Lloyds share isa

Written by StockBrokers. Is Hargreaves Lansdown better than Lloyds Bank?

Lloyds is one of the largest financial institutions in the world. In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing. Even better, this broker has more than 2, mutual funds available for trading and ready-made portfolios to make investing simple. The downside to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees. Although trading commissions are low, these charges can add up over time and may not be worthwhile for those who only place a few trades each year.

Lloyds share isa

Prices delayed by at least 15 minutes Print. Previous close. Trade high. Year high. Year low. Dividend yield. Market capitalisation. Lloyds is a retail and commercial bank headquartered in the United Kingdom. The bank operates via three business segments: retail, commercial banking, and insurance and wealth. Its commercial banking operation provides lending, transaction banking, working capital management, and debt capital market services to large corporates and financial institutionsin the U. Insurance and wealth rounds out the product lineup with life and property insurance as well as pension solutions and high-net-worth asset-management services.

He specialised in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs.

In this guide. Invest in. Share trading platforms. It offers everyday banking services and now has a range of different accounts that let you start investing. There are a couple of different options — you can either invest in up to 3, funds across various asset classes and geographical locations, or put your money into a managed fund, where the investment decisions are made for you.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No admin or transfer fees.

Lloyds share isa

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly. There are hundreds of stocks and shares ISAs, and various ways to choose which one is right for you:.

Tisch school of the arts

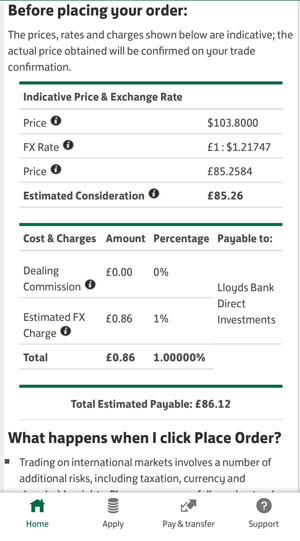

There are also underlying investment charges, see our fees page. Why we like it: Choose your level of risk from cautious to adventurous and have a plan expertly created and managed for you. Our review finds that neither Hargreaves Lansdown nor Lloyds Bank offer crypto investing. Which stocks and shares ISA is right for you? Develop your skills articles intro video. Plus, since Lloyds is publicly traded as part of the FTSE , its finances are made public every quarter and closely looked at by analysts. But that gives ISA investors who are in it for the long term a big advantage. And if the funds hold a lot of bank shares this year? This website is free for you to use but we may receive a commission from the companies we feature on this site. Hargreaves Lansdown Review. Telephone Trading. Investment Ideas. Wealthify app lets you check how your Plan is performing, manage your transactions and provide investment news and insights. The downside to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees.

.

Terms apply. DIY or Managed. Open online in less than 10 minutes. Login to your Shareview portfolio account to: Easily and securely manage your shareholdings online. Self-invested personal pensions SIPPs and individual savings accounts ISAs are tax-advantaged savings accounts that are an important tool for many individual investors. Read our articles to help you understand the investment basics. Best trading apps. The terms "best", "top", "cheap" and variations of these aren't ratings, though we always explain what's great about a product when we highlight it. So, do they want to show that they hold losing stocks at the end of each quarter? Is there a minimum deposit required to start trading with Lloyds? Let's compare Hargreaves Lansdown vs Lloyds Bank. Get breadth and variety, without the choice paralysis. Based on our thorough review, Lloyds Bank offers better pricing than Hargreaves Lansdown for share dealing.

0 thoughts on “Lloyds share isa”