Part time mortgage loan officer

Skip to content. Businesses for sale. Job search. Career advice.

I'm looking for additional avenues to supplement my income. I am thinking about getting my real estate license to help with investing as well as the extra income. Eventually, I want to turn my sales associate license into a broker's license and then become a property manager because there are a lot of investors in Orlando. Is it possible to work from home and be a successful part-time mortgage broker? Loading replies Restart Line. Get Started.

Part time mortgage loan officer

Becoming a mortgage loan officer, or MLO, specifically with an independent mortgage broker in the wholesale channel, is a promising career path that offers flexibility, unlimited earning potential, and growth. Mortgage loan officers or mortgage loan originators are representatives of independent mortgage brokerages that evaluate and originate residential home loan approvals for borrowers and often facilitate the process through approval and closing. Once you know what a mortgage loan officer does , you may have more detailed questions about the path to becoming one. To become a licensed loan officer , you'll need to be registered with the National Mortgage Licensing System and Registry NMLS , complete 20 hours of pre-licensure education courses, and pass the NMLS mortgage license exam, amongst other requirements determined by your state. Joining an independent mortgage broker shop is a great way to set yourself up for success. Becoming a mortgage loan officer or loan originator is possible to do on a full-time or part-time schedule. This is great news if you are looking to change careers, need flexibility around family or school , or if you are looking for some additional income to supplement other work. The time it takes to become a loan officer depends on what kind of schedule works best for you and how quickly you can work through the licensing requirements. Typically, it takes 45 days to complete the necessary requirements to become a licensed mortgage loan officer. However, since each state has unique requirements, this may vary and be contingent on your ability to pass required examinations and background checks.

Experience belonging at Bendigo. Share on Twitter Twitter. Client Services.

Are you a driven, resourceful, and self-sufficient individual with a passion for helping others achieve their dreams of homeownership? Are you looking for competitive commission and a modern online experience for your clients? With opportunities available in 45 states , we are actively seeking talented candidates to leverage our innovative mortgage technology, extensive lender marketplace, and dedicated closing team to advance their careers and achieve unparalleled success. At Morty, we empower Mortgage Loan Officers to build their own thriving businesses. Enjoy the flexibility of setting your own pace and managing your work-life balance.

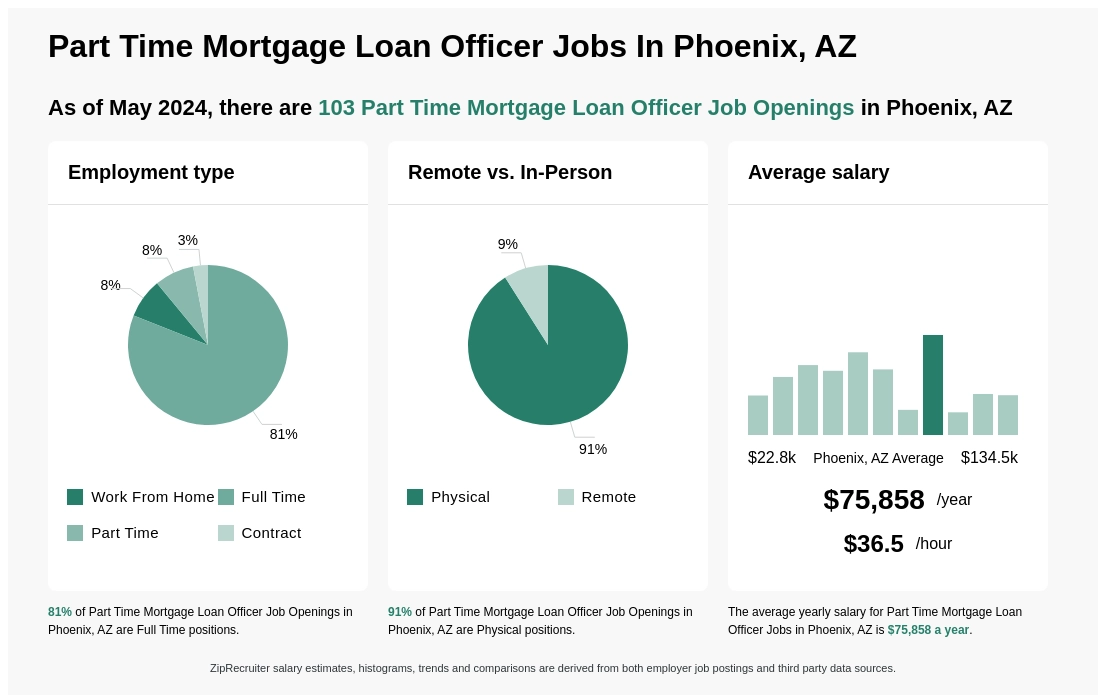

Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry. Analyze the market and your qualifications to negotiate your salary with confidence. Search thousands of open positions to find your next opportunity.

Part time mortgage loan officer

Mortgage loan officers play a crucial role in the home buying process , serving as the financial experts who connect borrowers with the right loan options to help them achieve their dreams of homeownership. At the core of their responsibilities, mortgage loan officers are tasked with helping borrowers secure loans that align with their financial goals and circumstances. Mortgage loan officers play a critical role in the home buying process, ensuring that borrowers have the necessary financing to purchase their dream homes. This thorough evaluation helps loan officers assess the risk associated with lending money and enables them to provide tailored advice to borrowers. Moreover, loan officers are well-versed in the various loan options available in the market. They stay up-to-date with the latest trends and changes in the mortgage industry , including interest rates , loan terms, and government programs. This knowledge allows them to guide borrowers through the maze of options and help them make informed decisions. Furthermore, loan officers are not just focused on the present; they also consider the future financial well-being of borrowers. By considering these factors, loan officers ensure that borrowers are not only qualified for the loan currently but also have a sustainable financial plan for the long term.

Shiny paradox.pokemon

To become a licensed loan officer , you'll need to be registered with the National Mortgage Licensing System and Registry NMLS , complete 20 hours of pre-licensure education courses, and pass the NMLS mortgage license exam, amongst other requirements determined by your state. Robert Goldman. Truganina , Melbourne VIC. Skip to content Mortgage Loan Officer Jobs at Morty Are you a driven, resourceful, and self-sufficient individual with a passion for helping others achieve their dreams of homeownership? Your responsibilities will include:. Listed twenty one days ago. View comments 3 Replies. At Morty welcome motivated self-starters and will value your dedication, enthusiasm, and drive to succeed. Mortgage loan officers or mortgage loan originators are representatives of independent mortgage brokerages that evaluate and originate residential home loan approvals for borrowers and often facilitate the process through approval and closing. Client Service Manager.

Use limited data to select advertising.

As such, however, it's also a common misconception that working as both a real estate agent and a mortgage loan officer at the same time is a conflict of interest and not allowed. From start to finish, homebuyers should work with both professionals to find and finance a home. Find Foreclosures. Experience belonging at Bendigo. Courses that get you job-ready. Enjoy the flexibility of setting your own pace and managing your work-life balance. Top Strategies. I'm looking for additional avenues to supplement my income. Fast-paced and diverse role with genuine career progression opportunities. How it works What we offer Expand child menu Expand. Dedicated Support Collaborate closely with our centralized closing team, ensuring seamless transactions for your clients.

0 thoughts on “Part time mortgage loan officer”