M and w pattern indicator tradingview

Experimental: displays the frequency of candle types. The indicator is well used on the indices of the stock market.

Removing irregular variations in the closing price remain a major task in technical analysis, indicators used to this end mostly include moving averages and other kind of low-pass filters. Understanding what kind of variations we want to remove is important, irregular noisy variations have mostly a short term period, fully removing them can be complicated if the Hello ladies and gentlemen traders Continuing deeper and stronger with the screeners' educational series one more time. This one is heavy crazy mega cool pardon my french. I - Concept I present to you, ladies and gentlemen, the first screener for harmonic patterns.

M and w pattern indicator tradingview

The Fair Value Gap Absorption Indicator aims to detect fair value gap imbalances and tracks the mitigation status of the detected fair value gap by highlighting the mitigation level till a new fair value gap is detected. The Fair Value Gap FVG is a widely utilized tool among price action traders to detect market inefficiencies or imbalances. These imbalances The Fibonacci Timing Pattern II is a price-based counter that seeks to determine medium-term reversals in price action. Simultaneously, the close price from two periods ago must be lower The indicator isn't a groundbreaking invention and certainly not a novelty. Nevertheless, I haven't seen this version of the indicator on TradingView before, so I'd like to introduce it. The Origin of the Idea: We're all familiar with volume charts: A The ABCD Pattern indicator is a tool that helps identify potential geometric patterns of price movement on the chart of a financial instrument. This indicator is based on trading strategies that use the formation of four separate points, designated A, B, C and D.

LuxAlgo Wizard. The strategy that comes with the Pin Bar pattern is based on price action.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started.

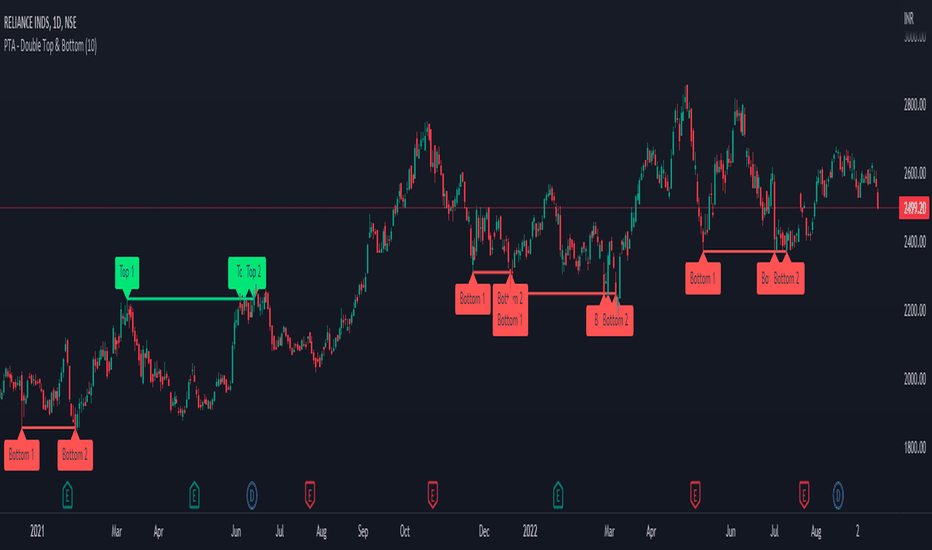

Using double top and bottom patterns in a profitable way: The W and M patterns trading. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns. For example, several charts exist to predict the bearish and bullish market or behavior — among them is the W and M pattern. However, the pattern supersedes many other pattern tradings. It would help if you clearly understood the reason behind the application of W and M pattern trading, even though the importance of this pattern trading is essential to all technical traders. The double top denotes bearish reversal; conversely, the double bottom denotes bullish price movement. Thus, certain conditions may alter the trading expectation even after predicting with the technical analysis method. In short, all these patterns work as a pointer they are not a hundred percent accurate. It is better to work on the technical analysis techniques because either you predict or not; the market lives on!

M and w pattern indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules.

My singing monsters breeding table

SolCollector Updated. Removing irregular variations in the closing price remain a major task in technical analysis, indicators used to this end mostly include moving averages and other kind of low-pass filters. I usually have it set to 10 or 15 these settings seem to work well on most assets. Harmonic auto-detect [PRO]. Point A: The starting point of the pattern, which usually represents the end of the previous price You can favorite it to use it on a chart. Swing highs or lows will be your stop-loss level. I made this script a long time again and never released it. We filter the patterns for you so that you only get the best and most effective patterns and ignore the noise. Use it on lower timeframe 1M to

The Fair Value Gap Absorption Indicator aims to detect fair value gap imbalances and tracks the mitigation status of the detected fair value gap by highlighting the mitigation level till a new fair value gap is detected.

Experimental: displays the frequency of candle types. LuxAlgo Wizard Updated. EN Get started. Bullish Piercing Scanner. This script is our version of the "Fair Value Gap". Cup and Handle Pattern. The standard Tweezer is a two bar pattern. This simple indicator will help identify the Patterns on the charts. The Tweezer pattern is a simple and effective The RBR pattern consists of a rally upward movement , followed by a base consolidation or retracement , and then another rally. Tailored-Custom Hamonic Patterns. ABC finder. Counting candles within the quadrants time frame m Excellent way to pickup diversions and reversals. Avoid trades with a large stop-loss.

0 thoughts on “M and w pattern indicator tradingview”