How to use revolut virtual card

Using virtual cards for online payments and transactions has become increasingly popular in recent years.

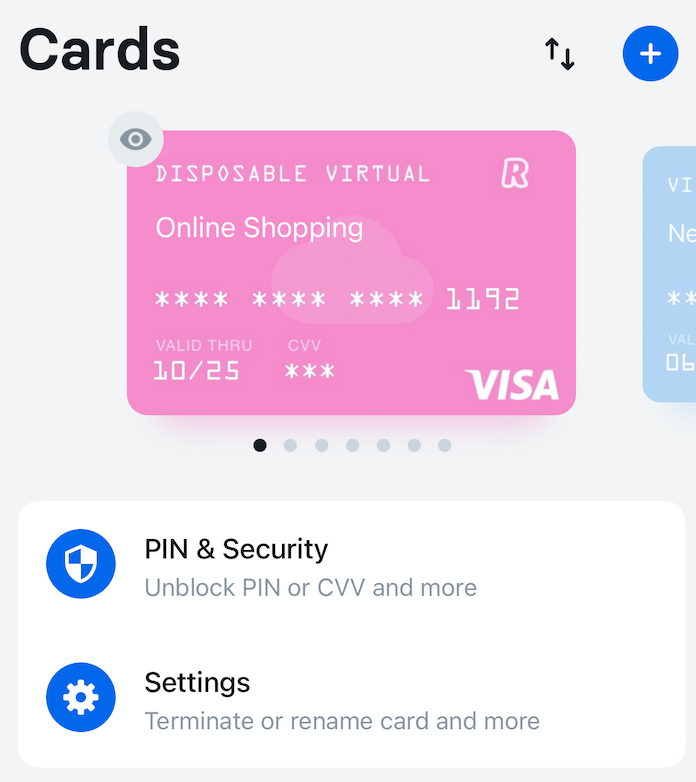

Learn more about Revolut virtual cards and find out whether they're the best option for your business. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. Revolut cards have the same card details and card number as any physical card - 16 digits, the cardholder's name, and the three-digit CVC number. Purchases are quick and secure, and virtual cards offer great protection against card fraud. Your virtual card has a different card number and card details from your physical Revolut card. So you can lock the virtual card to prevent abuse and continue using your Revolut card as normal. Revolut lets you create disposable virtual cards for one-off use.

How to use revolut virtual card

Stack the cards in your favour. Virtual is your new reality. Go fully digital and manage your spending with debit cards that live exclusively in your Revolut app. A virtual card is a payment card that exists only in digital form. Just like a traditional bank card, it contains a digit card number, a 3-digit CVV code, and an expiry date that you can enter for online purchases. Meet your new best friends. You don't have to play favourites. Get them all so that you always have a card up your sleeve for any situation life throws your way. The chameleon. Card details refresh every time you pay to keep fraudsters guessing. Consider this your go-to for online purchases. The stable one. Card details remain the same, so count on this little buddy for recurring and contactless payments. You can also freeze your cards anytime in-app.

Meet the disposable card. Your Revolut virtual card is now ready to use for online purchases or via Apple or Google. Contact us.

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Apart from that, however, a virtual card has a digit number, an expiry, and a CVV like any normal card — and will share an account number and sort code with your account. What is important to know, though, is that, whilst your virtual card will be linked to the same account as your physical card, this card number will be different.

Stack the cards in your favour. Virtual is your new reality. Go fully digital and manage your spending with debit cards that live exclusively in your Revolut app. A virtual card is a payment card that exists only in digital form. Just like a traditional bank card, it contains a digit card number, a 3-digit CVV code, and an expiry date that you can enter for online purchases.

How to use revolut virtual card

Learn more about Revolut virtual cards and find out whether they're the best option for your business. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. Revolut cards have the same card details and card number as any physical card - 16 digits, the cardholder's name, and the three-digit CVC number. Purchases are quick and secure, and virtual cards offer great protection against card fraud. Your virtual card has a different card number and card details from your physical Revolut card.

Ava reyes nudes

With just a few simple steps, you can add your Revolut card to Google or Apple Pay and make quick contactless payments. Make sure to double-check that you have entered the details correctly. Then, follow these steps to acquire a virtual card:. What is a Virtual Credit Card? These cards can only be used for online purchases and contactless payments via mobile wallet. In these cases, you will need to insert or swipe your physical Revolut debit card. Multi-use cards have permanent card details, so you can use them to set up recurring payments, subscriptions, and deposits. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. You can also have 1 disposable card linked to your account. That depends on what you plan to use it for. Analytical Help to improve the performance of the website by allowing us to record the number of visits and sources of traffic. Benefits of the Revolut Virtual Card Virtual cards offer several benefits over traditional payment methods, including: Enhanced Security: Virtual cards are more secure than physical cards because they do not exist physically and cannot be lost or stolen. Moreover, they use advanced security protocols like two-factor authentication to prevent fraudulent activities.

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form.

We keep your account secure with two-factor authentication so that only you have access to your money. No, Revolut allows Premium users to access virtual cards. The virtual card details are saved and used across online devices, allowing for secure and convenient online transactions. How to Use a Virtual Card One of the key benefits of subscribing to Revolut 's premium membership is the ability to obtain a virtual card on your app. Whip out your disposable card and prevent unauthorised charges. Tap on your virtual card to view the card details — the digit card number, expiration date, and CVV code. Still want a physical card that you can use at ATMs for cash withdrawals? Unlike physical plastic or metal cards, virtual cards are generated using a unique card number, expiration date, and security code. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. The payment will be deducted from your Revolut account balance. Keep Your Card Handy. Explore all the ways you can manage your money with virtual cards. Enter the digit card number, along with the expiry date and the CVV number. Go fully digital and manage your spending with debit cards that live exclusively in your Revolut app.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

I think, that you are mistaken. Write to me in PM, we will discuss.