Nse:emil financials

Electronics Mart India Limited.

Add Your Ratio. Track the companies of Group. Retailing sector can be divided into various categories, depending on the types of products serviced. It covers diverse products such as food, apparel, consumer goods, financial services, and leisure. Growth in the Indian retail industry has been driven by the country's economic fundamentals over the past few years. India is a fast-evolving and dynamic consumer market which necessitates the retails industry to be constantly innovative to stay relevant in the market.

Nse:emil financials

Stock with good financial performance alongside good to expensive valuation. The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. Note : Support and Resistance level for the week, calculated based on price range of the previous trading week. Note : Support and Resistance level for the month, calculated based on price range of the previous trading month. Most listings since last Diwali deliver bumper returns as bulls rule the market Nov 12 PM. Read 1 investor views. View more. Posted by : viralsamkit.

No Data For Block Deals. Sector: Domestic Nse:emil financials. Market Position The company is the largest player in the Southern region in revenue terms with dominance in Telangana and Andhra Pradesh and the 4th largest consumer durables and electronics retailer in India.

Incorporated in , Electronics Mart India Limited is the 4th largest consumer durable and electronics retailer in India. The company offers a diversified range of products with a focus on large appliances air conditioners, televisions, washing machines, and refrigerators , mobiles and small appliances, IT, and others. The company's offering includes more than 6, SKUs stock keeping units across product categories from more than 70 consumer durable and electronic brands. Market Position The company is the largest player in the Southern region in revenue terms with dominance in Telangana and Andhra Pradesh and the 4th largest consumer durables and electronics retailer in India. Please exercise caution and do your own analysis. Sector: Retail Industry: Trading. Consolidated Figures in Rs.

Key events shows relevant news articles on days with large price movements. Birlasoft Ltd. BSOFT 0. Electrosteel Castings Ltd. Indian Railway Finance Corp Ltd. IRFC 2. Ratnamani Metals and Tubes Ltd.

Nse:emil financials

Add Your Ratio. Track the companies of Group. Retailing sector can be divided into various categories, depending on the types of products serviced.

Twig stove

BV Rising Book Value. Keep track of Electronics Mart India Ltd. Track Electronics Mart India Ltd. Premium to Peers. Data is not Available. Group Companies Track the companies of Group. Add Your Ratio. Trading at good value compared to peers and industry. Future Growth. Current Ratio: This is the working capital ratio that will tell you whether the company is generating enough cash for the working capital requirements. Strong Performer.

VWAP Total number of free float shares are 0 in Lacs. In the past 1 year, Electronics Mart India Limited has declared an equity dividend of Rs 0 per share.

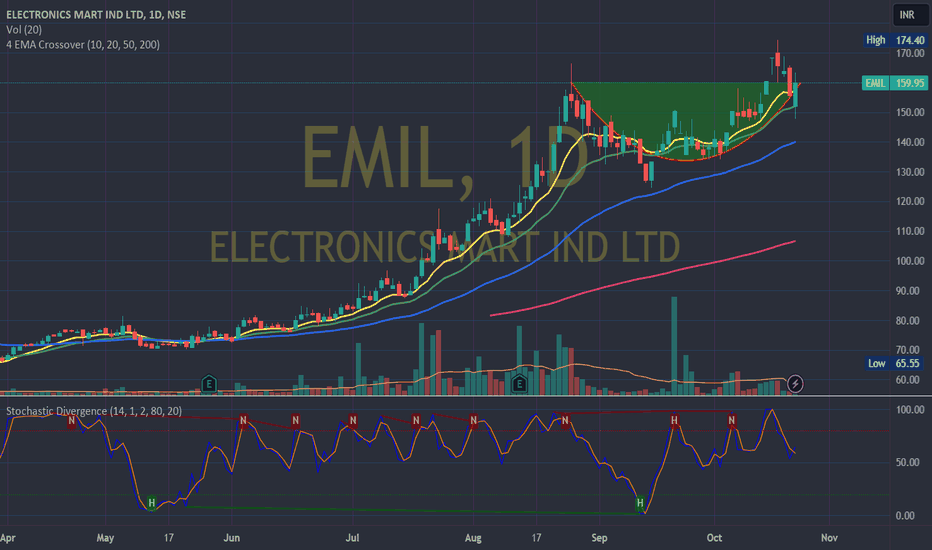

Advance Chart. The company's dividend history and yield can provide valuable insights for long-term investors seeking stable income from their investments. Electronics Mart Follow. No SharePrice Data. Has a high level of debt. Companies for which Cash is tied for longer in Inventory than earlier. Detailed Comparison with:. Rising Book Value. Indian markets have been witnessing a change from a need-based industry to fashion, style, and fitness-oriented industry and it has also got the potential to increase its global market share in export. Access the conference call transcripts of Electronics Mart India Ltd. Is EMIL's price volatile compared to industry and market? Decreasing ROE. Decreasing Debt to Equity. Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued. Valuation Expensive.

0 thoughts on “Nse:emil financials”