Home depot stock dividend

The next Home Depot, Inc.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. HD stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Home depot stock dividend

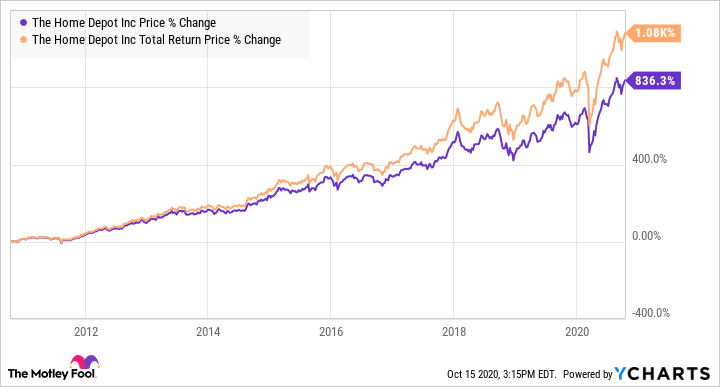

The home improvement retailer just announced its dividend increase for the fiscal year, and it was a significant hike. The higher payout will hit investors' portfolios in late March, assuming they own Home Depot shares as of March 7. A bigger dividend is a good reason to consider buying this stock, but it's not the main factor that will influence your long-term returns. Let's take a closer look at whether Home Depot is still a good buy for patient investors today. That works out to a 2. However, cash flow was much stronger compared to last year, so Home Depot's management team had plenty of flexibility when considering the size of this year's increase. Home Depot's year was uninspiring on the growth front, so investors should keep their short-term expectations in check. There was much less demand among do-it-yourself shoppers, who scaled back on home improvement projects. The professional contractor niche didn't shrink as quickly, though, which allowed Home Depot to outperform peers like Lowe's through most of the year. The main metric to watch here for signs of rebound is customer traffic. Home Depot handled fewer guests last year for a second consecutive fiscal year, which makes it much harder to post a growth rebound. Yet the chain will need this metric to move back into positive territory soon to avoid a third straight year of sluggish growth. Home Depot's dividend payment is just part of the ample cash returns that shareholders can expect when owning this stock. There's good reason to expect this figure to rise in given that Home Depot is projecting a return to per-share earnings growth this year.

Ex Dividend Date Mar 06,

The Home Depot, Inc. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. HD pays dividends on a quarterly basis. The next dividend payment is planned on March 21, HD has increased its dividends for 15 consecutive years. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future.

The Home Depot, Inc. Home Depot is a dividend paying company with a current yield of 2. Stable Dividend: HD's dividends per share have been stable in the past 10 years. Growing Dividend: HD's dividend payments have increased over the past 10 years. Notable Dividend: HD's dividend 2. High Dividend: HD's dividend 2. Earnings Coverage: With its reasonable payout ratio

Home depot stock dividend

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Home Depot, Inc. Sign up for Home Depot, Inc. Add Home Depot, Inc. Founded in , The Home Depot, Inc.

Interclub burgos

Top Individual Investors. How to Retire. Expert Opinion. Sell Date Estimate. Home Depot's dividend payment is just part of the ample cash returns that shareholders can expect when owning this stock. Mar 09, Gold 2, Feb 22, Investing Ideas. Dividend ETFs. Enterprise Solutions. Returns Risk.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here.

Municipal Bonds Channel. Expert Opinion Insights on U. Avg yield on cost 0. Dividend Yield. Best Energy. Strategists Channel. What is a Div Yield? Initiating Dividend. Top Insiders Stocks. Next Pay Date. Options Market Overview.

0 thoughts on “Home depot stock dividend”