an Investment Services Representative will apply for all options assignments and exercises.

Bravo, very good idea

Yes, a quite good variant

You are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.