Monevator broker comparison

W hat is the cheapest stocks and shares ISA available? The investing world can be complicated, but this time we have a simple answer for you, monevator broker comparison.

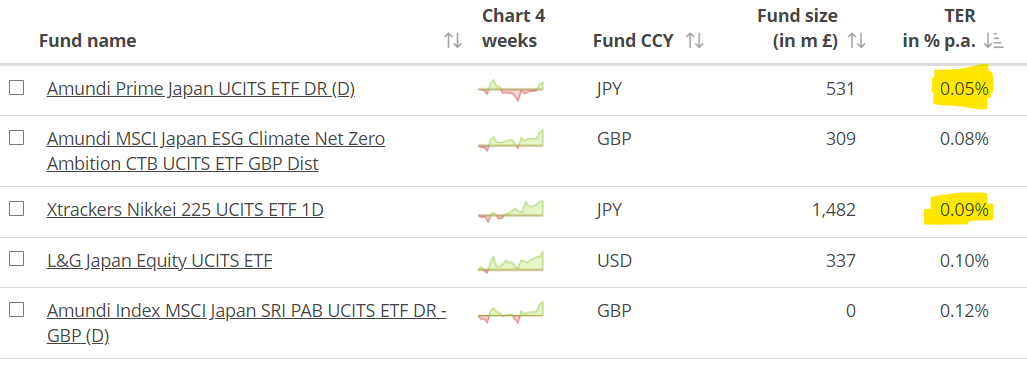

We just want to get pure, market cap-weighted, global equity beta at the lowest possible cost. As opposed to paying a fixed percentage on all that lolly. And ETFs — despite their name — count as shares, not funds. Not that it will matter to us with our ETFs. Ticker: PRIW.

Monevator broker comparison

F ind the cheapest investment platforms in the UK and make broker comparison easier with our tables below. Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. This article and the comparison table are not personal financial advice. Your capital is at risk when you invest. Getting in ahead of the sign-up incentives that we always see in the ISA season, a couple of the leading investing platforms have gone early with their marketing efforts. Terms apply. Capital at risk. See Interactive Investor. Terms apply and capital at risk. Again see Interactive Investor for more. Follow those links to jump straight to the relevant pages.

They then told her she needed to submit certified ID to prove change of name. Fee notes includes extra charges, options, inclusions, and exclusions that make a material difference to the price you pay. The staff sound hassled and put-upon … courteous certainly, but I got the impression Monevator broker comparison was one of very many making the same type of complaint.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them. You now have a base cost for the investing services you require.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them. You now have a base cost for the investing services you require. From here we can compare that cost against the best of the percentage fee platforms. The winner will be the cheapest deal for you. So as your portfolio swells, the costs may keep rising, too. To compare fixed fee Platform A with percentage fee-based Platform B , make the following calculation:.

Monevator broker comparison

F ind the cheapest investment platforms in the UK and make broker comparison easier with our tables below. Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. This article and the comparison table are not personal financial advice. Your capital is at risk when you invest. Getting in ahead of the sign-up incentives that we always see in the ISA season, a couple of the leading investing platforms have gone early with their marketing efforts. Terms apply. Capital at risk. See Interactive Investor.

Used campers near me

Decisions geo thank you. Best of luck in your new life! I sat there all that time looking at market quotes expressed as normvols. Interesting things happened over the 5 years to April , but not that interesting. But fees must. The Latest Articles Weekend reading: Buy gilts packet fresh on the primary market Tax avoidance versus tax evasion versus tax mitigation Pension drawdown rules: what are they? Not sure if this has been mentioned elsewhere but a decent discount in platform fees applies if you land a job with HL, however minor. Are these exit fees a reasonable administrative charge, or a blatant attempt to lock customers in? Get Money Motivated The really obvious thing we all forget when borrowing money If you want to make easy money, do something hard How to check your credit score for free in the UK. He said they had done this to increase transparency and avoid confusion; apparently in the past they did wait and take the fee once funds were added to the new SIPP but this caused some confusion. Although TMF says that the new provider Interactive Investor does not take over existing accounts until mid-March, a new investor is now quoted prices relating to II, and not to Halifax. AFAIK I have all their other emails , we were not notified about this I have to assume I must have accidentally deleted two emails — one for me and one to my wife as I cannot believe that they would not tell customers. We define a trading platform as a stock broker that encourages its users to buy and sell frequently. Thanks again for your help! Might just sacrifice the fees and use Halifax.

A ttention UK investors! You know how we created that massive broker comparison table?

Vanguard b a quite limited list of products e. It took 3 rather painful phone calls to get to someone who could help, who explained that they had indeed received the request to transfer — but when it came to lock my account as part of the process to stop me making any more investments while the transfer occurs someone experienced a technical glitch. Thanks for this article! Certain big name brokers sometimes negotiate small discounts on fund charges. Readers who might consider switching their investments probably should check they know what they are actually getting, rather than letting only costs or tax drive the decision. Finally, when transferring out to IWeb, there is a cost to invest this money with them, wouldnt this be the case? Or maybe it is something to do with the rate at which you are depositing cash with them? Woke I mean, Quentin? Many thanks to all those who respond. Guys many thanks for putting this great resource together in the first place, and for taking the trouble to keep it up to date with all the latest charging nuances….

0 thoughts on “Monevator broker comparison”