Ishares $ floating rate bond ucits etf

BlackRock Portfolio Centre. The figures shown relate to past performance.

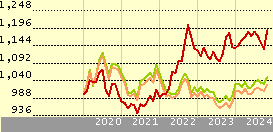

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years.

Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement. The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. ITR employs open source 1. We make use of this feature for all GHG scopes.

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric.

Xhamstergay

For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. Past performance of a security may or may not be sustained in future and is no indication of future performance. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. Modified Duration. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The MSCI ESG rating methodology recognises that certain environmental and social issues are more material based on the type of activity that the issuer is involved in by weighting the issues differently in the scoring methodology. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. Literature Literature. Show More Show Less. All insights All insights. Privacy policy. How do you like our new ETF profile?

Sustainability Characteristics provide investors with specific non-traditional metrics.

ITR employs open source 1. Performance Performance Chart. They are provided for transparency and for information purposes only. Learn more. Data, including ESG data, received through our existing interfaces, is processed through a series of quality control and completeness checks which seeks to ensure that data is high-quality data before being made available for use downstream within BlackRock systems and applications, such as Aladdin. The figures shown relate to past performance. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Securities lending is an established and well regulated activity in the investment management industry. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. The ITR metric is calculated by looking at the current emissions intensity of companies within the fund's portfolio as well as the potential for those companies to reduce its emissions over time. Convexity as of Mar 01, 0. The Fund may use derivatives for investment purposes and for the purposes of efficient portfolio management in connection with the environmental or social characteristics promoted by the Fund.

Anything.