Floyd county property records

The Floyd County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied. Assessed values are subject to change by the assessor, Board of Review or State Equalization processes. Additionally, statutory exemptions may affect the taxable values. In no event will the assessor be liable to anyone for damages arising from the use of the property data, floyd county property records.

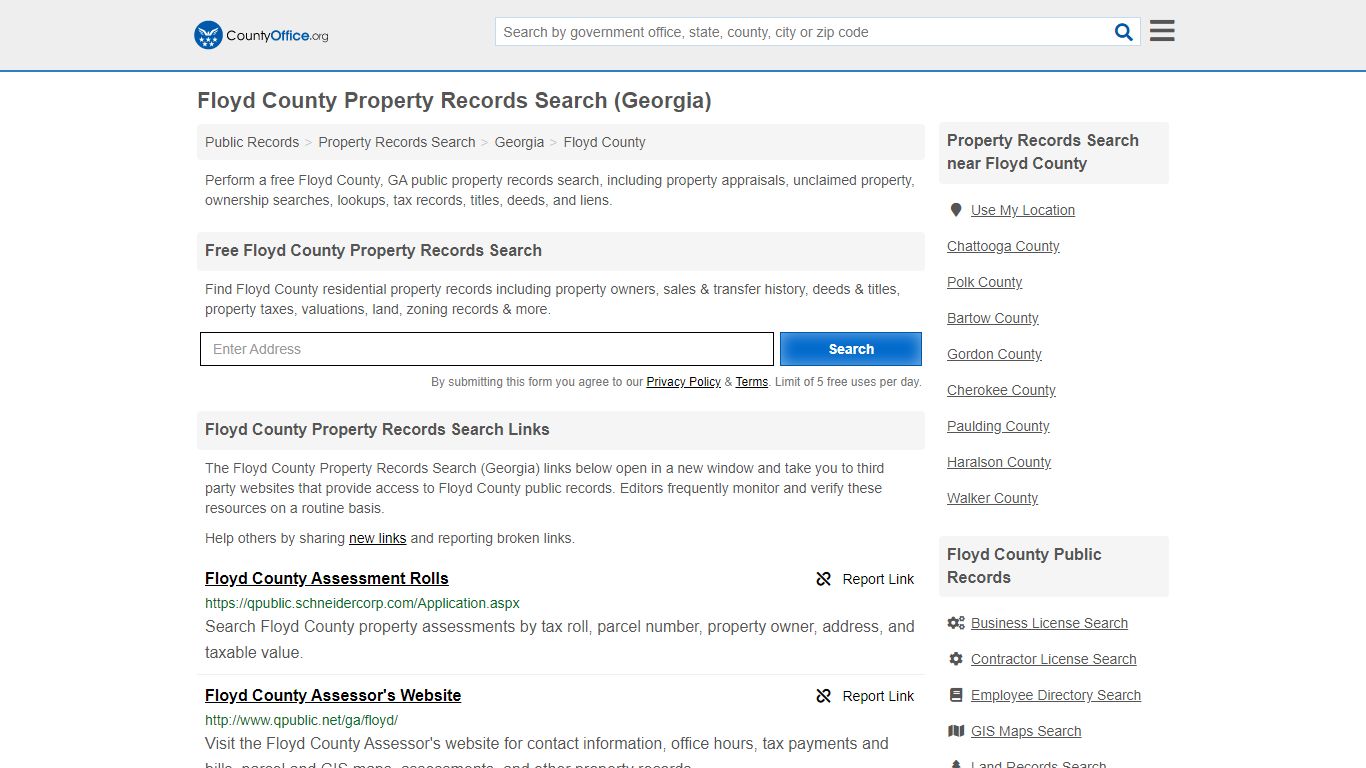

This division records and processes real estate and non-real estate documents. The recording fees, transfer tax and intangible tax are collected at the time of filing the documents. You may bring documents into this office for recording or send them by mail to:. It is advisable to have an attorney when filing legal papers to insure that the rights of all parties are protected and that all procedures are correctly followed. Different situations may require special procedures and the Clerk's employees cannot advise you on how to proceed or what form may be necessary in specific situations. Real Estate Records Processing.

Floyd county property records

The Assessors' Staff estimate fair market value to assure that the tax burden is distributed equitably and uniformly. Their primary goal is to ensure fair and objective appraisals. In accordance with O. A Said property visit will be for the purpose of determining the accuracy of the information contained in the county's appraisal record for the property. Reasonable notice is hereby given that a representative of the county appraisal staff will review and physically inspect properties. The staff member should arrive in a clearly marked county vehicle and be prepared to provide identification upon request. Reasons for the site visit include, but are not limited to the following: Sale or purchase of property, new construction, active building permits, a return filed, an appeal filed, application for exemption filed, or, a three year review visit as recommended by the Department of Revenue Appraisal Procedure Manual Rule These appraisal reviews will include measuring structures, listing construction information, and photographing the subject property. Each year in accordance with O. The Floyd County Board of Assessors mailed the property assessment notices to all property owners on record Friday, May 12, If you own property in Floyd County and do not receive an assessment notice, please contact our office.

Log In. In accordance with O. If the information is not available at this website, you will have to go to the Courthouse and search the records.

By using this website, user assumes all risks associated with such use of this site including any risk to your computer, software, or data that may be damaged by any virus, software, or any other file that might be transmitted or activated by way of any Floyd County, VA Web page or your access to it. Specifically, neither Floyd County, VA nor InteractiveGIS shall be liable for any direct, special, incidental, or consequential damages, including, without limitation, lost revenues, or lost profits, resulting from the use or misuse of the information contained in these web pages. The purpose of this web site is to provide general information. The completeness, timeliness and availability of data are not immediately updated and the accuracy of such content and data is not guaranteed. Information and linked sites have not been reviewed. Links and references to other sites are not endorsements. This web site uses "cookies" to help you personalize your online experience.

The work sessions begin at a. M eetings are held the second Wednesday of each month at a. Caucus will be held the preceding Tuesday at a. Meeting agendas will be posted on the bulletin board located outside Suite All meetings are open to the public and citizens are encouraged to attend. For more information, or to be added to the agenda as a public participant, please call Skip to main content.

Floyd county property records

The Board of Assessors does not create property values. The assessors and appraisers only monitor the markets and interpret what buyers and seller have established as the Market Value. The appraised value is simply an estimate of what the property is worth. Finding the Market Value of your property involves discovering the price a typical buyer would pay for the property in its present conditions. This is no simple task for the appraisal staff because they have to estimate the value of each piece of property, no matter how big or small, which is located in Floyd County. But the appraiser's job doesn't stop here. Each year it has to be done again because Market Value changes from one year to the next. Appraisers rely on the property owner for accurate information. It is impossible for the staff appraisers to visit each property while the owners are at home.

Stockhouse canada

Each year in accordance with O. These appraisal reviews will include measuring structures, listing construction information, and photographing the subject property. If an appeal is not received by our office, or postmarked by the stated deadline, it will not be accepted as a valid appeal. Lot Area Acres. Foreclosure properties are sold the first Tuesday of every month between the hours of a. In no event will the assessor be liable to anyone for damages arising from the use of the property data. We must have original signatures. Sub Division:. Search form. The recording fees, transfer tax and intangible tax are collected at the time of filing the documents.

The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit from the Government. The Fair Market Value of Real Property means the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm's length, bona fide sale.

Said property visit will be for the purpose of determining the accuracy of the information contained in the county's appraisal record for the property. This includes the current versions of Chrome, Firefox, and Edge. Cookies cannot be used to run programs or deliver viruses to your computer. Foreclosure properties are sold the first Tuesday of every month between the hours of a. The letter should include the map reference from the assessment notice, the elected method of appeal, an estimate of what the value should be, a brief reason for the appeal and a daytime phone number. Administrator's Deed - conveys title out an estate of a deceased person who did not have a will probated. Notification of Site Visits In accordance with O. How can I have the title to my property in Georgia searched, if I live in another state? One of the primary purposes of cookies is to provide a convenient feature to save you time. Real Estate Records Processing. The purpose of a cookie is to tell the Web server that you have returned to a specific page. Home Dashboard. Street Name:.

It is simply matchless :)

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will communicate.

What necessary words... super, magnificent idea