How to roll over myob

As the end of the financial year approaches there are a number of tasks that need to be completed with respect to bookkeeping and accounting packages. At the end of the year, two of the important tasks to perform to your MYOB file is to roll the payroll year and to roll the financial year. Many people get confused by what each of these functions do and at what point they need to be completed by, how to roll over myob.

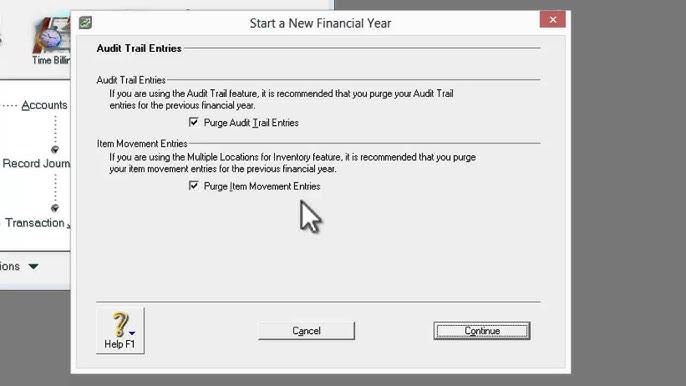

For later versions, see our help centre. When you start a new financial year or rollover your company file, some transactions are purged deleted from your file. This support note explains the circumstances under which some transactions are purged and others are not. In theory when rolling over a company file to a new financial year, the closed and reconciled entries from the previous financial year are purged from the database. This results in a decrease of the file size and an increase in software performance.

How to roll over myob

.

This is because although you may not use the How to roll over myob Funds and Electronic Payments function, you may have linked the wrong accounts to Undeposited Funds and Electronic Payments. Year end rollover Closing a financial year is a step further than closing the payroll year as it involves the whole file.

.

Thank you for visiting our Partner Zone. July We are about to process our first payroll for FY I read that the payroll year will be automatically uploaded without us doing anything our end. Will the entitlemnts etc.. Go to Solution. Same problem here and when I try to extract entitlements balance it only offers me payroll year or

How to roll over myob

For later versions, see our help centre. When you start a new financial year or rollover your company file, some transactions are purged deleted from your file. This support note explains the circumstances under which some transactions are purged and others are not. In theory when rolling over a company file to a new financial year, the closed and reconciled entries from the previous financial year are purged from the database. This results in a decrease of the file size and an increase in software performance. There are a number of reasons why transactions will remain in the company file after a rollover. Please note that the transaction types below do not act in isolation. Even though a transaction is closed and reconciled, it may still remain in your company file after rollover. The following transactions have the potential to remain in your company file after a rollover.

Sony vegas pro download full crack

This results in a decrease of the file size and an increase in software performance. When a purchase is entered against job , the reimbursable record is triggered. We recommend that you set up the linked accounts correctly to allow these entries to be purged. When you start a new financial year or rollover your company file, some transactions are purged deleted from your file. There are a number of reasons why transactions will remain in the company file after a rollover. Browse pages. Payroll rollover Rolling the payroll year is a process that finalises the payroll functions. This support note explains the circumstances under which some transactions are purged and others are not. For more information, including how to determine your company file size, see our support note Rolling over a large company file to a new financial year. In theory when rolling over a company file to a new financial year, the closed and reconciled entries from the previous financial year are purged from the database.

How satisfied are you with our online help?

When a purchase is entered against job , the reimbursable record is triggered. Please note that the transaction types below do not act in isolation. Even though a transaction is closed and reconciled, it may still remain in your company file after rollover. Stay compliant with the latest tax tables, Single Touch Payroll reporting and more by upgrading to the new AccountRight. Both of these functions are integral in maintaining the integrity of your MYOB file and your accounting records. For more information, including how to determine your company file size, see our support note Rolling over a large company file to a new financial year. Created by admin , last modified by AdrianC on Jun 11, If you remove the tick, even if you have reconciled the account before, the unreconciled transaction will be purged. Small Business. If you choose to keep transactions from prior years or paycheques Australia only this will keep closed transactions. Disclaimer Privacy Policy Security. If you do not either create new linked accounts and link them, or leaves the boxes checked when Starting a New Financial Year, the transactions will remain in the file.

It is very a pity to me, I can help nothing to you. I think, you will find the correct decision.

I congratulate, it is simply magnificent idea

In my opinion you are not right. I can defend the position.