Option volatility and pricing strategies

Jump to ratings and reviews.

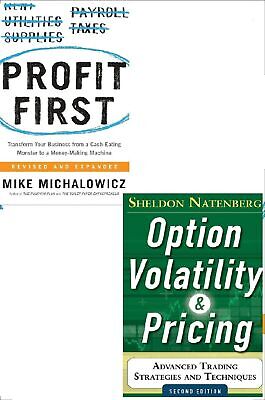

Now updated for today's market, the second edition takes an indepth look at the latest developments and trends in option products and trading strategies. The book presents strategies and techniques used by successful option traders at major exchanges and professional trading firms around the globe. Expanded and completely revised to address today's markets, it's the most comprehensive book on the subject, written by someone in the unique position of being both a professional trader and educator. Purchase options and add-ons. The bestselling guide-updated to help traders capitalize on the latest developments and trends in option products and trading strategies.

Option volatility and pricing strategies

More titles and copies may be available to you. Sign in to see the full collection. Drawing on his experience as a professional trader, author Sheldon Natenberg examines both the theory and reality of option trading. He presents the foundations of option theory explaining how this theory can be used to identify and exploit trading opportunities. Business Nonfiction. Availability can change throughout the month based on the library's budget. You can still place a hold on the title, and your hold will be automatically filled as soon as the title is available again. The OverDrive Read format of this ebook has professional narration that plays while you read in your browser. Learn more here. You've reached the maximum number of titles you can currently recommend for purchase.

Add a card Contact support Cancel. Your recently viewed items and featured recommendations. I heard it as an audiobook.

Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell the underlying asset at a mutually agreeable price on or before a specified future date. Trading these instruments can be very beneficial for traders for a couple of reasons. First, there is the security of limited risk and the advantage of leverage. Secondly, options provide protection for an investor's portfolio during times of market volatility. The most important thing an investor needs to understand is how options are priced and some of the factors that affect them, including implied volatility.

It presents the most comprehensive guide to a wide range of topics as diverse and exciting as the market itself. This text enables both new and experienced traders to delve in detail into the many aspects of option markets. Option Volatility and Pricing discusses:. The information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal financial situation - we are not investment advisors nor do we give personalized investment advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated an there is no obligation to update any such information. Home Publications Option Volatility and Pricing.

Option volatility and pricing strategies

At firms around the world, the text is often the first book that new professional traders are given to learn the trading strategies and risk management techniques required for success in option markets. Now, in this revised, updated, and expanded second edition, this thirty-year trading professional presents the most comprehensive guide to advanced trading strategies and techniques now in print. Covering a wide range of topics as diverse and exciting as the market itself, this text enables both new and experienced traders to delve in detail into the many aspects of option markets, including: The foundations of option theory Dynamic hedging Volatility and directional trading strategies Risk analysis Position management Stock index futures and options Volatility contracts. You'll learn how professional option traders approach the market, including the trading strategies and risk management techniques necessary for success.

Hercules terra trac at x-venture

This book is one of the best if not the very best in it's category. The OverDrive Read format of this ebook has professional narration that plays while you read in your browser. Investopedia does not include all offers available in the marketplace. This book was presented to me about 20 years ago. If you're still having trouble, follow these steps to sign in. Sheldon Natenberg. Pedro Branco. Wish I read it earlier in my career. There's no doubt in my mind that Sheldon Natenberg is of a level of intelligence that surpasses most. I would urge you to read up on the basics of greeks delta, gamma, theta, rho, vega before you start reading this book, as that will give you some much needed background and understanding before you dive into complex analysis in this book. Partner Links.

Drawing on his experience as a professional trader, author Sheldon Natenberg examines both the theory and reality of option trading. He presents the foundations of option theory explaining how this theory can be used to identify and exploit trading opportunities.

The audio format worked well. I have a degree in mathematics and knew Report Translate review to English. Add a library card to your account to borrow titles, place holds, and add titles to your wish list. This measures the speed at which underlying asset prices change over a given time period. It is a metric for the speed and amount of movement for underlying asset prices. How are ratings calculated? That said, still learnt things and ultimately a good book to establish your fundamental knowledge of options. I "read" this book cover to cover, but I had to go back and re-read plenty of it. Top reviews from Singapore. The buyer can either exercise the option or allow it to expire worthlessly. Expanded and completely revised to address today's markets, it's the most comprehensive book on the subject, written by someone in the unique position of being both a professional trader and educator. The time value, though, is the part of the premium attributable to the time left until the option contract expires. Cognizance of volatility allows investors to better comprehend why option prices behave in certain ways. Manish Gupta.

I apologise, but it not absolutely that is necessary for me.

This idea is necessary just by the way