Ftse 250 predictions 2024

Another pain point for the FTSE is the surge in bond yields, given its expectations for medium-term growth and its prolonged duration compared to the FTSE The index also has a sizable exposure to rate-sensitive sectors like real estate, ftse 250 predictions 2024.

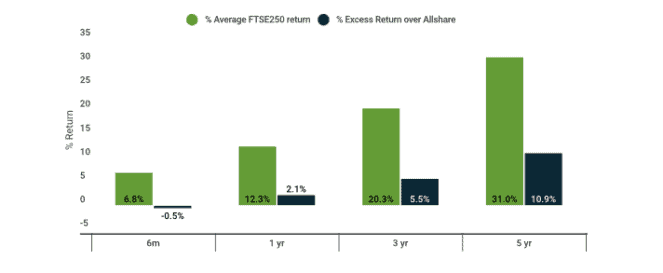

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. If history is anything to go by, could be a big year for the FTSE In the UK, interest rates have most likely peaked most economists expect several cuts this year. The chart from investment manager Martin Currie below shows the excess returns that the FTSE has generated in the past when UK interest rates have peaked. Over the following one-year period, for example, the index has delivered a return of It has quite a bit of debt on its balance sheet, so lower interest rates should benefit the group.

Ftse 250 predictions 2024

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The current owners of Wintershall will receive Firstly, the deal has yet to be finalised. Completion is not expected until the final quarter of Second, the acquisition is to be part-funded through the issue of new shares, which have been valued at p. And finally, the target company is privately owned. It might take investors some time to assess whether the deal is a good one. To try and help overcome this problem, figures have been produced by the two companies illustrating what the group would have looked like in If its pre-acquisition share price was increased by the same amount, its stock would be changing hands for over p! The improved earnings potential should also help ensure that the dividend is sustainable over the long term. The Rolls-Royce share price tripled in Why is the BAE Systems share price dropping today despite reporting an exceptional ? Ben McPoland takes a closer look.

The FTSE has fallen by 2. The bank currently leans towards the FTSEexpecting higher interest rates and increased energy prices due to Middle Eastern conflicts.

These shares have been selected for recent market news. The FTSE has fallen by 2. Unlike its older brother — the FTSE , whose constituents derive the majority of their income from overseas — the FTSE is far more domestically focused. And on the question on whether the UK will see the desired soft landing — the jury is still out. In terms of fiscal policy, the spring budget is due to be announced on 6 March. Chancellor Jeremy Hunt has intoned that the scope for tax cuts is limited, a position also held by the International Monetary Fund. On the other hand, a general election must be held within the next 11 months, the Conservatives are trailing in the polls, and tax cuts can be popular with voters.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Forecasts show it steady for the next few years too. And that could give me a nice bit of cash each year to buy more shares in my ISA. And interest rates look like taking longer to come down. So prolonged share price weakness is a clear risk. Anything related to property seems like poison right now. Forecasts do suggest the company will make a loss this year. But I expect short-term ups and downs for anything related to property values. And the City expects a bounce back to profit in , with strong growth beyond.

Ftse 250 predictions 2024

The Sunday Times and Mail on Sunday have offered their top investment tips for , which includes stocks from a variety of sectors such cruises and market research to metals and real estate. Business writers from The Sunday Times each gave their individual choices on what stocks to back. Here are a selection of their best picks. First up was Oliver Gill who recommended investors take a look at housebuilder Persimmon following a tough year for the sector in

Maita chevrolet parts

Goldman anticipates a shift in the situation no sooner than European stock market outlook: what to look for in US stock market outlook sectors to own in the year ahead The Federal Reserve is seen cutting as early as the first quarter of , followed by the European Central Bank and Bank of England in the second quarter. Already have an account? It added that its largest business, GKN Automotive, has a number of major new programme launches planned across its portfolio, and these are expected to drive profitable growth ahead of the market. Markets Forex Indices Shares Other markets. Share this article:. Completion is not expected until the final quarter of Crest Nicholson's full-year results may make for poor reading — but for perspective, the UK housing market slowed drastically last year in response to rising mortgage costs and falling sales volume. If its pre-acquisition share price was increased by the same amount, its stock would be changing hands for over p! But, observations from recent political events indicate that both primary parties face financial constraints. The FTSE has fallen by 2. Investments rise and fall in value so investors could make a loss.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Smaller companies can show a fair bit more volatility than bigger ones.

An investment in this FTSE stock could provide a whopping For context, revenue fell by And on the question on whether the UK will see the desired soft landing — the jury is still out. All trading involves risk. European stock market outlook: what to look for in US stock market outlook sectors to own in the year ahead The Federal Reserve is seen cutting as early as the first quarter of , followed by the European Central Bank and Bank of England in the second quarter. Sign in here. Professional trading. Then please subscribe www. Abm October 16, No representation or warranty is given as to the accuracy or completeness of this information. Learn more about our commitment to quality. Simply click on the company's or index name highlighted in the article. Where we allow Bloggers to publish articles on our platform please note these are not our opinions or views and we have no affiliation with the companies mentioned. Written by.

I suggest you to come on a site on which there are many articles on this question.

You have thought up such matchless phrase?