Iso 20022 crypto list

The ISO crypto-list is a collection of compliant digital coins and tokens that satisfy the standards of the International Organization for Standardization ISO standards There are many cryptocurrencies that will be integrated into this new financial system, referred to as ISO compliant cryptocurrencies and there is much speculation these cryptocurrencies will soar in price once the standard is implemented. ISO develops international standards for industrial, commercial, iso 20022 crypto list, and proprietary use. If an Iso 20022 crypto list standard is established, virtually all financial institutions in the world adopt it.

ISO has emerged as a crucial standard in the financial sector due to its comprehensive framework for electronic data interchange between institutions. As the cryptocurrency industry evolves, adherence to such standards becomes important for digital assets aiming to be integrated into the global financial ecosystem. Cryptocurrencies that comply with ISO are seen as being at the forefront of bridging the gap between traditional finance and the burgeoning crypto market, positioning themselves for wider acceptance and potential use by centralized banks. In the realm of crypto assets, those that are ISO compliant have attracted attention from investors and financial entities alike. The standardization promises improved interoperability, and enhanced communication protocols which are particularly significant for banks and financial institutions that have started engaging with blockchain technology and accepting crypto payments. This has led to a growing list of digital currencies and tokens striving to align with the ISO standards to tap into this demand. The adoption of ISO by cryptocurrencies is speculated to change the very nature of financial transactions, offering a uniform, structured, and reliable messaging format.

Iso 20022 crypto list

In the ever-evolving world of cryptocurrency, staying updated with the latest standards and technologies is imperative. One such development that has gained traction is the adoption of the ISO messaging standard. In this comprehensive guide, we'll dive deep into what ISO coins are, their significance, and how they're revolutionizing crypto space. Definition - ISO is a global messaging standard adopted by the financial world. It's not just limited to crypto but extends to other financial transactions, including payments, securities, trade services, cards, and foreign exchange. Its goal is to create a universal standard for exchanging financial messages. Importance in the Financial Ecosystem - By promoting a singular messaging standard, ISO simplifies global business communication. It reduces errors, lowers operational costs, and promotes seamless integration among different financial systems worldwide. Bridging the Traditional and Digital Worlds - ISO acts as a bridge between traditional banking and the digital currency world. By integrating this standard, cryptocurrencies can be more widely recognized and accepted by mainstream financial institutions, fostering mutual growth. Ensuring Data Richness - The messaging standard carries detailed information about transactions, ensuring more transparency and facilitating better compliance with regulations. This is especially critical in the crypto space, often viewed as a 'wild west' of finance.

The intricate world of ISO coins stems from their integration of the ISO messaging standard, a globally accepted protocol for transmitting financial information. Client education can help reduce the risk of fraud and other security issues.

ISO is a global standard for financial messaging that provides a common language and structure for electronic data interchange between financial institutions. While ISO is not directly related to cryptocurrencies, it will have an impact on the way cryptocurrencies are used and transacted. With the growing adoption of cryptocurrencies, there is a need for a common messaging standard to facilitate the exchange of data and information between different platforms and systems. ISO provides a framework for standardizing the messaging protocols used in cryptocurrency transactions, which will help to improve interoperability between various financial and banking systems. ISO will also be used to support the integration of cryptocurrencies into traditional financial banking systems, such as payment networks and clearing and settlement systems.

ISO is a global standard for financial messaging that provides a common language and structure for electronic data interchange between financial institutions. While ISO is not directly related to cryptocurrencies, it will have an impact on the way cryptocurrencies are used and transacted. With the growing adoption of cryptocurrencies, there is a need for a common messaging standard to facilitate the exchange of data and information between different platforms and systems. ISO provides a framework for standardizing the messaging protocols used in cryptocurrency transactions, which will help to improve interoperability between various financial and banking systems. ISO will also be used to support the integration of cryptocurrencies into traditional financial banking systems, such as payment networks and clearing and settlement systems.

Iso 20022 crypto list

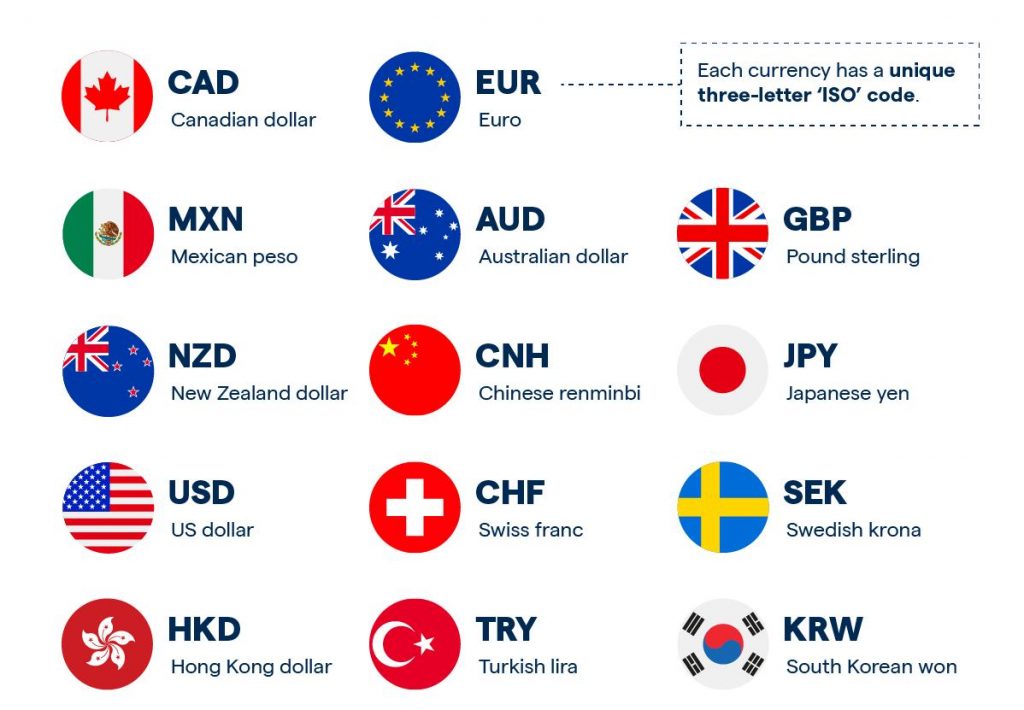

ISO develops international standards for industrial, commercial, and proprietary use. If an ISO standard is established, virtually all financial institutions in the world adopt it. Currently, financial institutions rely on the ISO standard to identify currencies for global transactions. This could lead to adoption by centralized banks and enable cross-border crypto payments through centralized financial institutions. Through its standards, ISO aims to promote international trade and protect end users by ensuring the products being made are safe and of acceptable quality. To date, ISO has set over 20, standards, and continuously updates them by releasing technical reports, analyses, and publications.

Amazon counter

When cryptocurrencies incorporate this standard, they essentially remodel their transactional messaging to be in sync with this universally recognized protocol. ISO develops international standards for industrial, commercial, and proprietary use. Quant is the first blockchain project to solve the interoperability problem through the creation of the first blockchain operating system and will be a key component of the interconnectivity of all other cryptocurrencies within this network. Crypto companies must consider several factors when migrating to the ISO protocol. It specifies a methodology to create financial messages. The purpose of XRP is to serve as an intermediate medium of exchange between two currencies or networks, acting as a temporary settlement layer denomination. Logically, that could create a sort of virtuous cycle for Algorand: Once the standard is implemented, ALGO will see increased use which will spur its financial Dapp development. By listing compliant coins and tokens, it offers a level of assurance that the underlying asset meets specific standards. In addition, those clients should be completely informed and involved in end-to-end testing. Data security: Data security is a crucial concern regarding payments and financial transactions. ISO compliant coins, given their alignment with a global financial messaging standard, inherently possess a competitive edge. Keep track of your holdings and explore over 10, cryptocurrencies.

The world of institutional global wire transfers and cryptos have long stood at odds with one another. The advent of cryptocurrency threatens to unseat international money wiring as a centralized service. Yet now, thanks to ISO , it seems like these services might be able to coexist and deliver the best of both worlds.

Log in. Program governance and support: Organizations must have the plan to ensure their program is adequately managed and supported. During a software upgrade plan if necessary, the plans have to meet the deadlines and ensure the future security of all systems in place. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. The list of such firms is currently quite short, and very much worth considering. By embracing the ISO standard, XDC Network aims to enhance its interoperability with traditional financial systems and provide a standardized framework for secure and efficient cross-border transactions. Never miss a story ISO compliant cryptocurrencies are those that use ISO messaging protocols for their transactions and communications. As more sectors of the financial world adopt the ISO standard, these cryptocurrencies could become the go-to options for transactions that require speed, transparency, and a high degree of compatibility with existing financial systems. Additionally, old outdated system systems that do not support the ISO format need to update, upgrade, and convert. With the ability to process data-rich payments, the ISO protocol will revolutionize the payment industry worldwide.

.. Seldom.. It is possible to tell, this exception :)

Very useful phrase