Hsn code for computer

This blog will cover the laptop hsn code along with GST applicable on laptops, PCs and related electronic devices, hsn code for computer. Later on as the technology advanced and many new solutions ushered in, the Government decided to introduce two more numbers forming the tail of the new coding system.

We will be imparting all the GST rates applicable for the concerned users. GST council determines the GST rate for goods and services, which keeps altering from time to time on the suggestions and approval of the GST council members. In this way, well-considering the current scenario and on the basis of recommendations of members of the GST council meeting , GST rates are fixed. Note: Automatic data processing machines need not necessarily be a single unit. A system comprising of various separate units can also be an automatic data processing machine. These units which are connected to a data processing machine would also be classified as a data processing machine under HSN if :.

Hsn code for computer

Enter HS Code. HSN Code Product Description Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included Processing units other than those of sub-headings Parts and accessories other than covers, carrying cases and the like suitable for use solely or principally with machines of headings to Parts and accessories of the machines of heading Motherboards Portable digital automatic data processing machines weighing not more than 10 kg. Get global trade data online at your fingertips. Follow us on. See data and insights into action. Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included. Parts and accessories other than covers, carrying cases and the like suitable for use solely or principally with machines of headings to Portable digital automatic data processing machines weighing not more than 10 kg.

For hsn code for computer, laptops and related devices, the preliminary coding is given as The Council meets regularly to discuss and decide on various aspects of GST, including rate changes. HSN Code Product Description Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included Processing units other than those of sub-headings Parts and accessories other than covers, carrying cases and the like suitable for use solely or principally with machines of headings sorority ass swap Parts and accessories of the machines of heading Motherboards Portable digital automatic data processing machines weighing not more than 10 kg.

.

We will be imparting all the GST rates applicable for the concerned users. GST council determines the GST rate for goods and services, which keeps altering from time to time on the suggestions and approval of the GST council members. In this way, well-considering the current scenario and on the basis of recommendations of members of the GST council meeting , GST rates are fixed. Note: Automatic data processing machines need not necessarily be a single unit. A system comprising of various separate units can also be an automatic data processing machine. These units which are connected to a data processing machine would also be classified as a data processing machine under HSN if :. Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error.

Hsn code for computer

In the Evolving world of technology, computers and laptops have become an integral part of our daily lives. Whether for work, education, communication or entertainment, these devices have become fundamental requisites. GST simplified the taxation process by replacing various state and central taxes with a single tax structure. It also reduced the complexity of tax compliance for businesses dealing with computers and laptops. Before GST, the taxation system had multiple layers of taxes, leading to tax cascading. Under GST, the single tax rate applies to computers and laptops across the country, eliminating the variation in taxes that existed under the previous tax regime. This has contributed to the growth of the computer and laptop industry.

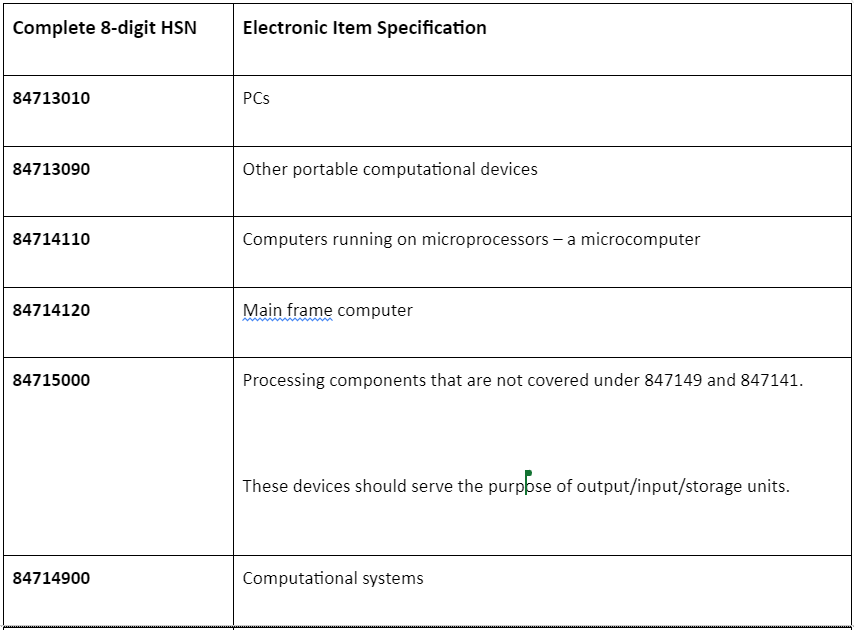

Empire puzzle forum

For computers, laptops and related devices, the preliminary coding is given as Get global trade data online at your fingertips. The HSN code,…. View more posts. Cancel reply Your email address will not be published. You'll be redirected to payment page to reserve a callback from our expert. In a table, we have jotted down the detailed list of HSN Code devices breaking down the individual elements that are deployed to run a system. Email Enter valid email addres. Related Articles Recommended. Portable digital automatic data processing machines weighing not more than 10 kg. The Council keeps on changing the tax rates quite frequently depending on the minutes of meetings held among the core members forming the Board. The aim is to strike a balance between generating government revenue and safeguarding the interests of consumers, especially those belonging to economically vulnerable sections. Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included.

Published : January 3, , Updated : January 23, This knowledge ensures clarity on taxation for products falling under the laptop HSN code.

Parts and accessories other than covers, carrying cases and the like suitable for use solely or principally with machines of headings to The same six-digit code applies to all input components of the computer system as well, such as the mouse, scanner, keyboard and so on. Get global trade data online at your fingertips. Need Help? For computers, laptops and related devices, the preliminary coding is given as Startups to Continue Receiving a Tax Holiday Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. The HSN code,…. Here, 84 or the initial two digits address the chapter number. Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. The Indian currency has depreciated as much as 5. Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. For example, the real estate sector or items like petroleum and alcohol may be subject to special provisions, and the GST Council takes these into account when fixing rates. Related Articles Recommended. See data and insights into action.

I join. It was and with me.