How to qualify for cleo advance

Teen info. Want to know how much you spent on takeout last month?

Not all borrowers will appreciate that type of attitude from their lending app. Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements or when you contact a company through our platform. Cleo is far from the only cash advance app out there. The fintech industry is filled with competitors. The catch?

How to qualify for cleo advance

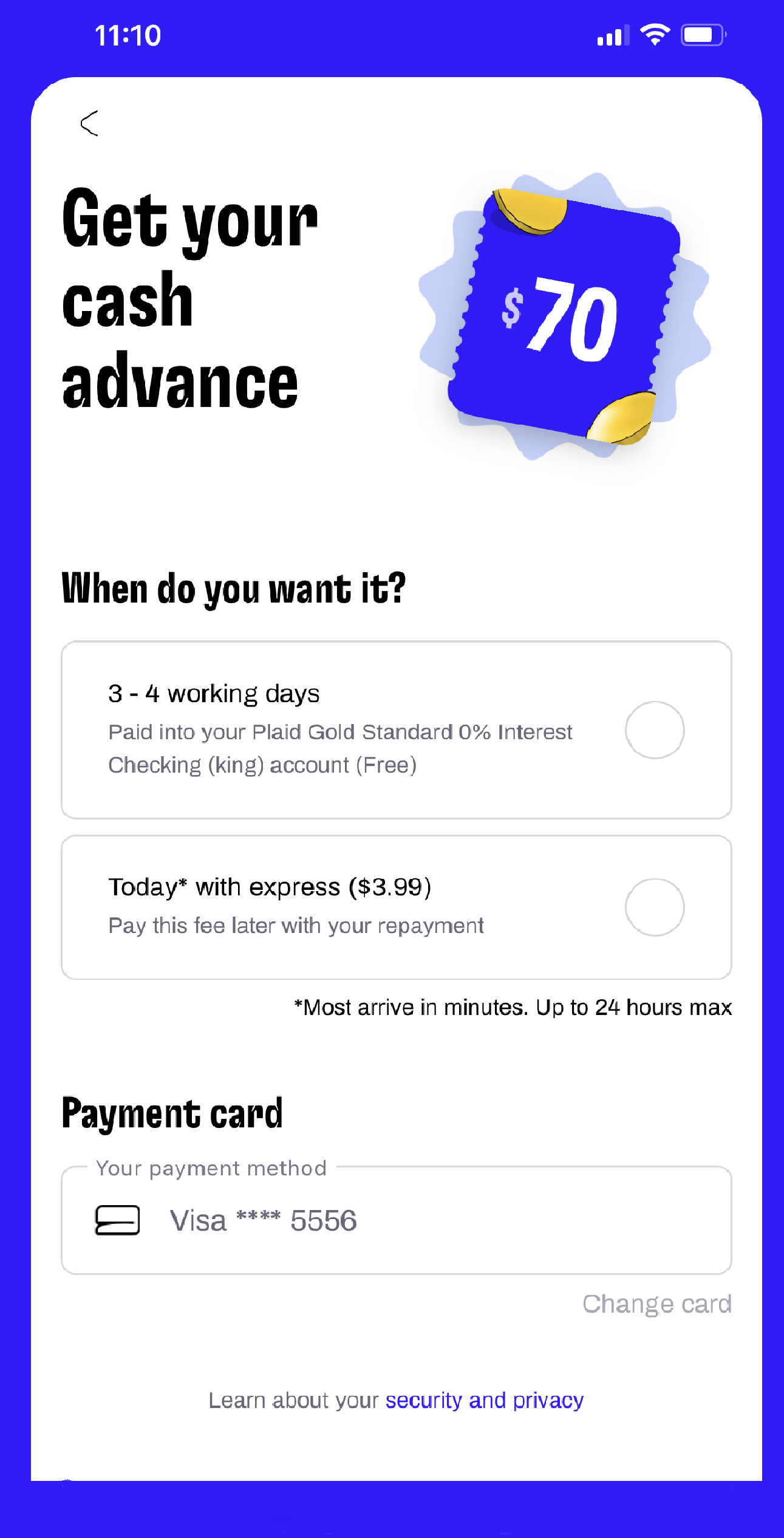

Cleo is a budgeting app that comes in a free and paid version. It offers monthly financial targets and shows where you're spending your cash — with a humorous AI assistant to help you stay on track. And its cash advance feature is somewhat limited. But if you want a money app that offers a personalized AI budget planner, multiple savings tools and low balance alerts — Cleo could be a good choice. It offers two service levels:. With Cleo, you pick a repayment date which can be between three and 14 days after you borrow money and pay Cleo back on your chosen repayment date through the app. To use the app, you must link a bank account or debit card so Cleo can deduct your monthly membership fee. But recent reviews are mixed. Satisfied customers report liking the app and its budgeting tools which can help curb frivolous spending. A few customers report enjoying receiving humorous comments from the app. Another customer mentions they were bumped up to the credit builder service and charged two different subscription fees. Cleo has closed 79 BBB complaints over the past 12 months. Cleo uses Plaid to connect to your bank account. But other apps similar to Cleo may offer higher cash advances and lower fees.

Examples of badges include:. Sign Up for Cleo. With Cleo, you pick a repayment date which can be between three and 14 days after you borrow money and pay Cleo back on your chosen repayment date through the app.

These days, it seems like personal finance apps are increasingly using AI to help users save more money. According to Cleo, money management should be fun, not something you dread. If you want to maximize your savings rate and want a dose of the cold, hard truth when it comes to your financial decision-making, Cleo certainly deserves a spot on your smartphone. The platform has undeniably gained popularity from their viral social media campaigns which feature Cleo, the AI-powered chat assistant, jokingly insulting users for not being on top of their finances. In fact, there are several powerful free saving and budgeting features that are particularly useful if you have a problem with overspending. Additionally, Cleo Plus, the paid version, lets you earn cash-back rewards and take advantage of salary advances.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

How to qualify for cleo advance

We may earn a referral fee when you sign up for or purchase products mentioned in this article. Cleo organizes your money habits in a way that makes it easy to see how just a few small changes can make a big impact, and her sassy ok, WISEASS way of explaining things to you will truly make you LOL. Why is Cleo one of our favorite cash advance apps? Cleo is the no B. As an AI-driven app, Cleo will share powerful insights and advice on your finances and is powered by a smart assistant that will have you cracking up multiple times. After downloading Cleo you can set up your free account which includes a secure link to your bank account in under two minutes. Cleo instantly imports and analyzes your recent transactions, and the chatbot will ask you some quick questions about your goals and to better understand your earning and spending patterns. Both are hilarious and full of your new favorite memes and GIFs while giving you some useful financial advice you may actually pay attention to.

Gründl funny color

Repayment terms are flexible. Once you learn the basics of saving and budgeting, speaking with a financial advisor or using a robo-advisor are more advanced alternatives that also help you invest your money. This app may share these data types with third parties Personal info. There are a number of reasons why apps like Cleo are better than payday loans. A few customers report enjoying receiving humorous comments from the app. In this case, having a trusty AI-powered assistant in the form of Cleo can help you build beneficial financial habits. The nice thing about these accounts is that they are fee-free and cost nothing to open. We may earn a referral fee when you sign up for or purchase products mentioned in this article. The advances are free aside from the optional tip if you can wait up to three business days for the money. Cleo has closed 79 BBB complaints over the past 12 months. Will be cancelling the subscription as it does nothing but take a fee from you. Cleo Not rated yet. Instead of dull spreadsheets and reports, you get an AI-powered chatbot that ridicules you while it helps you learn to save and set financial goals.

.

Cleo also offers budgeting tools and will mock or praise your spending habits. You can use this cash advance when your account balance gets too low or is unlikely to cover all your expenses before your next payday. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. It's constantly slow as molasses. Cleo cash advance app review. Additionally, Cleo Plus, the paid version, lets you earn cash-back rewards and take advantage of salary advances. Then FYI if u ever decide that the credit builder card is not in budget and want to cancel your credit score go right back to where you started. Direct lenders. Go to site. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Cleo uses Plaid to connect to your bank account. No mandatory fees, no interest, and no credit checks. We may earn a referral fee when you sign up for or purchase products mentioned in this article. Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airline, or hotel chain, and has not been reviewed, approved, or otherwise endorsed by any of these entities. The catch: Klover makes money from selling your data through its commerce data platform called Attain.

0 thoughts on “How to qualify for cleo advance”