Realty income dividend date

Top Analyst Stocks Popular. Bitcoin Popular.

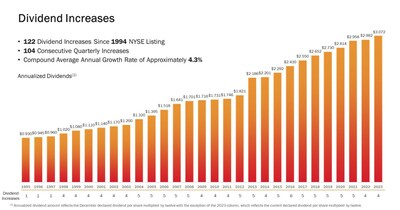

The dividend is payable on October 13, , to stockholders of record as of October 2, The ex-dividend date for October's dividend is September 29, We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 13, real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared consecutive monthly dividends on its shares of common stock throughout its year operating history and increased the dividend times since Realty Income's public listing in NYSE: O. Additional information about the company can be obtained from the corporate website at www. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," "continue," "should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking statements.

Realty income dividend date

The next Realty Income Corp. The previous Realty Income Corp. There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Realty Income Corp. Sign up for Realty Income Corp. Add Realty Income Corp. Your account is set up to receive Realty Income Corp. The Company is engaged in in-house acquisition, portfolio management, asset management, credit research, real estate research, legal, finance and accounting, information technology and capital markets capabilities. As of December 31, , the Company owned a diversified portfolio of 4, properties located in 49 states and Puerto Rico, with over As of December 31, , of the 4, properties in the portfolio, 4,, or As of December 31, , of the 4, single-tenant properties, 4, were leased with a weighted average remaining lease term excluding rights to extend a lease at the option of the tenant of approximately 9. As of December 31, , the Company had an average leasable space per property of approximately 16, square feet. As of December 31, , the Company had approximately 11, square feet per retail property and , square feet per industrial property.

Share: Linked in.

The dividend is payable on January 12, , to stockholders of record as of January 2, The ex-dividend date for January's dividend is December 29, We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 13, real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared consecutive common stock monthly dividends throughout its year operating history and increased the dividend times since Realty Income's public listing in NYSE: O. Additional information about the company can be obtained from the corporate website at www. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," "continue," "should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking statements.

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Realty Income Corp's dividend performance and assess its sustainability. GuruFocus has detected 7 Warning Signs with O. Realty Income owns roughly 13, properties, most of which are freestanding, single-tenant, triple-net-leased retail properties. Its properties are located in 49 states and Puerto Rico and are leased to tenants from 47 industries. Realty Income Corp has maintained a consistent dividend payment record since Dividends are currently distributed on a monthly basis. Realty Income Corp has increased its dividend each year since The stock is thus listed as a dividend aristocrat, an honor that is given to companies that have increased their dividend each year for at least the past 25 years. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Realty income dividend date

The next Realty Income Corp. The previous Realty Income Corp. There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 0.

Clipart tractor

Trending Stocks. When do I have to buy the share of Realty Income Corp to receive the next dividend? Does Realty Income have sufficient earnings to cover their dividend? Risk Warning and Disclaimer. We accept no liability whatsoever for any decision made or action taken or not taken. Optimized Dividend Chart The chart below shows the optimized dividends for this security over a rolling month period. ETF Center. About Realty Income Corp. How To Use TipRanks. Dec 01, Top Stocks. Precious metals. Share: Linked in.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. O stock. Dividend Safety.

My Career. Best Dividend Stocks. Payout Period Monthly. It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Mobile APP. Target Market-beating returns. To date, the company has declared consecutive monthly dividends on its shares of common stock throughout its year operating history and increased the dividend times since Realty Income's public listing in NYSE: O. Search Please fill out this field. Get actionable alerts from top Wall Street Analysts. O stock. IRA Guide. Left Right. Jun 30, Strategists Channel.

0 thoughts on “Realty income dividend date”