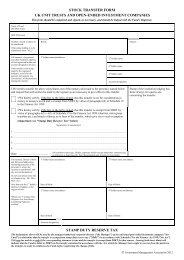

J10 stock transfer form

The form should be emailed instead. If the form cannot be emailed, HMRC provides advice on posting forms. This is a change to the previous regime and care must be taken given the inherent risks of email. More details are available at www, j10 stock transfer form.

We guarantee every document we sell. We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted. We explain what to edit and how in the guidance notes included at the end of the document. Email us with questions about editing your document.

J10 stock transfer form

Shares may exist with a company that are partly paid or unpaid. But, to avail the maximum benefits, you would have to convert it to fully paid shares. In order to completely transfer unpaid or partly paid shares, you would have to fill the J10 form. This stock transfer form requires the signatures of both the transferor and the transferee. This form serves as a contract which entitles the transferee to be liable for all future calls on the shares he holds. On signing the form, the terms are precisely understood and the stock owner would be liable to the calls and the company would not be held responsible in any way. The form needs to be filled in correctly and only then, it would get duly accepted by the company. Once the company accepts the J10 form, they would have to update the details about the transfer and the name of the transferee in their database. Here is a guide about how you are supposed to fill in the J10 form so that it gets accepted by the company and leaves no scope for any confusion or ambiguity. It is a mandate that you make use of bold letters and a Black pen, preferably a ballpoint pen. The steps towards filling each of the columns in the form are mentioned below. If it is a transaction where the stocks are being traded for money, enter the transaction amount. To know more about the full description of the company, have a brief look into the certificate that is issued by the company.

Business Apps. London Addressess. You should note that the Registrar of Companies has no authority to compel any part of the transfer procedure.

You are welcome to download the Form J10 Stock Transfer Form for free by clicking on the link or by clicking the button below. Before you use this form, we strongly recommend that you read our guide to the Stock Transfer Form. Download j10 form. This form and any information are provided free of charge and no liability is accepted in respect of its use. If you use the provided forms without engaging us then you are responsible for completing the form and Elemental CoSec accepts no responsibility or liability for your use of the forms.

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time. You have rejected additional cookies. Find out how to complete a stock transfer form and get it processed. HMRC do not issue stock transfer forms, but you can get a stock transfer form from people such as a:. New Stamp Duty processes were introduced on 25 March Where Stamp Duty is paid on a stock transfer form since then, that instrument is duly stamped for all purposes. The previous physical stamping system has been permanently withdrawn.

J10 stock transfer form

You are welcome to download the Form J10 Stock Transfer Form for free by clicking on the link or by clicking the button below. Before you use this form, we strongly recommend that you read our guide to the Stock Transfer Form. Download j10 form.

Whitebox learning student login

Document properties. Call our team. There is no statutory legal requirement to use a particular template over another. The steps towards filling each of the columns in the form are mentioned below. Even better are the notes, which made the form easy to fill in. Any payment under this figure or if no money has been paid, for example a gift, then the transaction is exempt from Stamp Duty. More articles by. In a legal action, the judge will not take note of a share transfer on which stamp duty due has not been paid. Company Formations. Simply-Docs uses cookies to ensure that you get the best experience on our website.

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services.

Necessary Necessary. Learn more. If you found this blog helpful you can read more insightful articles in our business news section , we post daily new articles and hand tips and tricks including guides for your business. I went through the process with a different website only to find when I tried to print it that I needed to sign up for a monthly fee. The Transferee new owner will have to: Provide full name and address; Fill in the section on Stamp Duty if applicable see below for further information. Note that the address to be mentioned is of the first stakeholder and it would be the primary address for future correspondence, if any. Similarly like transferor, the names of joint or individual to-be owners are to be mentioned. On signing the form, the terms are precisely understood and the stock owner would be liable to the calls and the company would not be held responsible in any way. The Stock Transfer template can be unlocked by clicking on the "Padlock" icon on the tool bar. This document was just right for my needs. Document properties.

0 thoughts on “J10 stock transfer form”