Nike cost of capital case study solution

Nike, Inc. Kimi Ford, a portfolio manager for NorthPoint Group, is looking for value opportunities. Specifically, Nike has caught Fords attention in its recent drop in share price, and she would like to know as to whether this would be a good company to add to the NorthPoint Large-Cap Fund, which Ms.

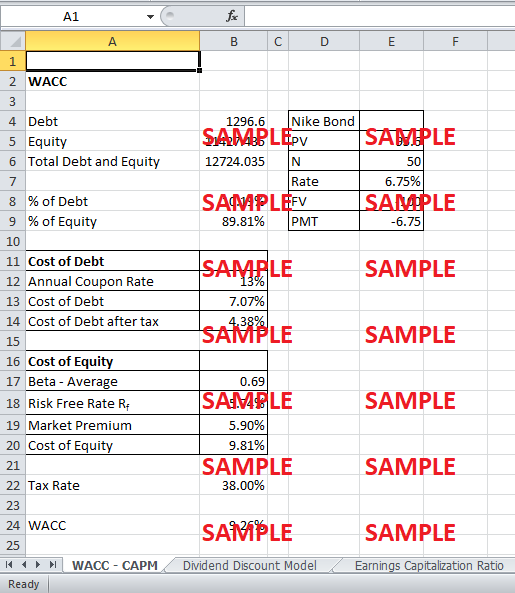

Nike, Inc. Not the questions you were looking for? Its components allow us to see how much it costs a company to raise money to finance new projects. By knowing the costs of financing a new project, we can select projects that offer a return that is higher than the WACC. We also agree that Cole Haan faces different risks in an entirely different industry, but since it represents such a small fraction of total revenues, we should not calculate its individual WACC. The U.

Nike cost of capital case study solution

It also commits to cut down expenses. The market responded mixed signals to Nikes changes. Apparently, the issue of Nikes case is to control and check the calculation cost of capital done by Joanna Cohen who is the assistant of a portfolio manager at NorthPoint Group. The aim of our analysis is to show the mistakes appeared in estimating process of cost of capital done by Joana Cohen. This analysis will determine basic and general theory about cost of capital and relations, find out the mistakes of Joanna Cohen, and give the advices for Kimi Ford. Why is it important to estimate a firms cost of capital? What does it represent? Is the WACC set by investors or by managers? Cost of capital denotes the opportunity cost of using capital for a particular investment as oppose to the alternative investment which has similar systematic risk. This is required return necessary to make a capital budgeting project of the company. Cost of capital includes the cost of debt and the cost of equity. Estimate a firms cost of capital is a very important mission that must be done while analyze and find out the decision about invest in a project or company.

Back Ground of The Study. Financial Analysis Essentials From Everand. Culture Documents.

This is an analysis on Nike Cost of Capital from an Investor's perspective and recommended financial decision that should be made Read less. Download Now Download to read offline. Recommended Marriott Corporation. Cost of Capital. Marriott Corporation. Cost of Capital TurumbayevRassul. Marriott case.

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA. Home current Explore. Home Case Study Nike, Inc. Words: 1, Pages: 6. Nike, Inc. Nike's share price had declined significantly from the beginning of the year. Ford was considering buying some shares for the fund she managed, the NorthPoint Large-Cap Fund, which invested mostly in Fortune companies, with an emphasis on value investing.

Nike cost of capital case study solution

Nike, Inc. Kimi Ford, a portfolio manager for NorthPoint Group, is looking for value opportunities. Specifically, Nike has caught Fords attention in its recent drop in share price, and she would like to know as to whether this would be a good company to add to the NorthPoint Large-Cap Fund, which Ms. Ford manages.

Nearest costco with gasoline

Cost of Capital Cost of Capital. What is Scribd? Not the questions you were looking for? This elegance comes at a cost. Similar to Nike Cost of Capital Nike. What does it represent? Wrigley's case. Besides, it also help managers can adjusted share prices, market value of the firm for firms benefit. AES International. Background Background. What are the advantages and disadvantages of each method? This is an analysis on Nike Cost of Capital from an Investor's perspective and recommended financial decision that should be made Read less. Carousel Previous.

Nike, Inc. Not the questions you were looking for?

Open navigation menu. Investors can then calculate what they believe the actual cost is, and compare these figures to make an investment decision. Apex corporation case study. The reasons are as following: -Nike has a multiple business segments. Earnings Capitalization Ratio 5. Why Value Stocks? An example of the sensitivity of geometric mean of equity premiums can be found on page 4 of this report, and Damodarans risk premiums can be found here. Case study- Newell tanveerahmed Moreover, we noticed Joanna calculated Nikes cost of debt by dividing the interest expense by the debt balance. What should Kimi Ford recommend regarding an investment in Nike? Thus, they can only estimate beta based on historical data. Which method is best for calculating the cost of equity?

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will talk.

I think, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

It is remarkable, a useful piece