Ing repayments calculator

ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank.

Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage rate. Find out how much you can borrow and if you will qualify for a home loan. Contact ING Direct lender representatives to help with loan selection, borrow amounts, loan structure and negotiate better interest rates. Compare Property Investment Loans. All the loan calculations are done for you when using the mortgage comparison pages.

Ing repayments calculator

Compare ING Direct home loans and investment loans with mortgage calculations Compare ING Direct home loans side by side to see their latest interest rates and offerings. Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage rate. Find out how much you can borrow and if you will qualify for a home loan. Contact ING Direct lender representatives to help with loan selection, borrow amounts, loan structure and negotiate better interest rates. Compare Home Loans. All the loan calculations are done for you when using the mortgage comparison pages. This includes mortgage repayments based on the loan amount and years selected, fees, total costs, annualised percentage rate and more. If you are looking for more specific calculators that show you how much you can borrow and See the advantages of how an offset account and extra repayments can reduce the cost and term of your loan. Home Loan Calculators.

Some providers' products may not be available in all states. Compare Home Loans.

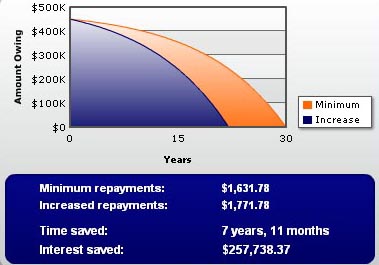

Home Calculators Home Loan Calculator. Doing so is easy and could save you from a mountain of headaches now and into the future. Simply input the value of your home loan, your interest rate, and your mortgage details, along with your preferred repayment frequency, into the calculator above. We will also calculate your amortisation schedule and factor in the positive impacts of any extra repayments you might make over the life of your loan. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. The more a person borrows, the larger their repayments will be.

Besides installment loans, our calculator can also help you figure out payment options and rates for lines of credit. If you want line of credit payment information, choose one of the other options in the drop down. Calculate your monthly payments before applying for any loan. Knowing this information is crucial to determine exactly how much you can afford to borrow without tilting your monthly budget. Also make sure that you know the terms of your repayment process, especially if you want to take out a student loan , as these types of loans have different terms than personal or auto loans. Most loans are installment loans , meaning that you receive a lump sum of money upfront that you pay back through a course of monthly payments. If you have a fixed rate loan, you will pay the same amount over the life of the loan. If you have a variable rate loan, on the other hand, the amount you pay each month could change based on how market conditions are affecting interest rates.

Ing repayments calculator

The loan payment calculator is a handy tool to compute the required monthly or any other frequency payments after taking a loan requiring equal payments. For example, you can estimate your car payment or mortgage installments. We also introduce the loan payment formula and present a practical guide that helps you to understand how to calculate the monthly payments on a loan.

Chihuahua for sale cebu

Rather, a cut-down portion of the market has been considered. Stamp duty calculator. Compare Property Investment Loans. Compare hundreds of loans from more than 30 lenders including the major Australian banks. Compare ING Direct home loans side by side to see their latest interest rates and offerings. Backed by the Commonwealth Bank. Book a free assessment using the link below and our experienced team of brokers will give you a call to talk through the best options for funding your upgrade. Loan for travel Travel bug got you? Rather, the portion of your repayments that goes towards interest gets smaller while the share going towards paying down your principal grows. How much can I afford to borrow? Have you been declined by ING?

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us.

It's important to remember that the interest rate a borrower signs up with might not be the interest rate they realise for the decades to come. Rather, the portion of your repayments that goes towards interest gets smaller while the share going towards paying down your principal grows. Bad Credit Rating, Default or Bankruptcy. Mortgage repayment calculator. Fixed rates home loans available for terms or 1,2,3,4, and 5 years. A home loan is likely to be the biggest expense you will ever have. ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank. In our experience, ING is pretty good to deal with—and as we mentioned above, for any of our clients that experience rate creep i. Looking for a home loan? Estimate your credit rating. Generally speaking, owner-occupiers typically make principal and interest repayments while investors might be more inclined to make interest only repayments. Loan amount. It determines how much interest is charged on each dollar borrowed. Enter your phone.

I am final, I am sorry, but it at all does not approach me. Who else, can help?

You could not be mistaken?

Should you tell you have misled.