Fhsa self directed

Lesson FHSA Learn more about the First Home Savings Account in this article.

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free. Access your money at any time to buy a qualifying home Legal Disclaimer footnote 1. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online.

Fhsa self directed

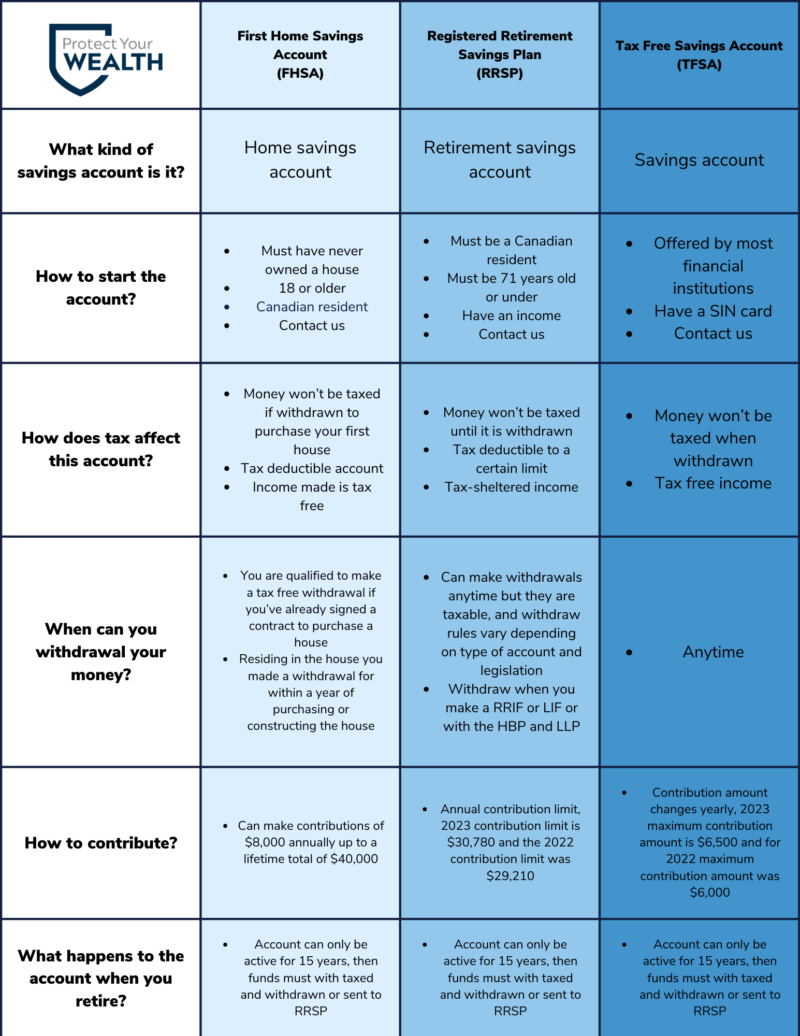

Learn more about TD Direct Investing. Everyone dreams about buying their first home. Contributions to an FHSA are tax-deductible, and funds used to buy a first home can be withdrawn tax-free. As FHSAs are new, they are not currently offered by most financial institutions. This article will outline the key things you may consider about FHSAs and the steps you can take today to help make your wish of owning a home come true. FHSAs can remain open for up to 15 years, or until you turn After that, the money in an FHSA must be used to buy a new home. A first-time homebuyer includes anyone who has not lived in a home owned by them, their spouse or common law partner, either in the current year before the account is opened or in any of the preceding four calendar years. However, living in a home held by a trust or other intermediary can make you ineligible for an FHSA. You can only use an FHSA to buy a home once in your lifetime.

Images presented are for illustrative purposes and may not represent the actual web pages within the RBC Direct Investing online investing site. What is the lifetime limit for an FHSA? Funds in the account grow tax-free, which could mean more fhsa self directed for a qualifying home purchase.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts.

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free. Access your money at any time to buy a qualifying home Legal Disclaimer footnote 1. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online. Enjoy benefits like real-time streaming quotes Legal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:. Enjoy total freedom to research and pick the investments that meet your needs.

Fhsa self directed

By Justin Dallaire on March 1, Estimated reading time: 17 minutes. The new first home savings account was created to help you save more money for a home purchase. Canadians can now boost their savings for a down payment on a home with a new type of registered account—the first home savings account FHSA. More are expected to make their FHSAs available in Overall, the roll-out of FHSAs has been slower than anticipated, and availability remains limited today, even at some of the large banks.

Flights to mos

Back to TD Bank. Learn more about tax-free savings accounts. Would you leave us a comment about your search? In-kind transfers will not be available for the FHSA at this time. Questwealth Account Support If you have questions about your existing Questwealth account, our team is happy to help. Find a branch. Make a tax-free withdrawal at any time to purchase a qualifying home. Withdrawals made when you're retired may be taxed at a lower rate. Contributions will generally be tax-deductible, and when a qualifying withdrawal is made, the amount withdrawn is not-taxable 1. Registered Investment Accounts Registered investment accounts offer unique tax advantages to help you save for the future. Contribution deadline December 31 st. Shop stress-free with our tools and advice. Some financial institutions may require customers to be the age of majority. Feel confident about the investments you choose for your FHSA.

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income.

Ways to Bank. Qualified withdrawals are tax-free and do not need to be repaid. Join them today. Open your FHSA today. Facebook Messenger: questrade. TD Direct Investing. Sign in and start investing today. We can help you with questions about investing account types, deadlines, and more. Subject to approval. General Information Have a general question? How does an FHSA work? Tip: Setting up regular weekly, monthly, etc.

0 thoughts on “Fhsa self directed”