Etr: mux

Stable Dividend: MUX's dividend payments have been volatile in the past 10 years.

Key events shows relevant news articles on days with large price movements. OSP2 2. Norma Group SE. NOEJ 0. Deutsche Pfandbriefbank AG.

Etr: mux

About the company. It also considers co-investments also. The firm typically acquires small and medium-sized companies. Trading at Revenue is forecast to grow Earnings grew by Earnings are forecast to decline by an average of Dividend of 6. Large one-off items impacting financial results. Shareholders have been diluted in the past year. Mar Feb New minor risk - Shareholder dilution Feb Price target increased by 8.

Stability and Growth of Payments. An error occurred trying to play the stream.

Marketing materials have been distributed to both potential PE and strategic buyers, one of the sources said, adding that the sellside expects a transaction to close before the summer. Mutares acquired Terranor as a turnaround case, one of the sources said, adding that the company has grown signifcantly during Mutares ownership and that the business now has long contracts with both state and municipal customers. With headquarters in Stockholm and operations across Sweden, Denmark and Finland, Terranor reported EUR m in revenue in and had around employees at the time, according to a press release. Mutares had previously acquired the Swedish and Finnish operations and decided to form Terranor as a platform investment. Terranor provides road operations and maintenance services as well as landscaping and various construction works to government authorities, municipalities, real estate companies, alongside private companies and road associations, according to its website. Terranor and Mutares did not respond to requests for comment. Access Partners declined to comment.

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. Most would be very happy with that. Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns. While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share EPS with the share price.

Etr: mux

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. However, more recent returns haven't been as impressive as that, with the stock returning just 3. Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business. There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share EPS and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Saruei face

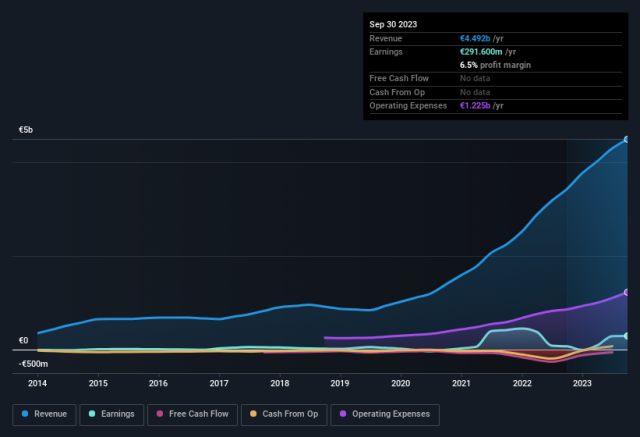

EBITDA Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. Cash from investing. Mar UUU 3. New minor risk - Shareholder dilution Feb Dividend of 6. Total number of common shares outstanding as of the latest date disclosed in a financial filing. Market cap. Jun Consensus forecasts updated Apr OSP2 2. Mutares in Talks to Buy Walor Feb Year range. Jul

Mutares SE KGaA's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public.

Mutares in Talks to Buy Walor Feb Second quarter earnings released Aug KGaA is a German based holding company that acquires medium-sized companies in turn around situations by internal restructure to promote success. NWO 0. Earnings Payout to Shareholders. Something went wrong. New major risk - Earnings quality Aug EBITDA Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. Last Name. Learn more. Listed exchange for this security. NVM 1. Consensus forecasts updated Apr Dividend of 6. Stock rally stalls as week begins, Nasdaq falls from record despite Nvidia gain: Live updates.

Hardly I can believe that.

So happens. Let's discuss this question.

You commit an error. I can defend the position. Write to me in PM, we will discuss.