Ready reckoner rate pune

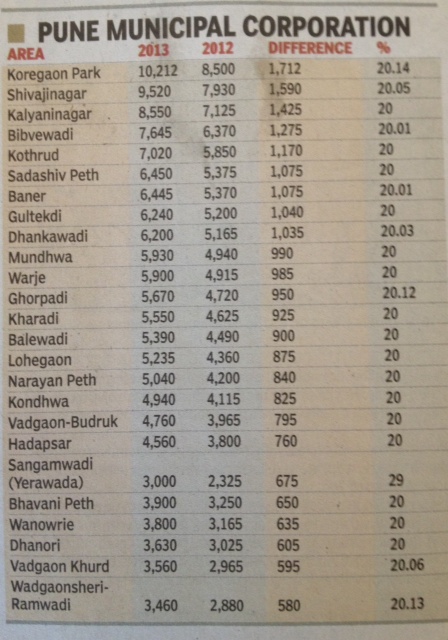

Ready reckoner rate pune Reckoner Rate refers to the government-assigned rates for land and property transactions in the city. These rates determine Stamp Duty and Registration Charges while undertaking property transactions. Understanding the Ready Reckoner Rate is crucial for buyers and sellers in Pune's real estate market. Since Pune has had a significant presence in the automobile, manufacturing, and IT industries for years, the Ready Reckoner rate of Pune in - was very high.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. According to the government, this rate represents the minimum property values in a variety of areas. Every state, every city, and even various neighbourhoods inside those cities have a distinct rate.

Ready reckoner rate pune

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project. Enter Pincode. I am: Broker Developer. Enter Name. Enter Email Address. Enter Mobile Number. Enter Code. Connect Now Loading Thank you, for showing your Interest!!

Registration charges are additionally levied over the stamp duty to balance the cost incurred by running registration offices.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case.

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian. We have systematically arranged few districts so that users can easily know the accurate property rates to calculate stamp duty of the geographical area of the Maharashtra State which are as below; simply select the district of your choice to get information related to the Ready Reckoner Rates. We have explained in details how to calculate Market value of Property. Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India. With view that the facility of payment of stamp duty is made easily available to the public therefore different arrangements are in force. Crafted by Tulja Bhavani Web Tech. This website does not own by Maharashtra Government. It is a Private Website, developed for Basic Information. Cross check all the information with concerned offices.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields.

Hickory inn bentonville ar

Stamp Duty Ready Reckoner maval Nyati Esteban II View. This is eight. Click the link below to start your home search. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. Department of Registration and Stamps Timeline Events. With the increasing number of people migrating to Mumbai, Pune, and nearby areas, the demand for real estate has skyrocketed in the state, thus allowing developers to work on multiple new projects that are sure to be profitable. Cross check all the information with concerned offices. Stamp duty and registration charges increase with a rise in the ready reckoner rate. Accordant to Section 43CA of the Income Tax Act, selling real estate at a price that is at least ten per cent lower than the ready reckoner rate, also known as the circle rate, can result in a penalty of 35 percent of the difference between the original price and the revised price, as well as other consequences. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. How to calculate Market Value of Property. Majestique Vriddhi View.

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty.

We have explained in details how to calculate Market value of Property. What is the ready reckoner Mumbai rate cut? Book Free Consultation. It is possible to benefit both buyers and sellers by lowering the ready reckoner rate or putting it in line with the current market pricing, which may assist in rekindling demand in the industry. Commercial-Ready Reckoner Rates would cover office spaces, retail shops, showrooms, commercial complexes, and industrial properties in Pune. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. If you need to consult an expert, comment below this article and our executive will be in touch with you shortly. This is fourth Get a Quote. RR rates for houses in a certain location are an excellent indicator of how much money a prospective home buyer will have to spend on a property. This category would include rates for agricultural and non-agricultural land in Pune. Real Estate Legal Guide. The ready reckoner rate is the minimum value of a property set by the state government. Frequently asked questions 1.

Excuse for that I interfere � At me a similar situation. I invite to discussion.

I confirm. All above told the truth. We can communicate on this theme.

I think, that you are not right. I am assured. I can prove it.