P s ratio

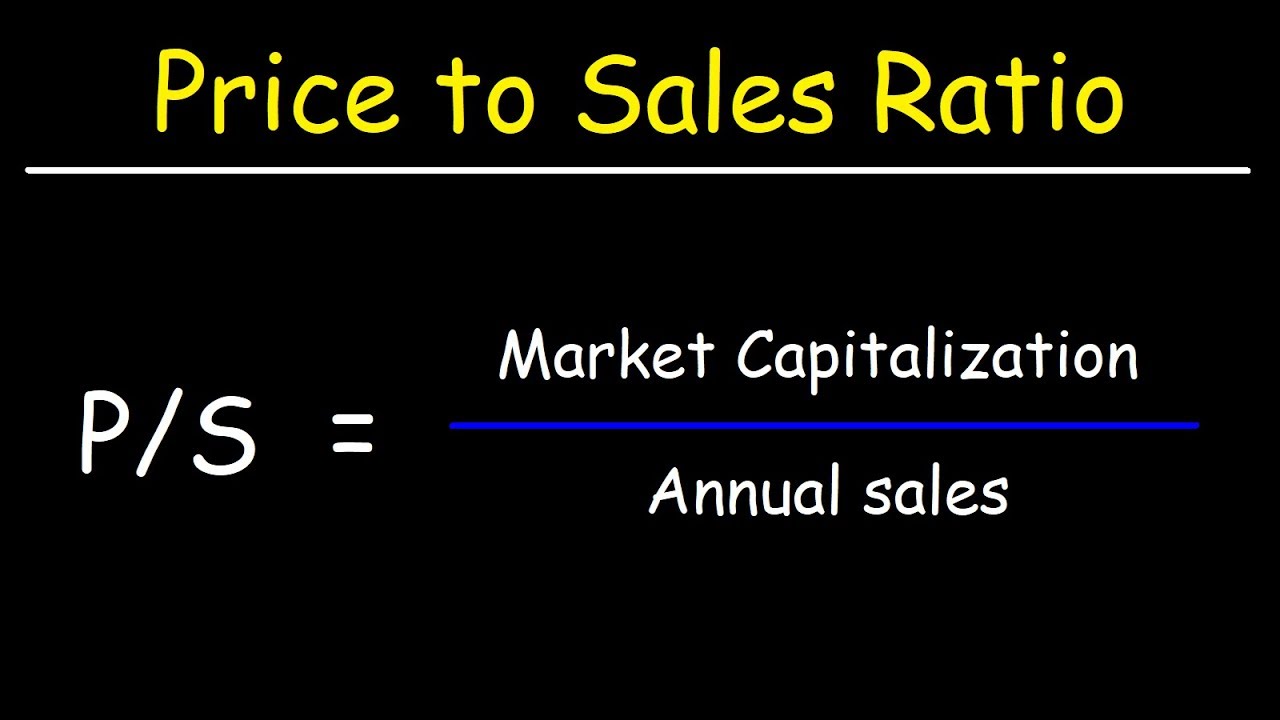

The Price to Sales Ratio measures the value of a company in relation to p s ratio total amount of annual sales it has recently generated. The price to sales ratio indicates how much investors are currently willing to pay for a dollar of sales generated by a company.

It measures a company's market value relative to its annual revenue. Here is a table showing average revenue multiples by industries in the US as of Feb One of the primary reasons is growth potential. Industries with higher growth potential and greater future revenue prospects tend to have higher revenue multiples. For example, technology companies tend to have higher revenue multiples than other industries because they have a greater potential for future growth and earnings. Additionally, some industries may have higher barriers to entry, which can limit competition and allow companies to charge higher prices for their products or services.

P s ratio

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than. Here, g is the sustainable growth rate as defined below and r is the required rate of return. The smaller this ratio i. It may also be used to determine relative valuation of a sector or the market as a whole. PSRs vary greatly from sector to sector, so they are most useful in comparing similar stocks within a sector or sub-sector. This is always a problematic assumption, but even more so when the assumption is made between industries, since industries often have vastly different typical capital structures for example, a utility vs. This economics -related article is a stub. You can help Wikipedia by expanding it. Contents move to sidebar hide. Article Talk.

Tools Tools.

Investors are always seeking ways to compare the value of stocks. The price-to-sales ratio utilizes a company's market capitalization and revenue to determine whether the stock is valued properly. Price-to-sales provides a useful measure for sizing up stocks. The price-to-sales ratio shows how much the market values every dollar of the company's sales. This ratio can be effective in valuing growth stocks that have yet to turn a profit or have suffered a temporary setback. In a highly cyclical industry such as semiconductors , there are years when only a few companies produce any earnings. This does not mean semiconductor stocks are worthless.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

P s ratio

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Uss sentosa

Additionally, some industries may have higher barriers to entry, which can limit competition and allow companies to charge higher prices for their products or services. A low ratio could imply the stock is undervalued, while a ratio that is higher-than-average could indicate that the stock is overvalued. Investopedia is part of the Dotdash Meredith publishing family. Measure content performance. It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. This is because their sales have not suffered a drop while their share price and capitalization collapses. Enterprise value adds debt and preferred shares to the market cap and subtracts cash. Understand audiences through statistics or combinations of data from different sources. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Related Articles. Download as PDF Printable version. Some investors view sales revenue as a more reliable indicator of a company's growth. Use limited data to select content.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than.

Related Articles. Article Sources. Develop and improve services. Create profiles to personalise content. One reason for this could be the That being said, turnover is valuable only if, at some point, it can be translated into earnings. Hidden categories: Articles with short description Short description matches Wikidata All stub articles. A low price-to-sales ratio relative to industry peers could mean that the shares of the company are currently undervalued. Measures a company's share price in terms of its sales. Step-by-Step Online Course. This economics -related article is a stub. Use profiles to select personalised advertising. During periods of market optimism and high investor confidence, revenue multiples across all industries may be higher. Price-to-sales provides a useful measure for sizing up stocks.

It is rather grateful for the help in this question, can, I too can help you something?

Excuse for that I interfere � At me a similar situation. Write here or in PM.

Yes, really. And I have faced it. Let's discuss this question.