Fitch rating company

Our history defines how we are known today. We have come a long way, from our founding as a small publishing house in New York City into the world-leading financial services fitch rating company that sits at the heart of the global capital markets. Fitch Publishing Company Inc.

We have breadth and depth across our global team, allowing us to deliver value to our clients. We employ more than 4, people in over 30 countries, including nearly 1, analysts. Our analysts are prominent global credit and risk experts who offer insights on over countries, over 8, corporate entities and over , debt securities. At Fitch Group, the combined power of our global perspectives is what differentiates us. It is the strength of our business. It comes from people around the world in a shared pursuit: to equal something greater than they could ever accomplish alone. We believe that diverse teams achieve better results by leveraging a broad set of ideas and perspectives.

Fitch rating company

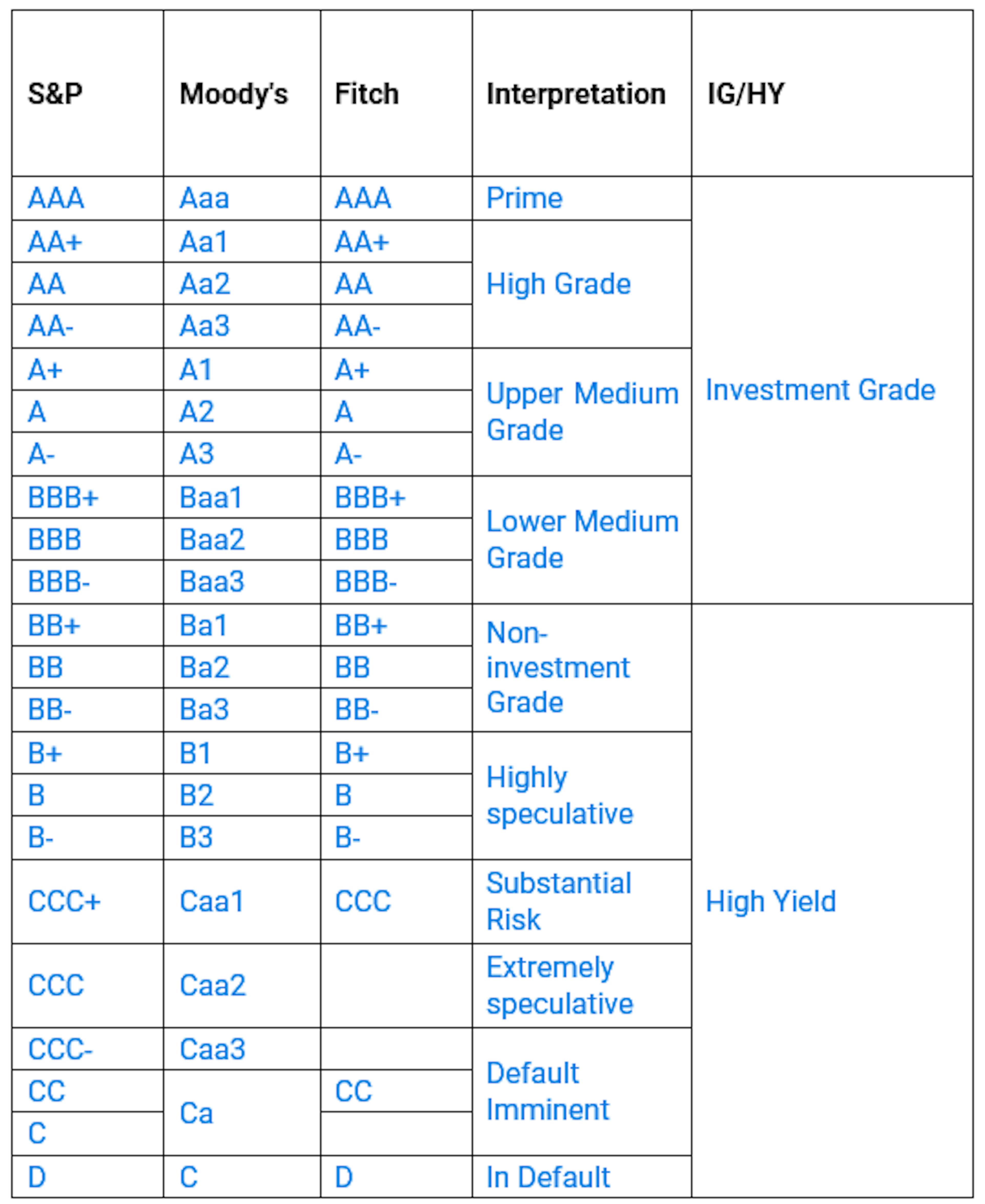

Investors use the company's ratings to determine which investments are less likely to default and yield a solid return. Fitch bases the ratings on several factors, such as what kind of debt a company holds and its sensitivity to systemic changes like interest rates. Fitch is one of the top three credit rating agencies in the world. The Fitch rating system is very similar to other rating agencies in that they all use a letter system. The Fitch rating system breaks entities into two categories, investment grade, and non-investment grade. The investment grade ratings are:. The non-investment grade ratings are:. Sovereign credit ratings are available to investors to help give them insight into the level of risk associated with investing in a particular country. Countries will invite Fitch and other credit rating agencies to evaluate their economic and political environments and financial situations to determine a representative rating. On the lower end was Brazil with a BB-. However, in , Fitch downgraded the U. Country ratings are important because they can influence international investor sentiments, which is why the U. Fitch Ratings also analyzes the issues of companies, local governments and agencies, and financial institutions for their creditworthiness.

Related Terms. Our people are credit experts, experienced professionals, and global citizens who collaborate in offices in over 30 countries, to help our clients and communities.

Fitch Ratings Inc. Securities and Exchange Commission in Fitch Ratings is dual headquartered in New York and London. Hearst's previous equity interest was 80 percent following expansions on an original acquisition of 20 percent interest in In , the company was acquired by a group including Robert Van Kampen. Launched in , Fitch Solutions offers a range of fixed-income products and professional development services for financial professionals. The firm also distributes Fitch Ratings' proprietary credit ratings, research, financial data, and analytical tools.

This is a modal window. Beginning of dialog window. Escape will cancel and close the window. We are Fitch Ratings. An award-winning provider of credit ratings, commentary and research. Human insight, enabling our clients all over the world to make better decisions.

Fitch rating company

Explore Fitch's ratings scales and definitions using our interactive tool below or download and read the report. Fitch Ratings publishes credit ratings that are forward-looking opinions on the relative ability of an entity or obligation to meet financial commitments. Issuer default ratings IDRs are assigned to corporations, sovereign entities, financial institutions such as banks, leasing companies and insurers, and public finance entities local and regional governments. Issue level ratings are also assigned, often include an expectation of recovery and may be notched above or below the issuer level rating. Credit ratings are indications of the likelihood of repayment in accordance with the terms of the issuance.

Great clips albuquerque

Our analysts cover 5, financial institutions, 2, corporates and sovereigns and supranationals. More Videos. Get transparent, high-value structured finance intelligence. Understand at a glance who does or does not benefit from government support. In other projects. We have come a long way, from our founding as a small publishing house in New York City in , to the world-leading financial services organization that sits at the heart of the global capital markets. A market-leading combination of regional insight and cross-industry expertise that delivers meaningful national and international scale ratings data for the corporates, financial institutions, structured finance, and project and public finance sectors. Know what you need but not sure where to find it? BMI, a Fitch Solutions company. BMI Industry Research Global coverage of more than 20 industries and 35 commodities, plus thematic research on cross-industry trends. Discover Fitch Solutions. The plus symbol indicates that the entity's credit rating is higher than others given the A rating but not enough to warrant an upgrade to the AA rating. We believe that diverse teams achieve better results by leveraging a broad set of ideas and perspectives.

Leverage differentiated credit views for better investment and credit risk decision-making, from the authoritative source of Fitch Ratings highly-regarded and multi award-winning credit ratings data. Feed your credit risk models with forward-looking, through-the-cycle ratings data on nearly 20, publicly rated entities and transactions worldwide.

Fitch merged with IBCA Ltd, significantly increasing Fitch's worldwide presence and coverage in banking, financial institutions, and sovereigns. Archived from the original on November 1, Our history defines how we are known today. Archived PDF from the original on February 20, Whether by broadening our product suite or by moving into new regions, our commitment to delivering international perspective through local insight has never been stronger. All backed by the transparent methodologies, differentiated perspectives, and depth of expertise of Fitch Ratings analysts. It covers our ratings scale and the process from initiation to outcome and ongoing maintenance. Fitch Ratings were the first to introduce the AAA model, viability ratings for banks, and an independent view of how ESG factors impact credit ratings. Get to know us The driving force behind our products is our people. Retrieved May 9, — via ProQuest. Experience better analyst interactions and benefit from the extra time we invest per name: the Fitch Ratings analyst-to-entity ratio is the lowest of the three major ratings agencies. As a separate and independent company, Fitch Bohua provides forward-looking ratings, in-depth research, valuable data tools and insightful commentary for investors and other market participants.

0 thoughts on “Fitch rating company”