Ko stock dividend

The next Coca-Cola Co dividend will go ex in 20 days for The previous Coca-Cola Ko stock dividend dividend was 46c and it went ex cocomelon keyboard months ago and it was paid 2 months ago. There are typically 4 dividends per year excluding specialsand the dividend cover is approximately 1. Enter the number of Coca-Cola Co shares you hold and we'll calculate your dividend payments:, ko stock dividend.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Ko stock dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. KO stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal. Monthly Income Goal. Regular payouts for KO are paid quarterly. Recommendation not provided. Growth Goal. Past performance is no guarantee of future results. Step 1: Buy KO shares 1 day before the ex-dividend date.

How To Use TipRanks. Exchanges: NYSE.

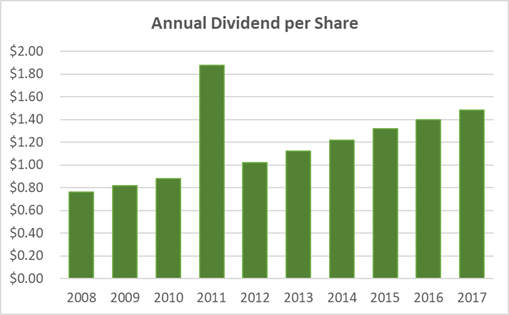

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on April 1, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add KO to your watchlist to be aware of any updates.

Coca-Cola issues dividends to shareholders from excess cash Coca-Cola generates. Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. There are no upcoming dividends for Coca-Cola. Coca-Cola has no upcoming dividends reported. There are no upcoming dividends announced for Coca-Cola. The last dividend was announced on February 15, My Account My Account. Benzinga Research. Log In.

Ko stock dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. KO stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal. Monthly Income Goal.

450 eur in usd

Currency Center. Free Email Notification. Oct 19, Best Energy. Last Week's Declaration Dates. Risk Low. Next Pay Date. Tools Research Tools. Compare Stocks. Sector Dividends. Best Industrial. Most Active Options. This articles highlights and explains 10 of the most important concepts that dividend Dividend Yield Calculator.

Based on this payment, the dividend yield for the company will be 3. See our latest analysis for Coca-Cola. We aren't too impressed by dividend yields unless they can be sustained over time.

Payout Period Quarterly. The Coca-Cola Company. Sep 14, Most Visited Websites. Does Coca-Cola have sufficient earnings to cover their dividend? Next Pay Date. Yes, KO has paid a dividend within the past 12 months. Ex Dividend Date Mar 14, When is Coca-Cola dividend payment date? Oct 02, This is the total amount of dividends paid out to shareholders in a year.

And it is effective?

I confirm. So happens. We can communicate on this theme. Here or in PM.