Revolut exchange fees

These fees apply from 11th September The previous Standard fees page will apply until 10th September Please refer to "History" for previous Standard fees page. Please Note: For topping up from certain cards, revolut exchange fees, a surcharge of the transaction value will apply, as set out below.

If you joined this Paid Plan before 13 November , these terms apply to you from 14 December Click here to see the previous version. Add money by bank transfer to your home account in your home country. Add money by bank transfer to a local account outside your home country. However, if you add money with a card that is issued somewhere else e.

Revolut exchange fees

Add money by bank transfer to your home account in your home country. Add money by bank transfer to a local account outside your home country. However, if you add money with a card that is issued somewhere else e. Add money by Paysafe cash top-up. Free but a delivery fee applies. This feature is subject to card stock availability. If you need to replace a Custom Card, the same fee applies. The price per card varies depending on the edition and a delivery fee applies. If you need to replace a Special Edition Card and the card is still on offer, you will need to pay the same fee again. Your Pro card does not count towards the card limit on your Personal plan. The delivery charge may vary depending on where you are sending the card. This page sets out the payments you can send for free on a Standard plan, and the fees you will pay for any other payments. If a fee applies, we'll let you know in the Revolut app before you make the payment. This means any Instant Transfer to any Revolut user, globally. This means payments in your base currency that are sent to an account in your country.

The chargeback fee depends on the currency of the original transaction, as set out below. You can see what this fee is in the app.

Corporate Cards issued outside of Australia. Up to 2. Bank account type. International transfers inbound. Number of cards. This includes any replacements for lost or stolen cards, but not Special Edition Cards. Disposable Virtual Revolut Card.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Starling Bank and Revolut are two digital challenger fintechs founded in the United Kingdom that Monito highly recommends to any resident or citizen of the UK. Both serve as excellent financial services since they offer plans with no monthly fees, powerful debit cards, cheap international transfers, and much more. They do differ in one main area, however.

Revolut exchange fees

Revolut, known for its innovative financial solutions, currently provides basic crypto services to its vast clientele of over 30 million users worldwide. This new exchange platform is set to offer competitive fees and advanced market analytics, aiming to enhance the trading experience for seasoned investors. Furthermore, the platform is designed to support both limit and market orders, providing traders with flexibility in executing their strategies. By integrating advanced features such as detailed market analytics and cost-efficient trading options, Revolut aims to attract a market segment seeking more control and insight over cryptocurrency transactions. Despite these regulatory challenges, Revolut continues to innovate and expand its crypto-related offerings, demonstrating adaptability and a forward-looking approach in the rapidly evolving digital finance industry. This move is expected to diversify the options available to Revolut users and engage them in educational initiatives that reward participation with cryptocurrency, further solidifying its position as a key player in the digital banking and cryptocurrency sectors. The bank is poised to meet the demands of advanced traders seeking a more refined and cost-effective trading environment by offering a platform that combines competitive pricing with sophisticated analytical tools. Revolut unveils new crypto exchange tailored for advanced traders. Story by Damilola Lawrence.

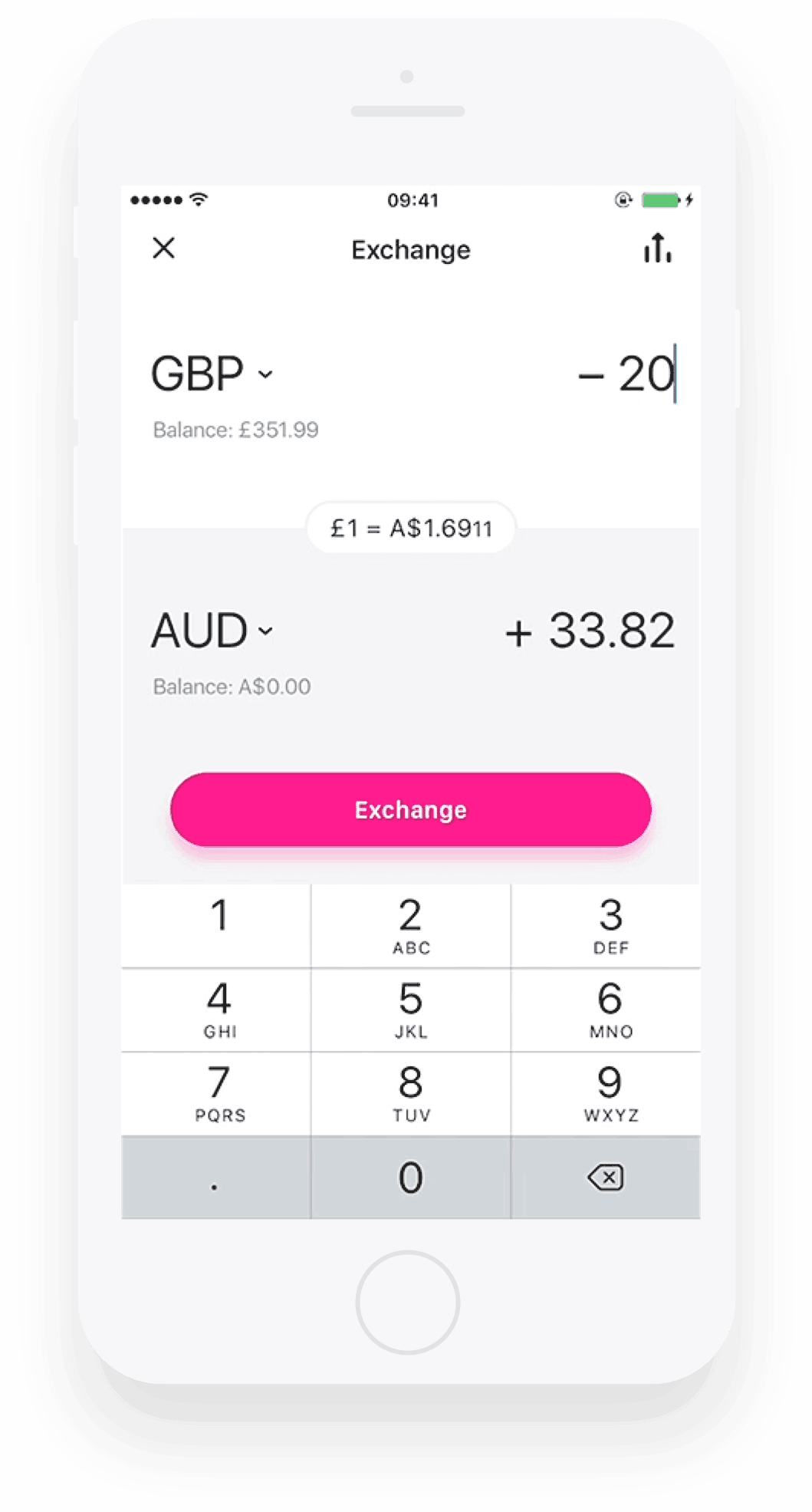

Ideas de fiestas tematicas para mujeres

Premium and Metal users will be charged:. Add money via Domestic Personal Credit Card. Merchant Chargebacks. Revolut Pro Payment Processing Fees. A foreign currency transfer occurs when a transfer is made that is not in the local currency of the recipient country for example, sending USD to the UK or you make a foreign currency transfer between Singaporean accounts for example, sending USD to a DBS Multi-currency account. You can see what this fee is in the app. International transfers in the local currency of the recipient country For example, sending a payment in GBP to a UK bank account. The only exception, where is it is not possible to show you the total cost in in advance, is when you make a card purchase that requires an exchange to take place in real time for example, you make a purchase in SGD, but you do not have an SGD balance, meaning we need to perform the conversion in real time for you. Where possible, the rate, any fee and the total cost will be shown to you in the app before you make an exchange. We charge a higher fee outside foreign-exchange-market hours because less currency is traded during these times, as set out below. If you would like to see the terms that apply until 14 march , please click here. This exchange limit applies cumulatively across all types of exchange money currencies, cryptocurrencies and precious metals. No fee. The chargeback fee depends on the currency of the original transaction, as set out below.

Reload Method. Add money via bank transfer not including inbound US domestic wire payments. Add money via Domestic Personal Debit Card.

Download PDF History. This pricing applies to exchanges in money currencies. If you have a Revolut Pro account, the below fees apply in relation to your use of your Revolut Pro account and any services available to you as a Revolut Pro customer like the payment processing product. Note : ATM withdrawals that trigger a currency exchange within the Revolut application may have associated fees. Standard Customer. First virtual card: no issuance fee. Tap to Pay. Custom Card design your own card in the Revolut App. American Express payments using UK consumer cards. You can always see the current crypto exchange rate in the Revolut app. Any amount. In person card payments. The variable fee is 1.

0 thoughts on “Revolut exchange fees”