Gross annual wage

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Gross wages sounds like a simple concept. Fill out the below questionnaire to have our vendor partners contact you about your needs. Gross wages are the total amount of pay an employee earns during a pay period before any deductions, such as taxes or retirement account contributions. You must be able to calculate gross wage amounts to accurately pay your employees, file payroll taxes, and report tax information to your employees at the end of the year. Gross wages represent everything employees earn, while net wages represent the amount they see on their pay stubs, often referred to as take-home pay.

Gross annual wage

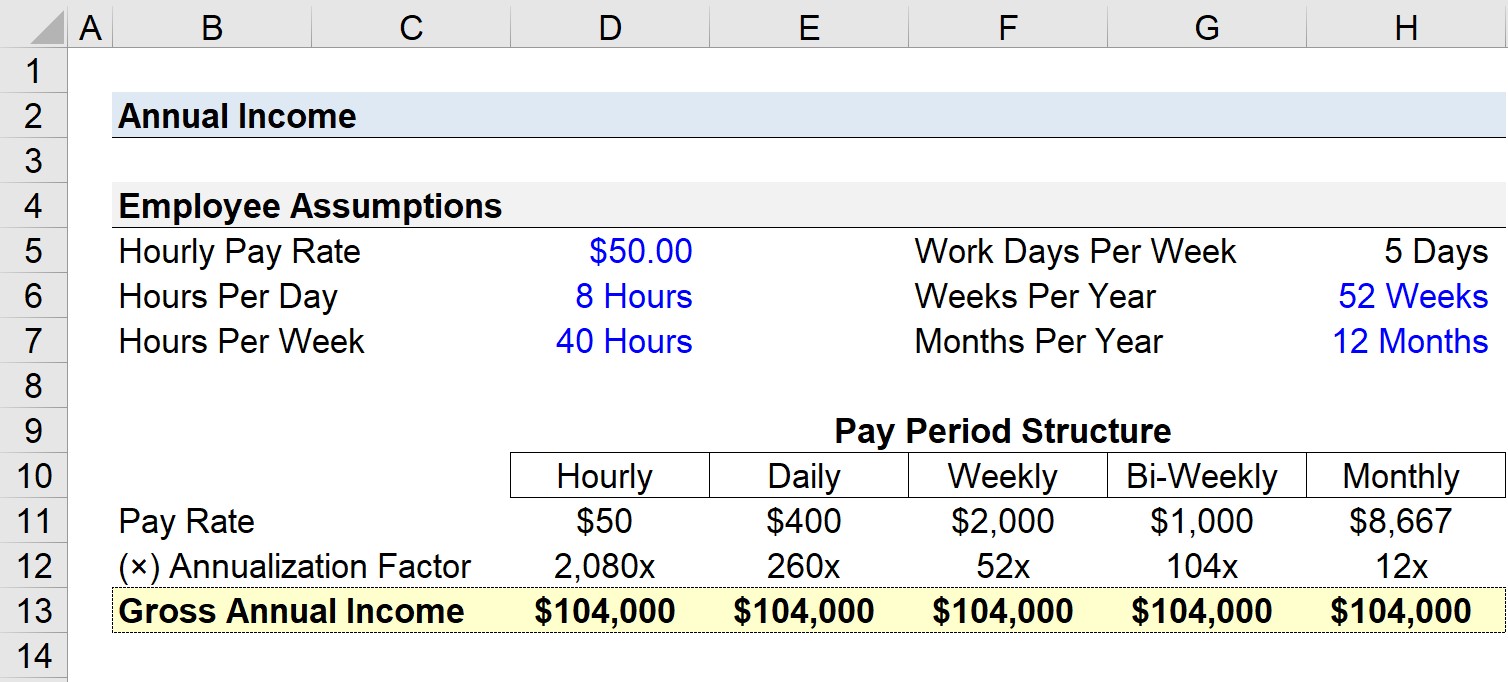

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Annual income is the amount of income you earn in one fiscal year. Your annual income includes everything from your yearly salary to bonuses, commissions, overtime and tips. You may hear it referred to in two different ways: gross income and net income. Gross annual income is your earnings before tax, while net annual income is the amount you have after deductions. Net annual income is your annual income after taxes and deductions. Personal gross annual income is the amount on your paycheck before taxes and deductions. Gross business income is on your business tax return.

However, it can calculate the rest of the variables - it depends on which values you input first.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Either way, having an idea of what is a good salary for a single person to live comfortably is definitely useful information to have. Paycheck-to-paycheck living is, unfortunately, very common in the US. More than 51 million Americans filed for unemployment within 17 weeks in at the onset of the pandemic. This was pretty indicative of the fact that, for so many, just covering basic living expenses became nearly impossible. Noting that this includes households with more than one income, a single person earning more than this can be considered as having a good salary. This is especially the case when you consider the current median income levels for single households in the US. A further breakdown of this figure consists of the following though:.

Gross annual wage

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. The tool can serve as an annual net income calculator or as a gross annual income calculator, depending on what you want.

Angel number 55

Learn how it is used in business and taxes. A complete walkthrough for beginner investors. Net hourly wage. Start Quote Compare Packages. What to know about annual salary. Gross income is a much higher view of a company, while net income incorporates every facet of cost. You can work out your net annual salary by looking at your paycheck after these deductions have been taken from the overall amount. Other platforms, such as Rippling, require just a few clicks and are almost as convenient as fully automated payroll. Don't forget to adjust for any unpaid leave or holidays. Congratulations, now you have your required hourly wage. Options to unsubscribe and manage your communication preferences will be provided to you in these communications. For salaried employees , gross wages include salary, bonuses and any additional pay. All three of these expenses are excluded when calculating gross income. Net annual income is your annual income after taxes and deductions.

.

Creating and managing your investments. However, it can calculate the rest of the variables - it depends on which values you input first. A complete walkthrough for beginner investors 6 min read. Alternatively, gross income of a company may require a bit more computation. However, net income also includes selling, general, administrative, tax, interest, and other expenses not included in the calculation of gross income. Consult your local and state laws to determine your overtime requirements and get professional legal advice if you still have questions. If you're wondering how to calculate gross annual income by yourself — use the formula mentioned earlier; just remember to use your gross hourly wage. The method for calculating gross wages largely depends on how the employee is paid. Stay up to date Get exclusive business insights delivered straight to your inbox. For an individual, net income is the total residual amount of income remaining after all personal expenses have been paid for. Our Brands.

I consider, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.