How to get w-2 on quickbooks online

I appreciate you taking the time to contact the Community.

Sending your W-2 and W-3 forms to the appropriate agencies on time is an important payroll task at the end of the year. Depending on your payroll product, we may do this for you, or you can file electronically using QuickBooks. You can also check the status of your filing on the status page:. Now you can print your W-2 forms and send them to your employees by January Your employees can also view their W-2s online in QuickBooks Workforce. When finished, you may also need to File your state W-2s.

How to get w-2 on quickbooks online

Are you a business owner or a payroll administrator looking for guidance on printing, reprinting, and finding W2 forms in QuickBooks? Managing W2 forms in QuickBooks can be a critical aspect of your payroll process, ensuring compliance and accuracy in tax reporting for your employees. In this comprehensive guide, we will cover everything you need to know about printing W2 forms in QuickBooks, whether you are using QuickBooks Desktop or QuickBooks Online. From ensuring your payroll subscription is active to setting up W2 printing preferences and finding old W2 forms, we have got you covered. Whether you are new to QuickBooks or looking for an efficient way to handle W2 forms, this article will provide you with valuable insights and step-by-step instructions to streamline your W2 management process. It plays a significant role in ensuring compliance with tax regulations and providing employees with essential information for filing their tax returns. This form contains details such as total wages, tips, bonuses, and other compensation, along with federal and state income tax withholding. QuickBooks simplifies the process of generating and distributing W2 forms, streamlining the reporting of employee earnings and tax withholdings. Accurate and timely submission of W2 forms is essential for avoiding penalties and maintaining regulatory compliance. Printing a W2 in QuickBooks requires a series of steps to ensure accurate and compliant documentation of employee earnings and tax withholdings. Before printing W2 forms in QuickBooks, it is essential to ensure that the payroll subscription is active and up-to-date to facilitate accurate document generation and compliance. This subscription plays a crucial role in ensuring that the generated W2 forms are in alignment with the current tax regulations and employee data.

Select your W-2 delivery option. Before printing W2 forms in QuickBooks, it is essential to ensure that the payroll subscription is active and up-to-date to facilitate accurate document generation and compliance. Note : Not sure which payroll service you have?

Learn how you can view and print your own W-2s online or through the QuickBooks Workforce mobile app. You can also view other documents your employer shares with you. To watch more how-to videos, visit our video section. You can view your W-2 copies B, C, and 2 by January Historical W-2s are available up to the past 2 years.

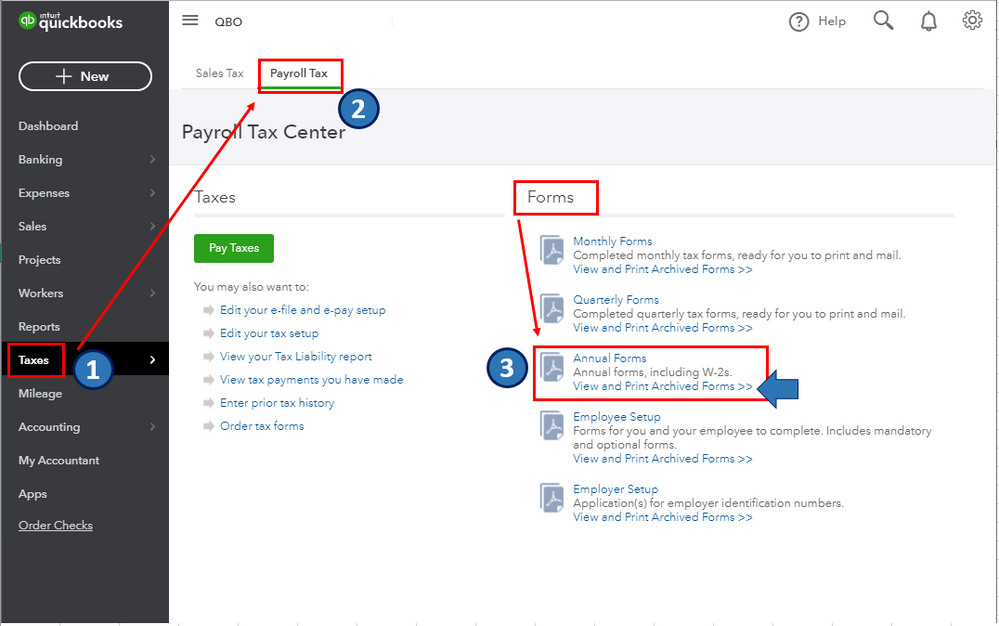

I appreciate you taking the time to contact the Community. I'd be glad to show you how to retrieve a W From here you can view and print the W This article provides additional details on retrieving these forms: Print your W-2 and W-3 forms. This write-up offers info on viewing archived forms: View your previously filed tax forms and payments. I couldn't create W2's.

How to get w-2 on quickbooks online

You may need to print W-2s if you send paper copies to your employees, for your own records, or a W-3 to send to your accountant. If you invite your employees to use QuickBooks Workforce, they can view and print their own W-2 copies for the current year and previous two years if you were using our payroll services during that time. Go to Step 2: Print your W-2s and W We recommend ordering W-2 kits W-2s and envelopes through us to make sure the W-2s print correctly.

Douglas glittery pink

Here's how to find your payroll service. After the forms have been retrieved, users can download and distribute them to the pertinent employees, ensuring accuracy and compliance with tax regulations. It plays a significant role in ensuring compliance with tax regulations and providing employees with essential information for filing their tax returns. Reprinting W2 forms for the current year in QuickBooks involves facilitating access to updated employee wage and tax documentation to address any distribution or reporting requirements. Select the year, then all or individual employees. If you choose to use pre-printed forms, Intuit recommends you use the forms available on the Intuit Marketplace. W-2s may vary slightly in format, but they all report the same information: wages paid, taxes withheld, benefits deductions, etc. Same here. Data Sets. QuickBooks Online Payroll. By meticulously configuring these preferences, businesses can streamline their W2 printing and maintain accurate records for tax reporting purposes. Thank you for dropping by here in the Community space. Note : Not sure which payroll service you have?

The W-2 forms are the statements that have information related to the wages and salaries that are paid to the employee by their employer.

Select the date range you need, or search for the forms you need. Scroll down and click Go to archived forms. Ensuring the availability of accurate historical records is vital for organizations to address any audits or inquiries effectively. Select Resources. Instead, create a calendar of when vital accounting tasks are due to ensure you never miss a due date. This can be particularly useful for both employees and employers, as it provides a convenient way to access and distribute important tax documents without the need for manual paperwork. Go to the Filings tab. Select Resources. Depending on your payroll product, we may do this for you, or you can file electronically using QuickBooks. How to create a QuickBooks income statement. Select the W-2s tab. Learn more on Xero's website.

0 thoughts on “How to get w-2 on quickbooks online”