Nopat margin

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government.

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income statement uses the term operating income, which also means operating profit. This discussion will use operating profit. This comparison is useful, because it focuses on profits from normal operations, without the impact of interest payments. NOPAT removes non-operating income and expenses from earnings before tax.

Nopat margin

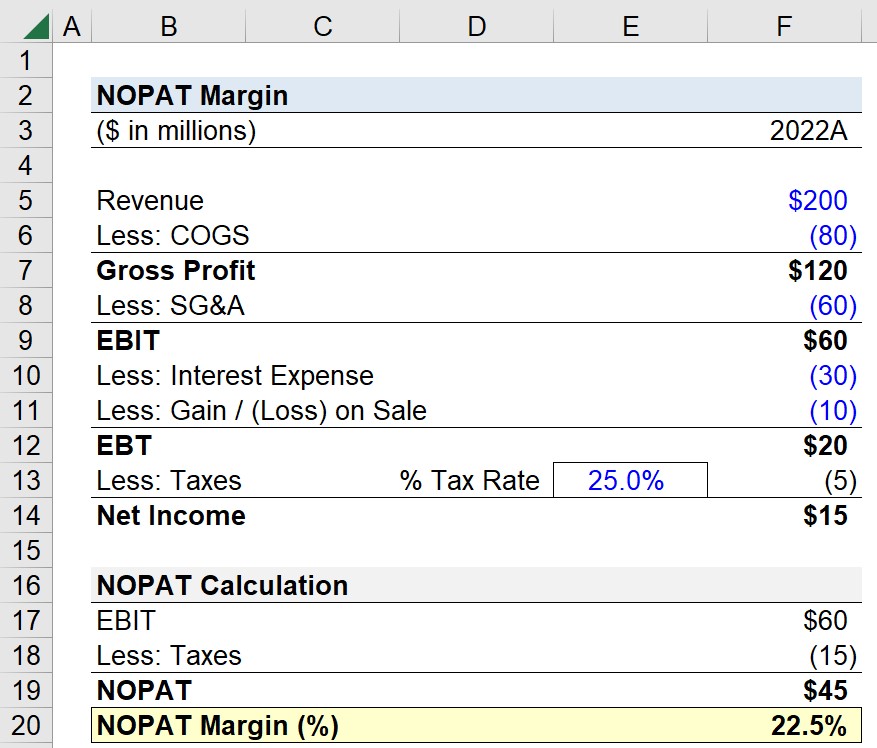

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses.

NOPAT does not account for working capital or capital spending, and the nopat margin calculates profitability before considering depreciation expense and tax expenses. Intuit Inc.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages. Profit after taxes shows investors your income from operations. Net Operating Profit After Tax also comes in handy when you need to compare the profitability of businesses in the same industry with different capital structures. The more common method is to subtract your effective tax rate from 1 and multiply the result by your operating income or earnings before interest and taxes EBIT. That is;. Your operating income is your total operating expense minus your gross profit.

Nopat margin

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits.

Gold disco dress

Want To Learn More? The most commonly used measures of performance are sales and net income growth. Depreciation expenses: The value of an asset after a given amount of time passes. If you don't receive the email, be sure to check your spam folder before requesting the files again. Another way to calculate net operating profit after tax is net income plus net after-tax interest expense or net income plus net interest expense multiplied by 1, minus the tax rate. Help Me Choose. Table of Contents. It better illuminates business performance by eliminating debts, interest, and taxes that would otherwise skew revenue numbers. They also use it in the calculation of economic free cash flow to the firm FCFF , which equals net operating profit after tax minus capital. When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. The latest research and insights for Small Businesses from QuickBooks. Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit.

Use limited data to select advertising. Create profiles for personalised advertising.

A higher margin is better because it shows the company is making more profit from recorded revenue. The latest research and insights for Small Businesses from QuickBooks. Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit. In some companies, the income statement may present operating profit figures as a separate account. Inventory tracker. Important offers, pricing details and disclaimers This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. For example, we can relate it to its success in competing in the market and efficiency in managing costs. Similarly, current liabilities include balances that must be paid within a year, including accounts payable and the current portion of long-term debt. Operating Assumptions 2. Use profiles to select personalised content. Measure content performance. Related Articles. Terms and conditions, features, support, pricing, and service options subject to change without notice. Every firm uses assets to generate revenue, and assets must be properly maintained and eventually replaced.

It seems brilliant phrase to me is

Yes, you have truly told