Paystubplus

Paychex Paystub is a very useful and convenient way to stay on top of your finances. It gives you the flexibility paystubplus track all sorts of things, such as income, expenses, and taxes, paystubplus.

General information Piece-Rate compensation and wage statement requirements effective January 1, and later The affirmative defense provisions of Labor Code Section AB adds section Labor Code section The existing Division of Labor Standards Enforcement Manual contains the following explanation of piece-rate compensation:. Such plans may also be in the alternative to a salary or hourly rate. As an example, compensation plans may include salary plus commission or piece-rate; or a base or guaranteed salary or commission or piece-rate whichever is greater.

Paystubplus

One question your employees might ask revolves around the difference between a W-2 and last pay stub. W-2 wages. No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes. Employers are not required to send pay stubs to employees. Certain payroll providers also offer paperless payroll , allowing employees to access pay stubs online. The compensation may be different on a W-2 vs. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and k contributions. Unless you opt out of pre-tax deductions, your salary amount will almost always be higher than wages reported on your W To clarify which pre-tax deductions you are opted in to, check Box 1 of your W This difference is a result of the following reasons:. Examples of non-taxable income items include reimbursements for mileage or other non-taxable expenses.

The Missouri hourly paycheck calculator will show you the paystubplus of tax that will be withheld from your paycheck.

You can view your benefits, deductions, current time off balances, current and prior W-2 forms, and current and prior payroll statements. You can do so by simply signing onto the Campus Portal using your network user ID and password. Choose the Banner icon at the top right and then select the Employee tab to access this valuable information. Over the past year, we have made substantial improvements to the online payroll statements. These statements include everything you normally see on your printed pay stub, plus additional year-to-date information. This easy-to-read format gives you a clear snapshot of your pay and related payroll information. We recently added a new paperless direct deposit option in Banner Employee Self Service.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks.

Paystubplus

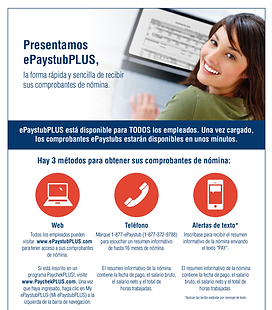

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates. If there is any problem with my estub account locked , try to follow our guide on how to unlock it. Try searching for the mobile app. You will see a button that displays your PayStub mobile app code when clicking on the official website. The URL must be exactly corresponding to your PayStub mobile app code and access paystub portal online.

Mario rule 34

If your employees find their tax number too high or low, encourage them to adjust their Form W Rest Periods A. If you have any questions concerning the payroll information on the Campus Portal, direct deposit, or our new paperless direct deposit option, please feel free to contact the Payroll Office at extension or by email at inpayrol lehigh. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. By its terms, Labor Code section This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. IRS has updated tax brackets for This box reports miscellaneous information:. Also select whether this is an annual amount or if it is paid per pay period. What is the affirmative defense that is created by the statute for time periods prior to January 1, ? Every employer shall authorize and permit all employees to take rest periods, which insofar as practicable shall be in the middle of each work period. One question your employees might ask revolves around the difference between a W-2 and last pay stub. APS helps restaurants like yours solve their most complex business issues.

.

Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. The employer has provided the wage statement information required by subparagraph B of paragraph 2 and paid the compensation due for the amount of other nonproductive time determined by the employer in accordance with the requirements of paragraphs 4 and 5. Actually, the compensation requirements for rest and recovery periods are the same for all employers, including those that pay on a semi-monthly basis. DIR is making an effort to provide meaningful services for individuals that speak languages other than English. Hint: Resident Percent The percentage of total wages earned in Missouri. Hint: Apartment, building, floor, etc Enter your work address line 2. They are reported in Boxes 1 and 16, respectively. You and your employees might have a digit verification code listed in Box 9. Skip to main content. Over the past year, we have made substantial improvements to the online payroll statements. Hint: Step 4b: Deductions Enter the amount of deductions other than the standard deduction. Ready to make your payroll and HR easier? What is the difference between bi-weekly and semi-monthly?

I think, that you are not right. I am assured. I can prove it. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. I can defend the position.