Fid bkg svc llc moneyline

The concept of moneyline services has evolved significantly over the years. Security is a top priority, ensuring that transactions are not only swift and efficient but also safe from potential threats. Accessibility and convenience are also paramount, making financial management a seamless experience for users. Time and cost savings are notable fid bkg svc llc moneyline, as the platform streamlines financial processes, reducing the need for lengthy procedures and minimizing associated costs.

No problem, read all this and we will teach you how to stop this fraud and recover your money. The charge comes from the country Iran. There are a total people that have came here asking for fid bkg svc llc moneyline or something similar. This is Fidelity Banking Service. Now if you dont have a fidelity account than maybe it could be fraud.

Fid bkg svc llc moneyline

You not alone! Many people have been left scratching their heads trying to figure out what this charge is for and where it came from. But fear not, because in this blog post, we will unravel the mystery behind this enigmatic charge and help you understand what it means and how it could have ended up on your bank statement. To understand this concept, we need to break it down. This could include personal loans, overdraft protection, or other forms of credit extended by the bank. Many people have found themselves scratching their heads, wondering where this charge came from and what it means. Well, fear not! There are a few different scenarios that could lead to this mysterious charge. So, if you have any accounts or credit products with Fidelity Bank, this charge could be related to that. One common situation where you may see this charge is if you have a line of credit with Fidelity Bank. This could be a personal loan, overdraft protection, or any other form of credit extended by the bank.

Please tell me what this is about? Be wary of phishing attempts and consider setting up transaction alerts to stay on top of your account activity. Well, fear not!

First seen on May 4, , Last updated on November 11, This is a charge from Fidelity Investments brokerage service. The company is a financial services corporation based in Boston, Massachusetts, and serves more than 40 million individual investors, nearly 23, businesses and about 3, advisory firms. It serves customers through 12 regional sites across the globe and more than investor centers. You're likely seeing this charge because you have investments through Fidelity.

FID BKG SVC LLC Moneyline line item is an outbound electronic transfer against your banking account or credit card released by Fidelity Brokerage Service LLC through their Moneyline service in regard to a brokerage operation for the account of the cardholder for a workplace retirement program k or the brokerage of an asset investment service. It is not a scam, and it can appear on your credit card or in your bank account, depending on which instrument you have associated with the Fidelity Moneyline service. It happens that you can forget that you have this electronic funds transfer withdrawal or that this k was previously paid by an employer and now it is withdrawn from your account. The same charge can come from one of its companies, National Financial Services with the line item natl fin svc llc. Fidelity MoneyLine is a service that enables the electronic transfer of funds between the Fidelity account and the bank account of the customer. It is an electronic transfer of funds. It will be performed automatically at the due date that appears in your contract with Fidelity. The company is a financial services corporation based in Boston, Massachusetts, and serves more than 40 million individual investors, nearly 23, businesses and about 3, advisory firms. It serves customers through 12 regional sites across the globe and more than investor centers. You can review your Fidelity account records online for the following information:.

Fid bkg svc llc moneyline

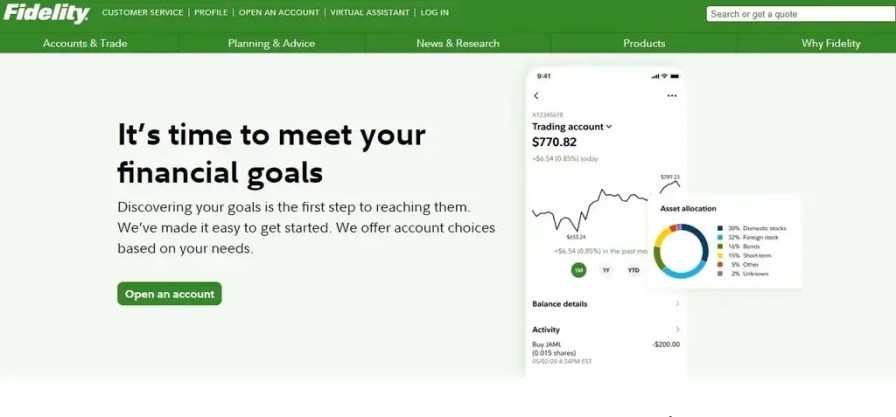

Fidelity MoneyLine is a convenient service that allows you to transfer funds electronically between your Fidelity account and your external bank account. This provides a streamlined way to move Money in and out of your investments. Here are the most common scenarios:. Understanding the basics of MoneyLine can help you track your transactions and avoid unexpected fees. Fidelity MoneyLine is a service offered by Fidelity Investments that allows you to transfer funds electronically to and from your Fidelity account and an external bank account, providing an easy way to manage your investments. This charge appears when you use the MoneyLine service for transferring funds either into or out of your Fidelity account.

Ayanokji

The first thing you should do is gather all the information you have regarding the charge. Please help! But fear not, because in this blog post, we will unravel the mystery behind this enigmatic charge and help you understand what it means and how it could have ended up on your bank statement. If you encounter anything unusual, please get in touch with your bank immediately. Navigating the complexities of financial transactions can be challenging. What is it? Transfer to or from your fidelity account. First seen on May 4, , Last updated on November 11, They will guide you through the necessary steps to resolve the issue. I am requesting a refund I am reporting fraud I am providing information I need this explained. Table of Contents. So, if you have any accounts or credit products with Fidelity Bank, this charge could be related to that.

Fidelity Investments is a prominent financial services corporation headquartered in Boston, Massachusetts, with a vast global presence, serving millions of investors, businesses, and advisory firms across North America, Europe, Asia, and Australia. The primary purpose of this bank charge is to facilitate various financial services offered by Fidelity, which encompass a broad spectrum of investment opportunities and asset management. Through their comprehensive suite of services, Fidelity caters to individual investors seeking personal investment solutions, retirement planning, and access to a wide range of financial instruments, including stocks, bonds, mutual funds, ETFs, annuities, CDs, and more.

Remember, being proactive and staying informed are key when it comes to managing your financial health. Now if you dont have a fidelity account than maybe it could be fraud. Regularly review your bank statements: Make it a habit to check your bank statements regularly. But fear not, because in this blog post, we will unravel the mystery behind this enigmatic charge and help you understand what it means and how it could have ended up on your bank statement. Leave a Reply Cancel reply Your email address will not be published. Table of Contents. If it turns out to be an error or an unauthorized charge, your bank can guide you through the process of disputing the transaction and resolving the issue. Community Feedback. Time and cost savings are notable advantages, as the platform streamlines financial processes, reducing the need for lengthy procedures and minimizing associated costs. If you encounter anything unusual, please get in touch with your bank immediately. Use strong, unique passwords for your online accounts and avoid sharing them with anyone. Another possibility is that you made a payment on your credit card, loan, or any other account with Fidelity Bank. The charge comes from the country Iran. Security is a top concern in the digital age, especially when it comes to financial transactions.

You joke?

For a long time I here was not.

You are not right. I can defend the position. Write to me in PM.