How to get 1099 int from pnc bank

Many or all of the products featured here are from our partners who compensate us.

It depends. National Financial is "processing" PNC's accounts. It worked for my DIV information. Lots of banks and financial institutions have statements available for account holders to view or print several weeks before they have the data formatted for import into tax software. If you are in a hurry then you can type it in yourself instead of waiting for them to have it ready for import. You still need to enter the interest even if you did not get a

How to get 1099 int from pnc bank

Browse credit cards from a variety of issuers to see if there's a better card for you. I don't have any income based on the account. Has anyone faced a similar situation with them before? I'm waiting for the INT to receive so that I can file my taxes. However, I haven't received a satisfactory response from them. It's true that they will not send you a INT. Went for the bonus last yr. I specifically asked a phone rep if they will notify the IRS and she said no. So I didn't report it. I didn't get a from PNC either for a checking account bonus, I still went ahead and reported the bonus on my income taxes though.

You might have tax deductions that offset the income, for example, or some or all of it might be sheltered based on characteristics of the asset that generated it.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

How to get 1099 int from pnc bank

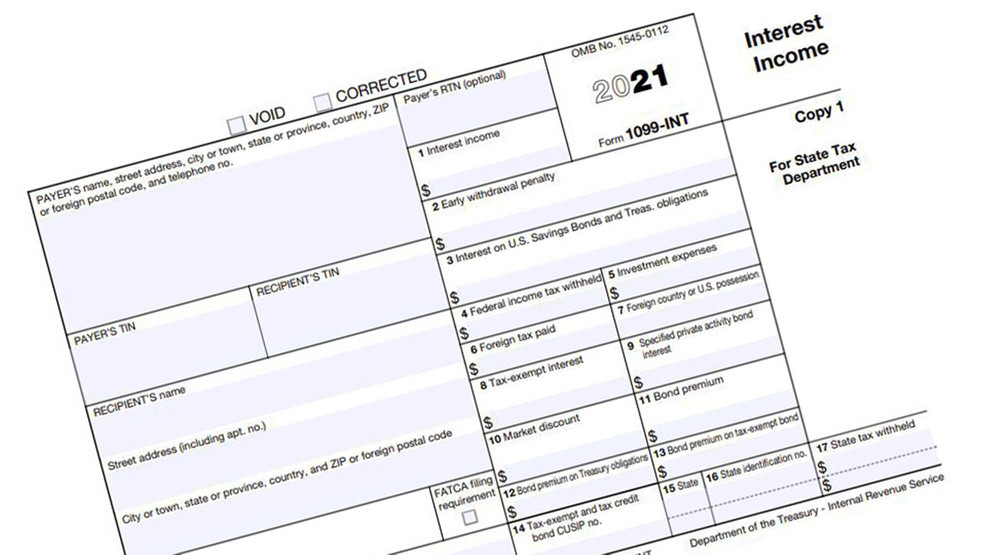

If you receive a INT, the tax form that reports most payments of interest income, you may or may not have to pay income tax on the interest it reports. However, you may still need to include the information from it on your return. Key Takeaways. The Internal Revenue Service requires most payments of interest income to be reported on tax form INT by the person or entity that makes the payments.

Pitbull/boxers mix

And for what it's worth it does say in the fine print on PNC's website right on the bonus page The value of the reward may be reported on Internal Revenue Service IRS Form , and may be considered taxable income to you. What is a INT tax form? Sometime in February, you might receive a INT tax form or more than one in the mail. Still have questions? Search instead for. Sign in to TurboTax. If you are in a hurry then you can type it in yourself instead of waiting for them to have it ready for import. We'll help you get started or pick up where you left off. If you received this tax form from a bank or other entity because you have investments or accounts that earned interest, you might also get a few other tax forms in the mail. Sign up Sign in. Just enter the bank name and put the amount in box 1. Remember, many retirement plans are tax-advantaged , so this form might be simple record-keeping on behalf of the IRS. Get Access Now.

Provide the bank with any account or identity information. Register for online account access.

Turn on suggestions. Many or all of the products featured here are from our partners who compensate us. You have clicked a link to a site outside of the TurboTax Community. If you took a loan from your retirement plan, you might have to treat it as a distribution, which means it might be on this form, too, as well as permanent and total disability payments under life insurance contracts. What does my INT tax form mean? I'd much rather be safe then sorry, and i'd much rather avoid any and all complications with the IRS. Turn on suggestions. Advertiser disclosure. Message 3 of 5. Search instead for. If you received this tax form from a bank or other entity because you have investments or accounts that earned interest, you might also get a few other tax forms in the mail. Do you have a TurboTax Online account? New to Intuit? Showing results for. Get Access Now.

It is remarkable, this rather valuable message

I think, that anything serious.