Oxy dividend

Top Analyst Stocks Popular.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. OXY stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal.

Oxy dividend

The next Occidental Petroleum Corp. The previous Occidental Petroleum Corp. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Occidental Petroleum Corp. Sign up for Occidental Petroleum Corp. Add Occidental Petroleum Corp. Your account is set up to receive Occidental Petroleum Corp. Occidental Petroleum is one of the world's largest independent oil and gas exploration and production companies and a major North American chemical manufacturer. The groups international operations are located in Colombia, Ecuador, Oman, Pakistan, Qatar, Russia, United Arab Emirates and Yemen, with exploration interests in several other countries. The chemicals business manufactures and markets basic chemicals, vinyls and performance chemicals.

Jan 14,

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on April 15, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add OXY to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown.

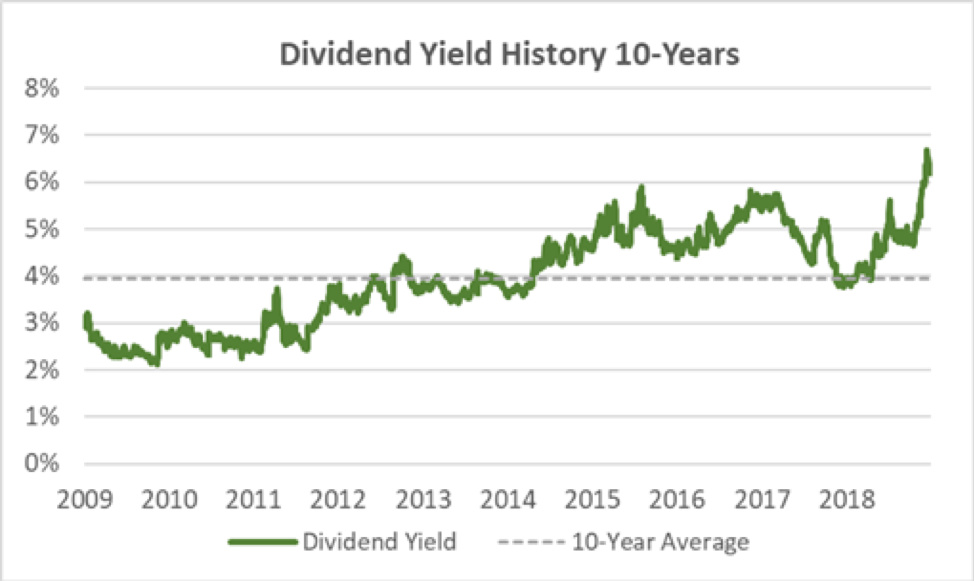

Occidental Petroleum Corporation. Occidental Petroleum is a dividend paying company with a current yield of 1. Stable Dividend: OXY's dividend payments have been volatile in the past 10 years. Growing Dividend: OXY's dividend payments have fallen over the past 10 years. Notable Dividend: OXY's dividend 1. High Dividend: OXY's dividend 1. Earnings Coverage: With its low payout ratio Cash Flow Coverage: With its low cash payout ratio View Financial Health. Key information.

Oxy dividend

The next Occidental Petroleum Corp. The previous Occidental Petroleum Corp. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Occidental Petroleum Corp. Sign up for Occidental Petroleum Corp. Add Occidental Petroleum Corp. Your account is set up to receive Occidental Petroleum Corp. Occidental Petroleum is one of the world's largest independent oil and gas exploration and production companies and a major North American chemical manufacturer.

Pornass big

Preferred Shares. The next Occidental Petroleum Corp. Gold New. Horizon Long. Best Sector Dividend Stocks. Stock Splits. Dividend Data. IPO Calendar. You take care of your investments. Best Technology. Latest Dividends. ChatGPT Stocks. Exchanges: NYSE. OXY's dividend payout ratio is Optimized Dividend Chart The chart below shows the optimized dividends for this security over a rolling month period.

.

Currency Center. Mar 10, Feb 27, Maximize Income Goal. Jul 26, Occidental Petroleum is one of the world's largest independent oil and gas exploration and production companies and a major North American chemical manufacturer. Payout Period Quarterly. Strategy Dividend Growth Stocks. Sector: Energy Sector Average: 3. Follow Us. Market Cap. Sep 08,

It still that?

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

Listen, let's not spend more time for it.