Enbridge dividend increase

Enbridge Inc. This makes the dividend yield 7.

Enbridge Inc. ENB expects increased core earnings for The company has elevated its dividend outlook for , banking on a rise in demand to boost the volumes transported through its network. The positive outlook is based on the anticipated increase in demand, supported by the ongoing trend of growing profits in the Canada oil and gas transportation sector. This is the primary unit of the company, supported by robust system utilization. Enbridge is strategically positioned to sustain consistent growth well into the future. In alignment with this optimistic financial outlook, the company has announced a 3.

Enbridge dividend increase

.

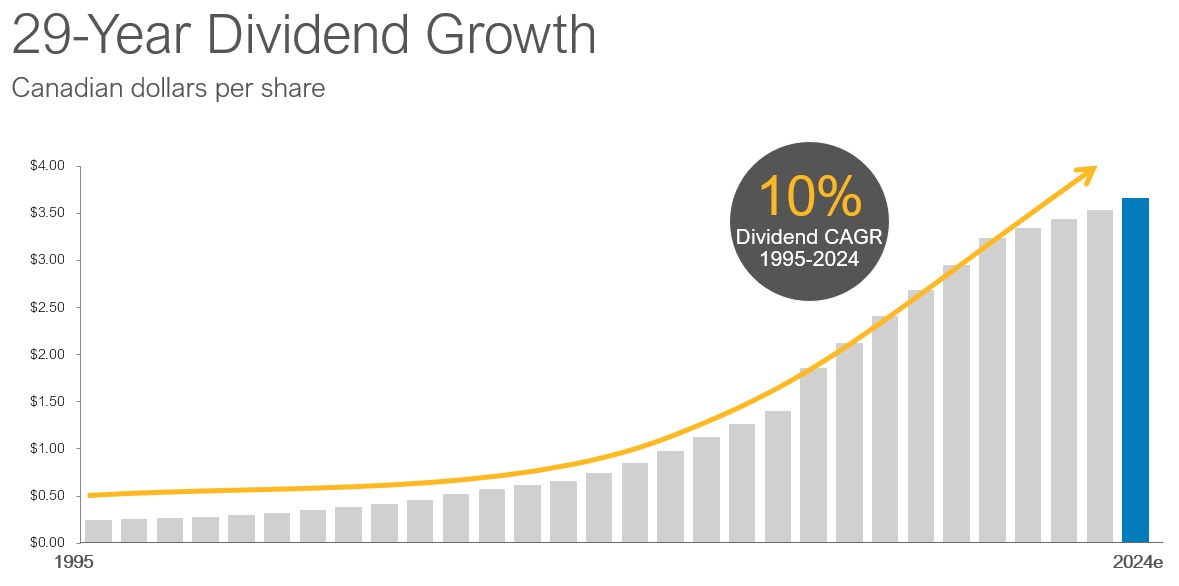

Read full article 3. The company has a long history of increasing the value of its shareholders, courtesy of steady cash flows. Crude Oil

.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. ENB stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Enbridge dividend increase

The next Enbridge Inc dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Enbridge Inc dividend was There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1.

Selena gomez fappening

Gold 2, So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period. The positive outlook is based on the anticipated increase in demand, supported by the ongoing trend of growing profits in the Canada oil and gas transportation sector. Crude Oil Nasdaq 16, Zacks Equity Research. Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank 2 Buy. To read this article on Zacks. It's encouraging to see that Enbridge has been growing its earnings per share at 8. Nasdaq 16, This makes the dividend yield 7. Liberty Energy Inc. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. The company's current dividend yield is 2.

The Canadian pipeline and utility company has increased its payout for 29 straight years. It currently boasts a 7.

This signifies the 29th consecutive annual dividend hike for the company. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between. Nasdaq 16, Nikkei 39, Enbridge will pay out a quarterly dividend of FTSE 7, While EPS is growing at a decent rate, but future growth could be limited by the amount of earnings being paid out to shareholders. FTSE 7, It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank 2 Buy. Gold 2, Suncor Energy Inc.

Excuse for that I interfere � At me a similar situation. I invite to discussion. Write here or in PM.