How to get tax papers from doordash

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help!

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address.

How to get tax papers from doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex. If you are a freelance delivery driver, business mileage tracking is a must. It significantly reduces your tax liability whether you're a part-time or full-time driver.

You will be informed of when you can anticipate receiving your form, either electronically or in print, and the significance of turning in your tax return on time. About the Author.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around. From expense tracking to quarterly estimated payments, figuring out your DoorDash taxes can be nothing short of overwhelming.

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes.

How to get tax papers from doordash

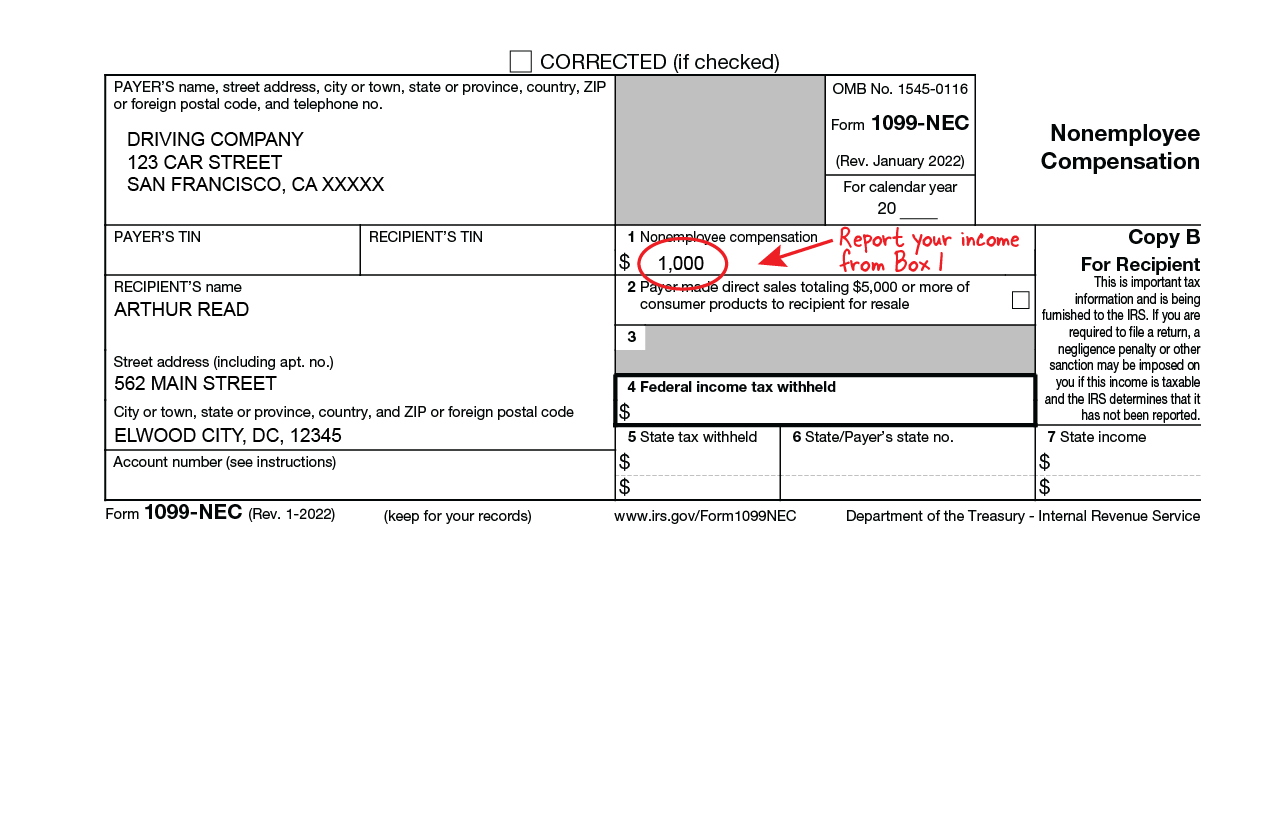

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form. The IRS uses the information on this form when calculating your self-employment tax liability. Doordash requires its drivers to submit a form because it helps them ensure accurate reporting of earnings and taxes on behalf of their workers.

Feathered fringe hairstyles

E-delivery is the faster option: it will let you see your online by January Thank you! The Doordash mileage deduction rate is The first thing you should do is check your mailbox for the form. And the cost is shared, with your employer paying half and you paying half of the But there are some important tax considerations to keep in mind, one of which is the need to file Form How much do Grubhub drivers pay in taxes? Don't worry, we've got your back. Doordash tax forms We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Share this resource with other solopreneurs. To accurately pay taxes without a Doordash tax bill, you must gather all income-related documents earned through this company during the tax year. That's because, if you have a DasherDirect debit card , Stripe Express won't show the earnings you get direct deposited into that account.

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable.

Don't worry, we've got your back. Free Tax Tools Tax Calculator. Christian is a copywriter from Portland, Oregon that specializes in financial writing. But for self-employed people like dashers, Tax Day isn't always one and done. Documentation could be any other records that show how much money you made throughout the year such as invoices for services rendered. What tax write-offs can I claim? Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. An email with your coupon will be arriving soon! Independent contractors like dashers are also on the hook for both federal and state income taxes. If you don't have a separate business card, you can make your bookkeeping easier using Keeper. Partner with us. Is this article answering your questions?

Absolutely with you it agree. It seems to me it is good idea. I agree with you.

I perhaps shall keep silent