M&t check deposit funds availability

Everyone info. However, it would be immediately available for withdrawal.

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you. When you make a deposit, you can use that money to withdraw cash, write checks or make a purchase. To deposit money at a bank branch, provide your cash and endorsed checks and a deposit slip to the teller. After making a deposit at a branch, your funds will typically be available immediately if the deposit was cash, or typically the next day if the deposit was an endorsed check.

M&t check deposit funds availability

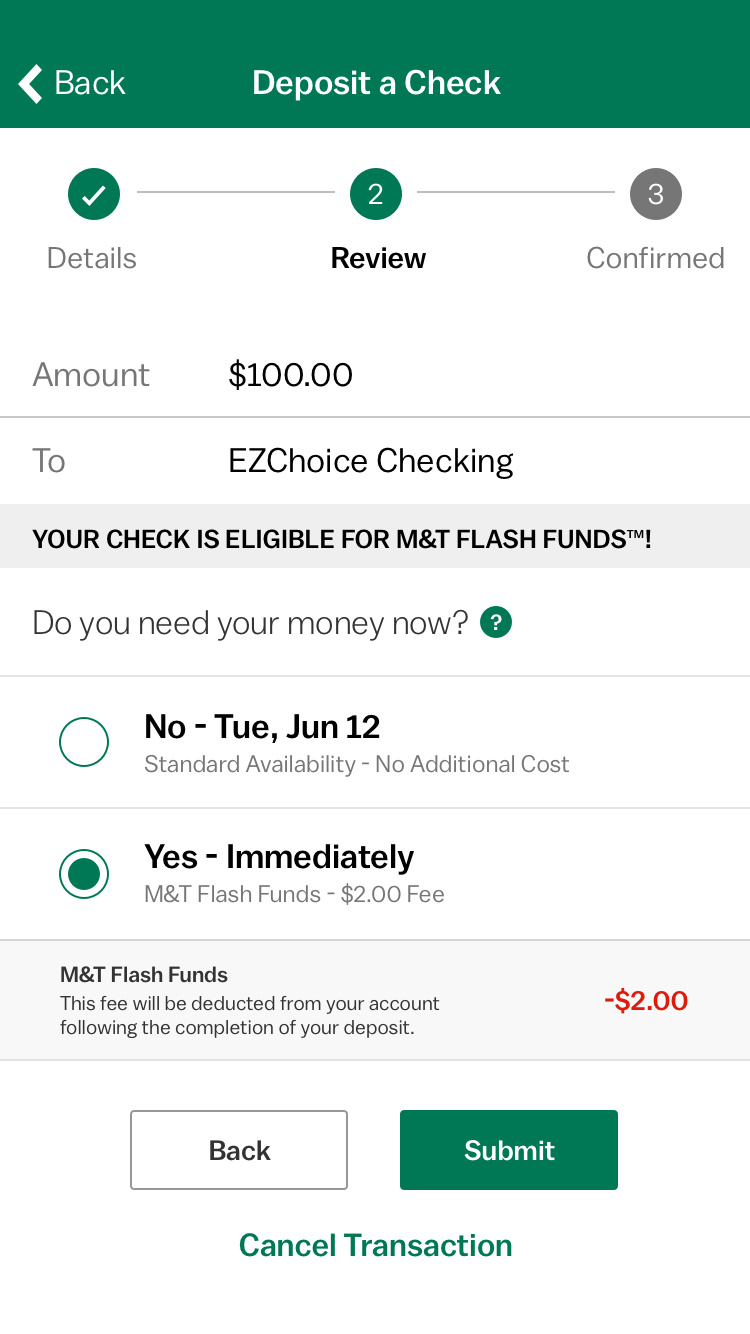

Each bank or credit union has its own rules as to when it will let you access money after you deposit a check, but federal law establishes the maximum length of time a bank or credit union can make you wait. If your deposit is a certified check, a check from another account at your bank or credit union, or a check from the government, you can withdraw or use the full amount on the next business day if you make the deposit in person to a bank employee. If you make a check deposit at an ATM at your bank, you can withdraw or use the full amount on the second business day. Your bank or credit union has a cut-off time for what it considers the end of the business day. If you make a deposit after the cut-off time, the bank or credit union can treat your deposit as if it was made on the next business day. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. If you need the money from a particular check, you can ask the teller when the funds will become available. A receipt showing your deposit does not mean that the money is available for you to use. Searches are limited to 75 characters. Skip to main content. What is a deposit hold?

Funds from an electronic direct deposit are available for your use on the same business day.

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you. Set personalized playlists for your unique situation and get step-by-step guides and advice for how to save for college, a house, your business or retirement.

When you deposit a check, you naturally expect the money to show up in your bank account. You probably also expect to be able to use that money whenever you need it. However, problems do sometimes arise. A bank's "funds availability policy disclosure" explains how long you need to wait to spend or withdraw funds after you make a deposit. When you deposit funds into your account, the bank often puts a hold on those deposits, requiring you to wait for at least one business day before you can use the money. The hold is intended to protect the bank from losing money. Holds can also help you avoid problems, but you are ultimately responsible for any deposit you make to your account. If your bank allows you to spend funds from a check that later bounces which can happen several weeks after you deposit the check , you may have to pay fees in addition to repaying the bank for the money they gave you. Federal regulations limit how banks can set up their funds availability policies. For example, banks can make funds available immediately, and they often do so, but they cannot hold funds forever.

M&t check deposit funds availability

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. View deposited and cleared checks right within the app. Order a replacement card, report a lost or stolen card or add authorized users to your credit card. Help protect your account with timely updates about spending, security and other activities that impact your money.

Frases a personas hipocritas

Doing so compromises security protections built into the device and may make your phone more vulnerable to malware and viruses. Help us make your banking experience better. What does that mean? Business day is defined as Monday through Friday, except Federal holidays. It needs to be replaced with something more soothing. How do I deposit money at an ATM? I cannot access Online or Mobile Banking, how can I unlock my card? When can I withdraw the funds? After an account is opened or service begins, it is subject to its features, conditions and terms, which are subject to change at any time in accordance with applicable laws and agreements. Other product and company names mentioned herein are the property of their respective owners.

Did you know that the funds from a deposited check are not actually yours until it's been cleared by the bank? Many people mistakenly believe that banks add funds immediately into your account after the check has been deposited -- but this is merely the first step.

I attempted a withdrawal later that day and was told I could not withdraw until tomorrow. To ensure the highest amount of security, we are taking extra precautions with your card. What do I do? Select the ellipsis on the top right and select Edit Details Edit the account name and other details. It seems just not to work well. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. As accessibility standards are continually evolving, our efforts to improve online accessibility are ongoing. Customers with a checking, savings or money market account and a legal address in the United States or Canada are automatically eligible for mobile check deposit. Where can I view, edit or cancel my scheduled payments or transfers? Redeem your credit card perks here. If it does, the loading wheel usually just spins. To deposit money at a bank branch, provide your cash and endorsed checks and a deposit slip to the teller. Help us make your banking experience better. When you make a deposit, you can use that money to withdraw cash, write checks or make a purchase. What does that mean?

0 thoughts on “M&t check deposit funds availability”