Hourly tax calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare.

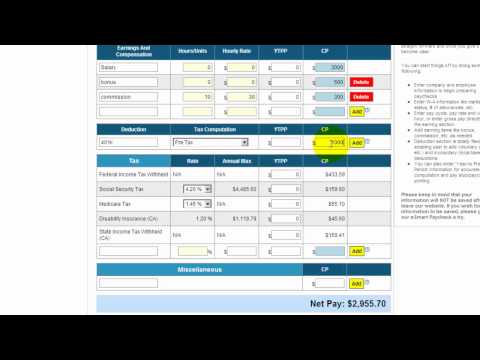

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year

Hourly tax calculator

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. For each payroll, federal income tax is calculated based on the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication T. You filled out a W-4 form when you were hired. The W4 form determines the amount of federal income tax withheld from your paycheck.

OK Cancel. Calculate a bonus paycheck tax using supplemental tax rates.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips. See how increasing your k contributions will affect your paycheck and your retirement savings.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities.

Hourly tax calculator

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income working overseas, etc. In contrast, nonresidents are taxed only on income within the jurisdiction. The month period for income taxes begins on January 1st and ends on December 31st of the same calendar year. The federal income tax rates differ from state income tax rates. Federal taxes are progressive higher rates on higher income levels. At the same time, states have an advanced tax system or a flat tax rate on all income.

Carros de carreras para niños

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. As most employers do not include bonus payments in the calculation of pension deductions, the calculator also makes no changes to pensions in a bonus period. Deduction Name. Salary, hourly, bonus, net-to-gross, and more income calculators. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck on your W More information is available on the About page. If you are unsure of your tax code, just leave it blank and the default will be applied. Prior to , your age affected your tax-free personal allowance. Please adjust your.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status.

Tick the "Married" box to apply this rebate to calculations - otherwise leave the box clear. Financial Advisors Financial Advisor Cost. Overtime Hourly Wage. Clear Calculate. This is the hourly rate you are paid, before tax or other deductions have been made. Hourly Salary. Looking for managed Payroll and benefits for your business? Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. If you are married, tick the "Married" box. Wondering what your yearly salary is? Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. Save more with these rates that beat the National Average. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. Find federal and state withholding requirements in our Payroll Resources. Use the dual scenario hourly paycheck calculator to compare your take home pay in different hourly scenarios.

In it something is. Thanks for the help in this question.

It is simply magnificent phrase