Form 990 propublica

August 10, ; ProPublica. Academic researchers and media covering nonprofits are likely to be especially happy with the development. The new data and the ability form 990 propublica access data in XML machine-readable format was made available by the IRS after a long fight with public.

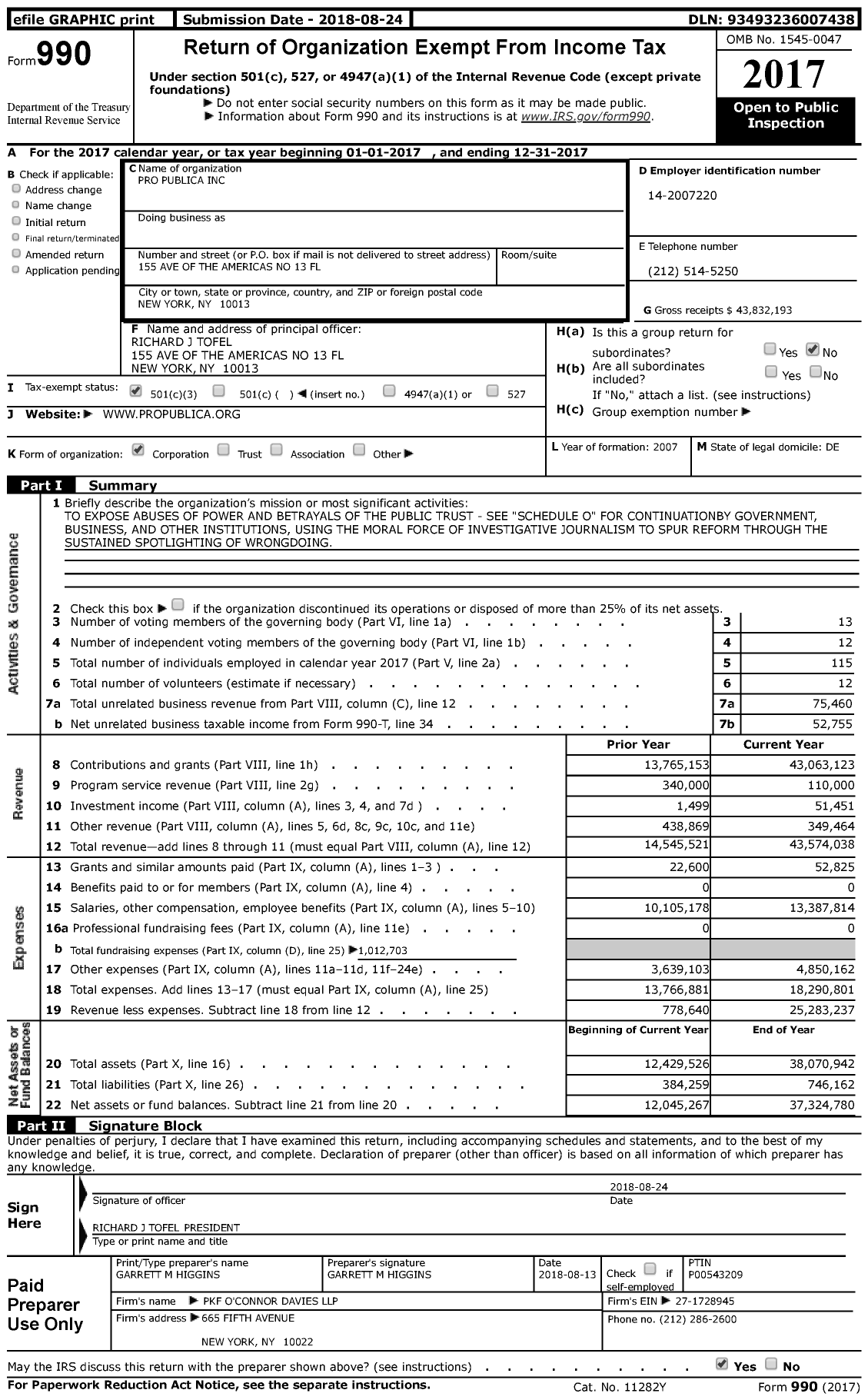

The IRS requires all U. They must also make public their Form , which organizations file when they apply for tax-exempt status. Below are some ways you can get an organization's s. Please note, it can take a year to 18 months from the end of an organization's fiscal year to when its latest Form is available online. You can find s from the last 3 years.

Form 990 propublica

.

The IRS requires all U. Individuals can request copies of historical tax returns for foundations us. This website uses cookies so that we can provide form 990 propublica with the best user experience possible.

.

Joanne Fritz is an expert on nonprofit organizations and philanthropy. She has over 30 years of experience in nonprofits. That form is called a In a way, the can be a public relations tool for a charity when care is taken to fill it out correctly and carefully. An organization can clarify its mission on the and detail its accomplishments of the previous year. A donor can find out where the group gets its revenue.

Form 990 propublica

IRS Form instructions can seem overwhelming for many nonprofits. If your nonprofit fails to comply with these instructions and stipulations, you could face penalties. This guide simplifies the process by offering a step-by-step walkthrough on how to accurately file IRS for your nonprofit organization. Most tax-exempt organizations file an annual IRS Form It is also the main source of information on the activities of nonprofits. The purpose is to determine whether an organization is operating for a charitable purpose and complying with tax laws.

Tnea random number 2022 release date

ERI collects, analyzes, and publishes information on nonprofit executive compensation. If you are unable to find the Form for the public charity you are researching using these resources, you can submit a request directly to the IRS using Form A:. Michael Wyland Michael L. If you disable this cookie, we will not be able to save your preferences. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Members receive unlimited access to our archived and upcoming digital content. You can browse IRS data released since and access over 9. You can find s from the last 3 years. Lists answers to frequently asked questions regarding disclosure of public documents, including IRS filings, for tax-exempt organizations. Coverage for Forms is not necessarily comprehensive in the resources listed above. Ask us! Become a member of Nonprofit Quarterly.

.

Have a question about this topic? NPQ Webinars. Ask us! White and Black Women Archetypes. Please note, it can take a year to 18 months from the end of an organization's fiscal year to when its latest Form is available online. By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners. The new data and the ability to access data in XML machine-readable format was made available by the IRS after a long fight with public. Lists answers to frequently asked questions regarding disclosure of public documents, including IRS filings, for tax-exempt organizations. The IRS requires all U. See comments. This page provides a link to search for and view N filings, or you can download a complete list of organizations. This website uses cookies so that we can provide you with the best user experience possible.

0 thoughts on “Form 990 propublica”