First republic bankstock

In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPMthe titan of the American banking sector, first republic bankstock, emerged with a remarkable financial narrative for The bank's journey

First Republic Bank signs and logos rest near a parking space, below, and on the exterior of a bank branch location, above, Wednesday, April 26, , in Wellesley, Mass. First Republic Bank signs and logos are attached to a window at a branch location, Wednesday, April 26, , in Boston. First Republic Bank signs and logos rest on the exterior of a branch location, Wednesday, April 26, , in Boston. The San Francisco bank plans to sell off unprofitable assets, including low interest mortgages it provided to wealthy clients. It also has plans to lay off up to a quarter of its workforce, which totaled about 7, employees at the end of last year. With deposits fleeing, First Republic was forced to borrow from federal programs to shore up its balance sheet. The interest the bank has to pay on those funds is much steeper than what it has to pay out on deposits, and the added expense will reduce net income.

First republic bankstock

While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. Now, some analysts are declaring the show is over for First Republic. The root of the issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB. Also akin to SVB, First Republic is a regional, Silicon Valley—based bank that caters largely to wealthy businesses and high-net-worth individuals. Why is this an issue? According to its recent balance sheet , on Dec. The vast majority of these uninsured customers are businesses. Wealthy business clients also have the resources to pull their money out as soon as they start seeing alarm bells. However, 11 large U. While executives and advisors at First Republic have been trying to engineer a sale for weeks, the bank is not an attractive buy. Teams of advisors managing billions are packing up and hopping ship—taking their high-net-worth clients with them to new employers. One thing is for sure, nobody is getting out of this mess unscathed. But who—between the investors, depositors, and the government—takes the biggest loss depends on what happens next. Wedbush equities analyst David Chiaverini explained that there were three most likely cases for the path forward. The one that is the most speculated about is that the financial institution goes into receivership and the FDIC takes over, which is similar to what happened with SVB.

Market on Close Market on Close Archive.

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco , California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. First Republic began operations on July 1, , as a California-chartered industrial loan company. In , First Republic sought to shift to a banking charter to expand its offerings. It lobbied the Nevada Legislature to pass a law allowing conversion of a Nevada thrift into a Nevada state bank.

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY SVB Financial Group. SIVBQ 0. Republic First Bancorp Inc. FRBK Rite Aid Corp. RADCQ 0. Tesla Inc.

First republic bankstock

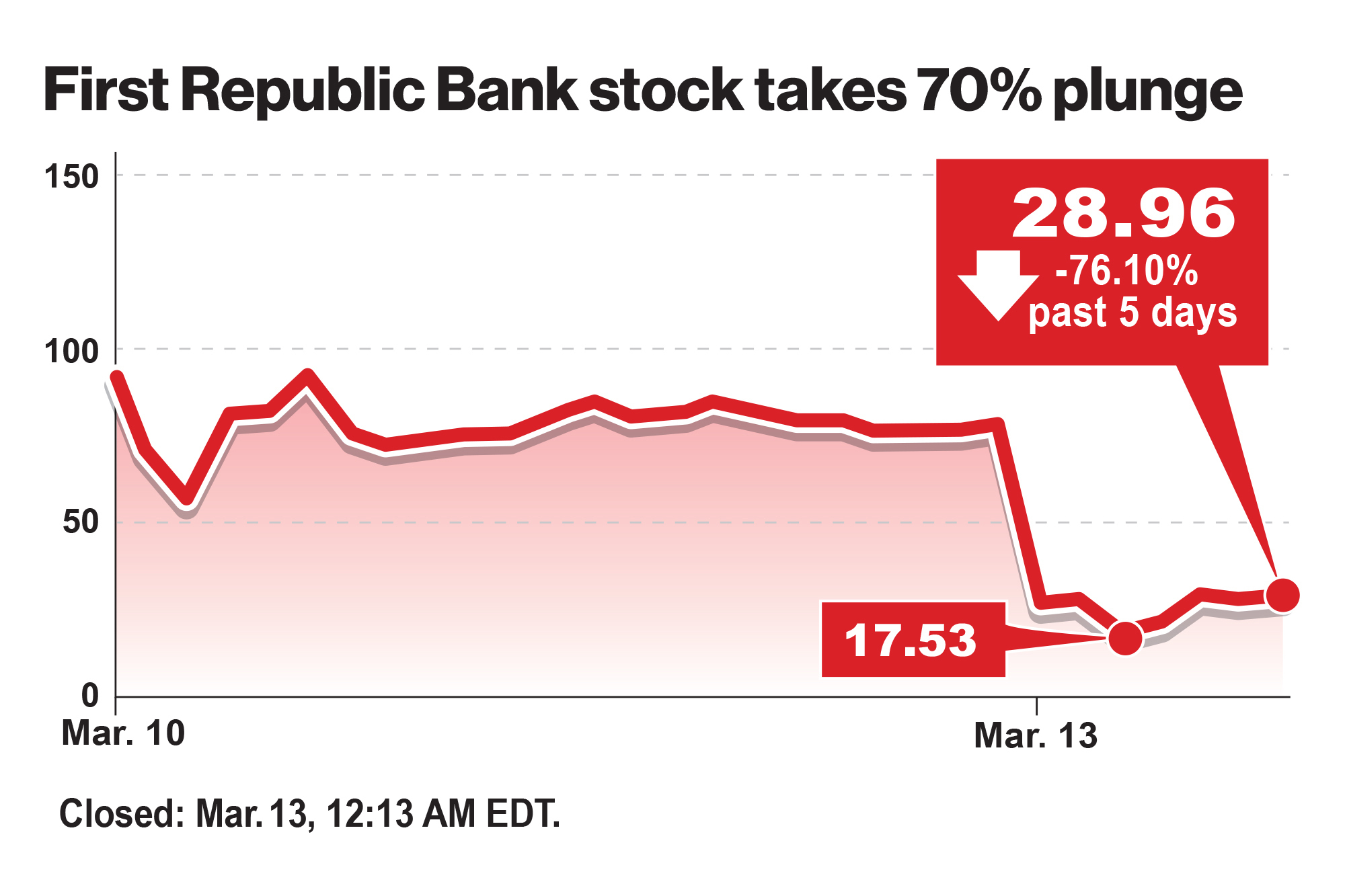

Shares of JPMorgan Chase rose 2. Regional bank shares slid. Shares of PacWest Bancorp slipped Shares of First Republic Bank remained halted from early Monday morning. Meanwhile, the latest ISM manufacturing report revealed that manufacturing activity contracted for the sixth straight month in April. The Federal Reserve begins its two-day monetary policy meeting Tuesday, which is expected to conclude with a quarter-point rate hike. Investors will be watching for clues on how the central bank will proceed with its inflation-fighting plan and whether the recent banking turmoil has altered Fed officials' plans. The Dow fell 47 points, or 0.

Halloween 2018 common sense media

More From AP News. US stocks tumble as bitcoin, gold score record highs. The San Francisco bank plans to sell off unprofitable assets, including low interest mortgages it provided to wealthy clients. Wikimedia Commons. Yet nobody knows for sure that the FDIC would assume the loss taken by the big banks if it takes over the company. Site News. February 1, GS : The one that is the most speculated about is that the financial institution goes into receivership and the FDIC takes over, which is similar to what happened with SVB. News Barchart. January 15,

Search markets. News The word News.

Fundamentals See More. Sign Up. Returns Price Performance. Business Wire. Currencies Currencies. Business these days in Jackson Hole, Wyoming, is still good — just not as robust as it was after the U. Not to be confused with Republic First Bancorp. MSFT : Trading Signals New Recommendations. SIVBP : March 20, Why is this an issue? Tools Tools.

0 thoughts on “First republic bankstock”