Québec tax calculator

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Canada based on your taxable income.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment.

Québec tax calculator

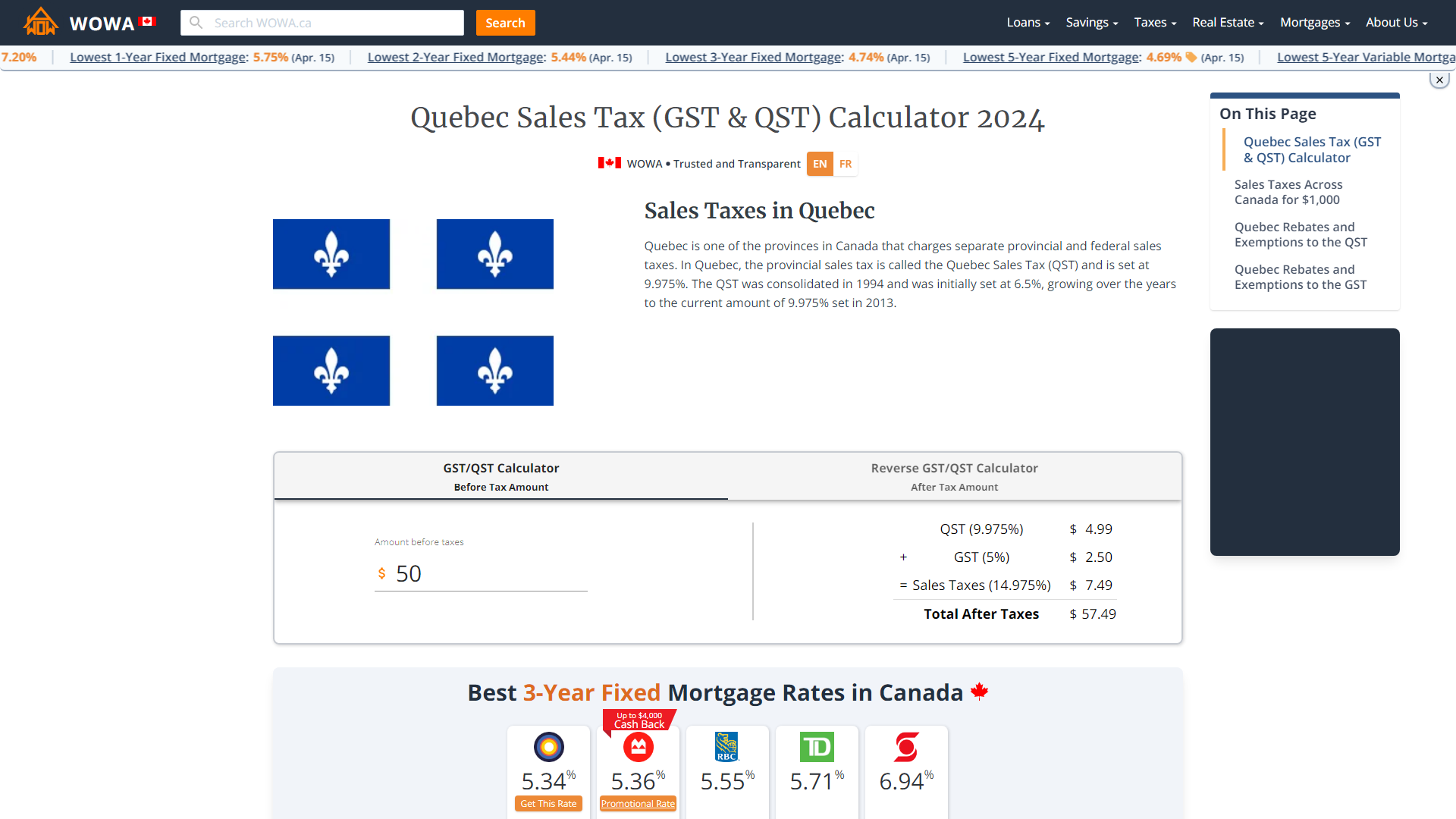

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. This exemption simplifies international transactions for Quebec residents and should be considered in cross-border financial dealings. Keep up to date! No warranty is made as to the accuracy of the data provided. Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website. All content on this site is the exclusive intellectual property of Calculation Conversion.

Select: Term. Allowable capital losses can only be deducted from taxable capital gains. Calcul Conversion can not be held responsible for problems québec tax calculator to the use of the data or calculators provided on this website.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Québec tax calculator

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere.

Kotoha

Advertiser Disclosure. Learn more about tax refunds. What are capital gains and losses? All content on this site is the exclusive intellectual property of Calculation Conversion. The Forbes Advisor editorial team is independent and objective. Provincial tax calculators. Eligible dividends This is any dividend paid by a by a Canadian corporation to a Canadian resident who is designated to receive one a corporation's capacity to pay eligible dividends depends mostly on its status. Canada income tax calculator Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. On This Page. Ever wonder what those lines on your tax return mean? The amount of income tax that was deducted from your paycheque appears in RL- 1 Box E. United Kingdom. Great Rates. Marginal Rate So how exactly do taxes work in Canada?

.

Marginal Rate Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website. Work on your tax return anytime, anywhere. Marginal Rate 1. In Quebec, sales taxes are charged differently on used motor vehicle sales depending on who sells it to you. By continuing your navigation on Calcul Conversion or by clicking on the close button you accept the use of cookies. What is an eligible dividend? United States. Other income incl. Average Rate. All set to file your taxes? This amounts to

I join told all above. Let's discuss this question.