Northwestern mutual financial planning

Some people think it's a retirement plan.

It's difficult to separate the financial needs and goals of your business with the goals you set for yourself and your family. We can help you develop an integrated approach that addresses both, allowing you to create a competitive business advantage and live the life you envision. By taking a comprehensive view of your financial plan personal, business and estate you'll clearly see how the success of your business will support your personal financial goals, such as buying a home, saving for college, retirement or leaving a legacy. Our integrated planning approach can also help prevent difficult financial periods in your business from impacting the plans you've made at home—and vice versa. Learn more about our full range of personal financial planning strategies and solutions and how we can help you evaluate, prioritize and address your needs.

Northwestern mutual financial planning

Saving for a home, saving for college and funding retirement are some top savings goals that people include in their financial plan. Planning with a financial advisor can help you identify blind spots and find opportunities to make your money work harder for you—and adjust to life changes that come your way. Think about the last time you took a big road trip. Rather than hop in the car and wing it from point A to point B, you probably mapped out the best route first; found hotels and scenic points along the way; and planned a backup route in case a traffic jam or stormy weather knocked you off course. Financial planning is a bit like preparing for that trip—except point A is where you stand with your finances today, and point B is the future you who has accomplished your goals with the help of smart money decisions. Some common financial planning goals people plan for include:. Getting married, which can include combining finances or planning as a couple. Buying your first home or buying a second home or third home. Growing your family and planning for costs of raising a child. Paying off debt. Creating college savings plans to send kids to college. Starting a business. Determining how much you need to live your dream retirement. Creating an estate plan that will protect your family should something happen to you. Creating a will or trust to pass assets on to your children.

Here's what you can expect when you work with one:.

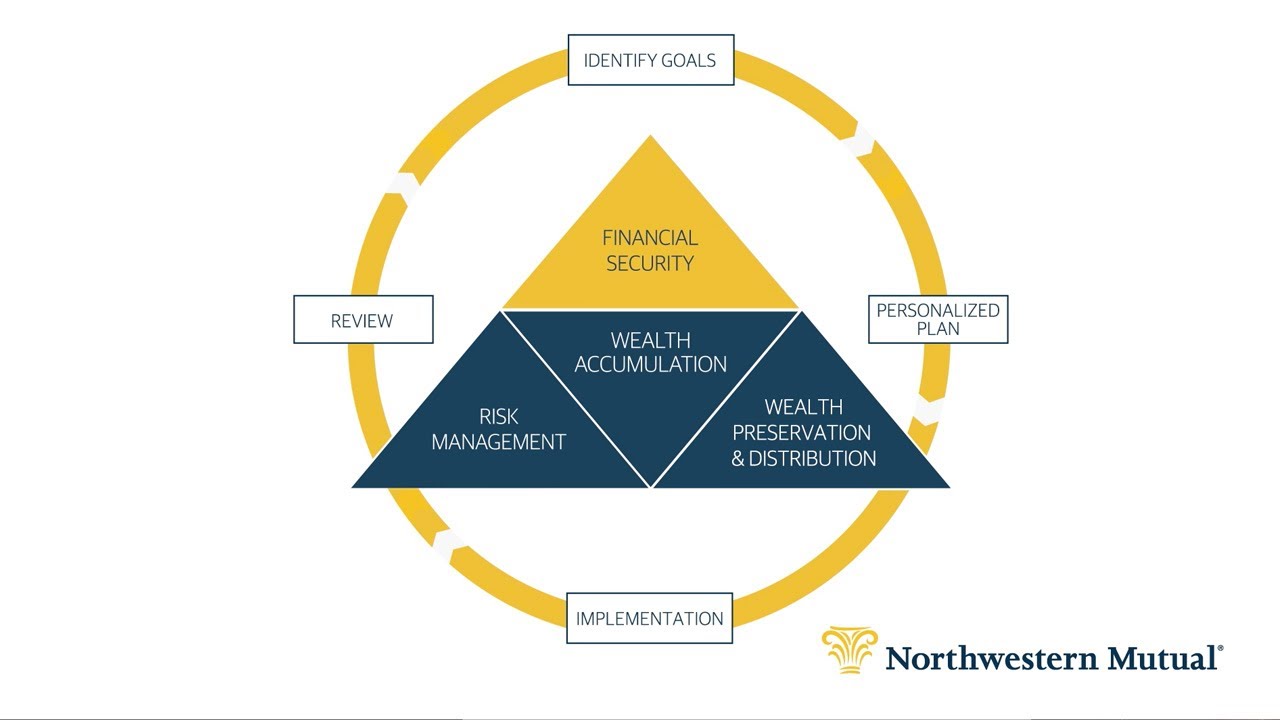

A good financial plan is about more than growing your wealth, it also includes strategies to protect it from common risks. A good financial plan uses a range of financial options that work with investments to help you grow and protect your wealth. Improving your financial picture? Good plan. Our guide includes financial steps to set you up for financial success now and in the future. Get our guide.

Our financial advisors help you do it. Our financial advisors help protect your family and keep your goals on track with insurance designed to give you financial flexibility, protect your income, and more. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Here's what you can expect when you work with one:. Someone who understands what's most important to you today and later on. Who thinks of all the what-ifs so you don't have to, guiding you as your life and goals change. You'll get a personalized plan , at no cost to you, that balances your current, and future, priorities.

Northwestern mutual financial planning

What is a financial plan, exactly? It shows you how the different parts of your financial life like your investments, retirement accounts, savings, debt payoff plans and even insurance work together to get you to where you want to be financially. A solid financial plan will include flexible strategies to grow your money over time and to protect it from the curveballs life will inevitably throw. The first step to creating a financial plan is to sit down and think about what you really want both now and in the future. A financial advisor will get to know you and learn about the goals that are most important to you — and even help you identify some goals you may not have thought about. Common goals might include buying a home, preparing to have kids and sending them to college, protecting your family, starting or growing a business and being able to retire comfortably. For instance, is it more important to have enough money to retire early or to have enough to see the world in retirement even if it means working a little longer? The best financial plans include a range of options that can help put you on the best route to your goals while including the flexibility to take detours if needed. These may include:. While some plans may focus more on one area than another based on your situation, all these components work together.

Color adobe comex

With Northwestern Mutual, you'll get a financial partner who really hears you—who listens to your concerns and guides you through them, so you know you'll make the best financial choices. We create a financial plan differently. Play Media Watch the video. A financial plan helps you use a range of financial options that reinforce each other in order to create a reliable stream of income in retirement. Get matched with an advisor. Most of our advisors will design a financial plan at no cost to you. Most of our advisors will design a financial plan at no cost to you. A good financial plan helps you prioritize what you want in the future with your goals today. A financial plan can help you protect your wealth from taxes in numerous ways. Special needs planning. How does a financial advisor get matched to me? Best life insurance company for consumer experience, 2.

Some people think it's a retirement plan. Others a budget. We're here to clear things up.

Your plan is built specifically for you, so no two are alike. Our financial advisors are here to guide you. Learn more. Sign me up. Here's how we do it. Your financial advisor can also connect you with other professionals, such as tax or estate planning advisors, for those areas of your finances that require very specialized knowledge. We've got answers. But investments alone can leave you vulnerable. Sign me up. A good financial plan is about more than growing your wealth, it also includes strategies to protect it from common risks.

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?

Completely I share your opinion. It is excellent idea. I support you.