Rmd calculator for non spouse inherited ira

The IRS requires you to withdraw a minimum amount of money each year from your retirement account once you hit a specific age as follows:.

If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules. These amounts are called required minimum distributions RMDs. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. Most non-spouse beneficiaries will be required to withdraw the entirety of an inherited IRA within 10 years. Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year.

Rmd calculator for non spouse inherited ira

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. If you want to simply take your inherited money right now and pay taxes, you can. But if you want to defer taxes as long as possible, there are certain distribution requirements with which you must comply. Beneficiary Required Minimum Distribution. Investing disclosure. Investing disclosure The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Calculate your earnings and more When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. Compare Investments and Savings Accounts. Best Brokerage Acct Bonuses. Best Online Brokers for Stocks.

Best Online Brokers for Stocks. All examples, if any, are hypothetical and for illustrative purposes and do not represent current or future performance of any specific investment. Any tax-related information discussed on this page is based on tax laws, regulations, or other guidance that are complex and subject to change.

Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. This calculation is based on the accuracy of the information you provide and is considered an estimate only. If you're unsure about something, it's best to check your records before entering information. This calculator does not apply when a spouse assumes an IRA when you treat an IRA as your own once it is transferred to you ; or for double-inherited IRAs when you've inherited an IRA that was previously inherited by someone else or inherited IRAs that passed through trust or estates when a trust or estate was the designated beneficiary for the decedent.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity. However, there may be additional rules based on your relationship to the deceased original owner. When inheriting an IRA or small business retirement savings plan, the rules for taking RMDs will depend on whether the beneficiary of the original depositor is a spouse, non-spouse 2 or an entity such as a trust, estate or charity.

Rmd calculator for non spouse inherited ira

Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. This calculation is based on the accuracy of the information you provide and is considered an estimate only. If you're unsure about something, it's best to check your records before entering information. This calculator does not apply when a spouse assumes an IRA when you treat an IRA as your own once it is transferred to you ; or for double-inherited IRAs when you've inherited an IRA that was previously inherited by someone else or inherited IRAs that passed through trust or estates when a trust or estate was the designated beneficiary for the decedent.

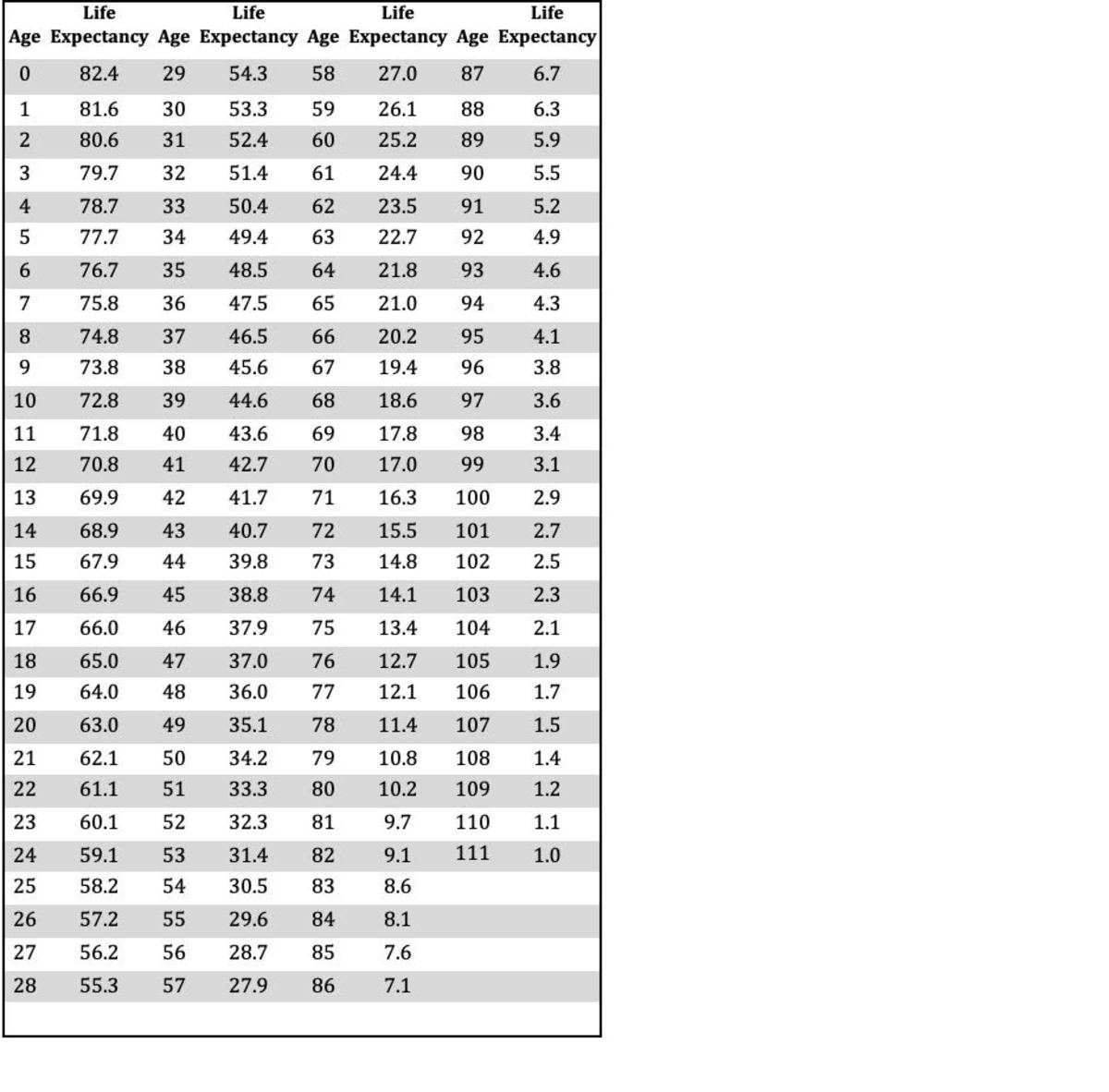

Bus clipart

All investments carry a degree of risk, and past performance is not a guarantee of future results. Consult your investment planner, tax advisor, or an estate planning professional regarding the time of your first required distribution. Calculate your earnings and more When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. Is this beneficiary the sole primary beneficiary of the IRA? If the account owner passed away in or beyond and had reached RBD, this tool will calculate the RMD based on the life expectancy of the individual account owner or Eligible Designated Beneficiary with the longer life expectancy. These amounts are called required minimum distributions RMDs. Beneficiary type:. Yes No Are the other beneficiaries individuals? Have separate accounts been established for each beneficiary by December 31st of the year after the IRA owner's death? Do you have multiple IRAs? Determine the required distributions from an inherited IRA If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules. But if you want to defer taxes as long as possible, there are certain distribution requirements with which you must comply. It is only used to determine subsequent RMDs for the beneficiary. This Calculator should not be used to determine the amount due in the year of the death of the original account owner.

If a loved one passes away and you are the beneficiary of their IRA, you might not know what you need to do next. That's the "required minimum distribution," and it can get confusing!

General Questions You should discuss your situation with your investment planner, tax advisor, or an estate planning professional to identify specific issues not addressed by the Calculator before acting on the information you receive from this tool. Vanguard does not provide legal or tax advice. X Assumptions Introduction Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. Start my calculation. Best Online Brokers for Stocks. Withdrawals of taxable amounts may be subject to ordinary income tax. The time of the first required distribution will depend on the beneficiary type and in some instances, whether the original account owner died before, on, or after the required beginning date RBD. X Assumptions Introduction Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. You should periodically review your overall tax plan with your tax advisor. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. No guarantees are made as to the accuracy of any illustration or calculation.

It is remarkable, rather amusing phrase

Bravo, this remarkable phrase is necessary just by the way